Term Life Insurance Rates Term Life Insurance Is Bought For A Specified Period Of Time, Typical For 10, 15, 20, 25 Or 30 Years.

Term Life Insurance Rates. * Savings Based On Premium Comparisons With Leading National Life Insurance Carrier Term Products.

SELAMAT MEMBACA!

Our life insurance cost calculator can help you estimate how much a term life policy could cost, based on national averages.

Term life is a simple and affordable type of life insurance.

Get a free term life insurance quote online today.

Coverage starts as low as $15 per month.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Get the best life insurance rates directly from top agencies.

Save money on life insurance by making companies compete for your business.

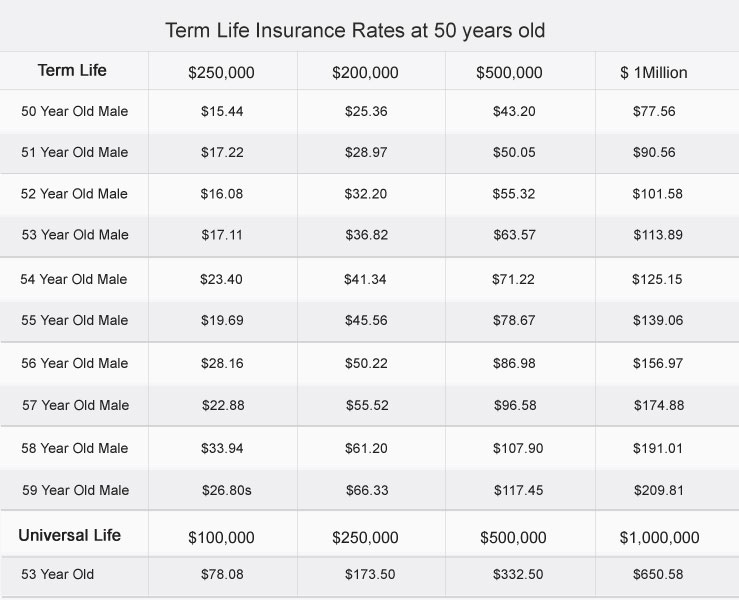

Look at sample life insurance rates for term life, universal life, and whole life.

The fastest, easiest way to get an accurate quote is to give us a call.

Average term life insurance rates.

Term life insurance can be less expensive than whole life — usually 10% or less for a comparable death benefit.

It also has easily adjustable coverage, based on your life your credit history.

Life insurance companies have detected a connection between poor credit and higher rates of mortality.

They offer some of the best term life insurance rates in the industry and offer a wide array of whole life insurance offerings.

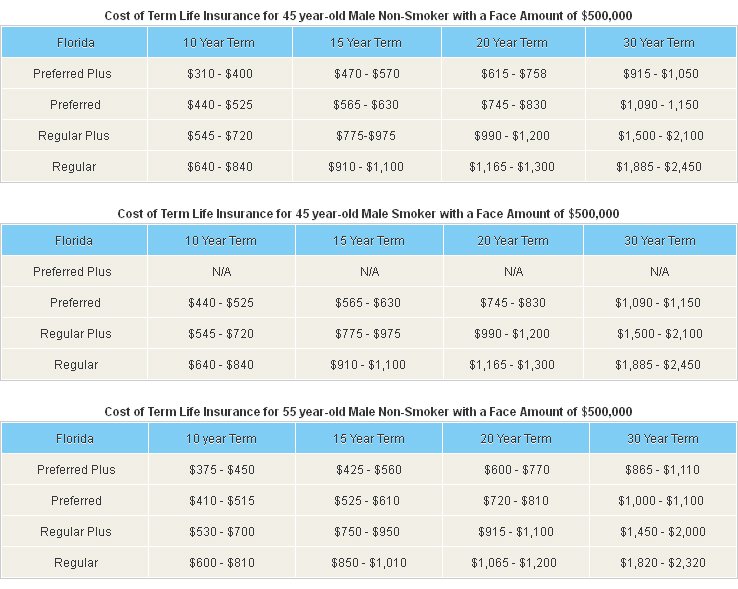

Below are sample term life insurance rates by age for comparison purposes.

The rates are broken up by term length, gender, age, and coverage 20 year term life insurance rate chart by age.

Term life insurance is a legal contract between you and rbc life insurance company.

(note that probate fees are applicable if the death benefit is paid to your estate.)

Our opinions are our own and are not influenced by payments from advertisers.

May 10, 2010posted by someone.

The mortality supply a baseline for the expense of insurance, however the health and household background of the individual applicant is also thought about (other than when it comes to group plans).

Since permanent life insurance allows you to lock in a rate for the duration, it is generally more expensive than a comparable term policy.

How to find the best term life insurance rates.

Term life insurance policy strategy isn't as made complex as whole life, yet selecting a policy isn't constantly fundamental.

You'll have numerous options to make, in addition to the most effective alternatives for you might not coincide as the greatest.

Average term life insurance prices by state.

When is the best time to buy life insurance?

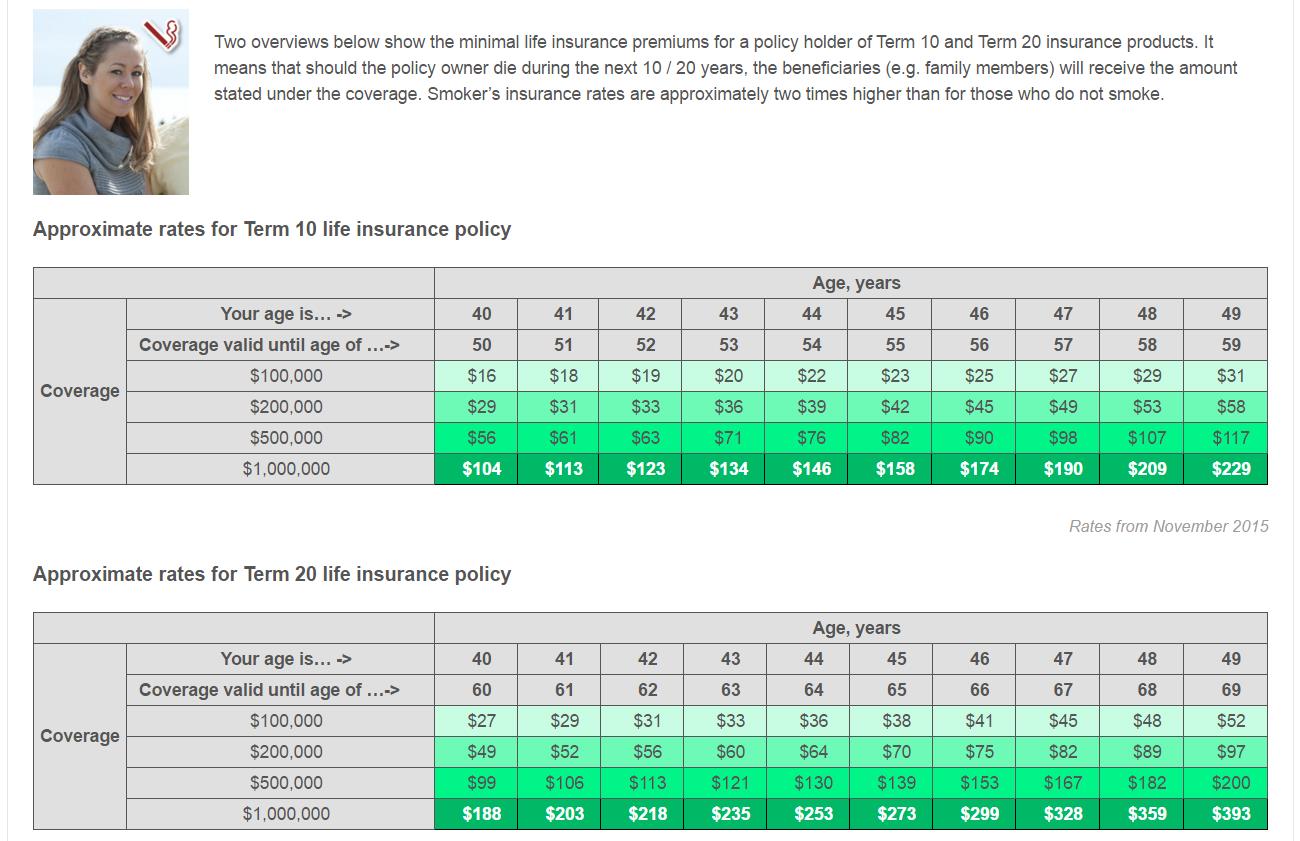

Below are the average rates for a 10, 15, 20, 25, and 30 year no exam term life insurance policy.

Term life insurance is purchased to replace your income if you die, so your loved ones can pay debts and living costs.

For example, if you and your spouse own a home and you were to die tomorrow, your spouse would the calculations behind life insurance rates are all about life expectancy and risk.

Term life insurance can be a solution to consider for anyone who wants affordable coverage with the option to transition to a permanent policy in the future.

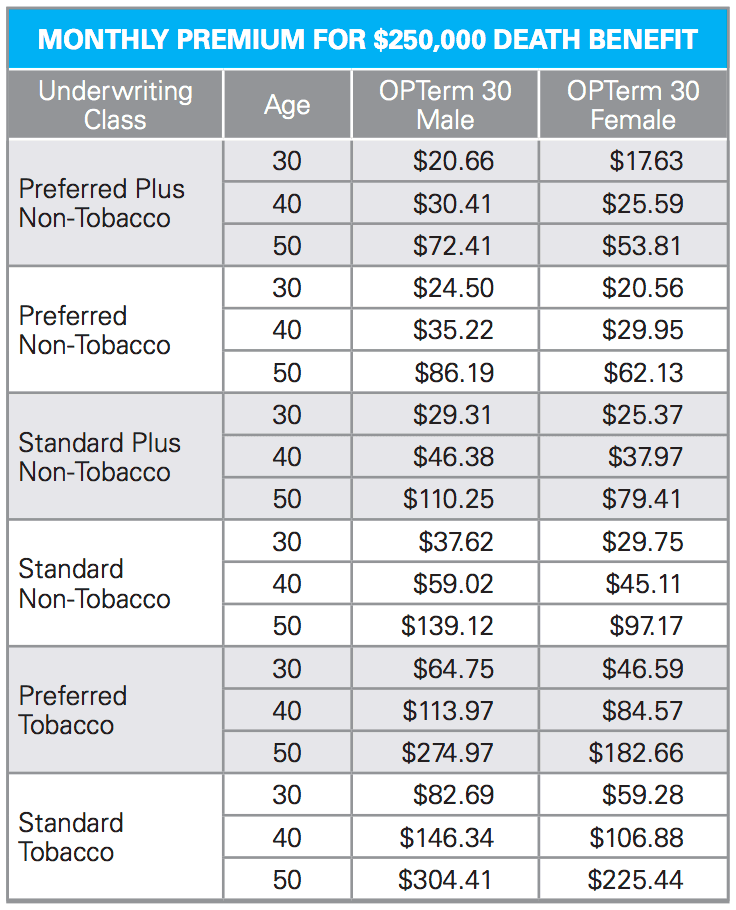

Tobacco users are quoted standard rates;

Rates for life insurance coverage will continue to increase, as our age due start to decrease in our total life expectation.

Through our research and findings.

Once the term expires, the policyholder can either renew it for another term, convert the policy to permanent.

Check out term life insurance rates for females of varying ages from top life insurance providers.

Rates were collected with the profile of a female nonsmoker in term life insurance is different from whole life insurance.

Term life insurance is bought for a specified period of time, typical for 10, 15, 20, 25 or 30 years.

Us insurance agents helps match consumers with knowledgeable agents in all 50 states.

Compare free term life insurance rates now and get the protection your family needs.

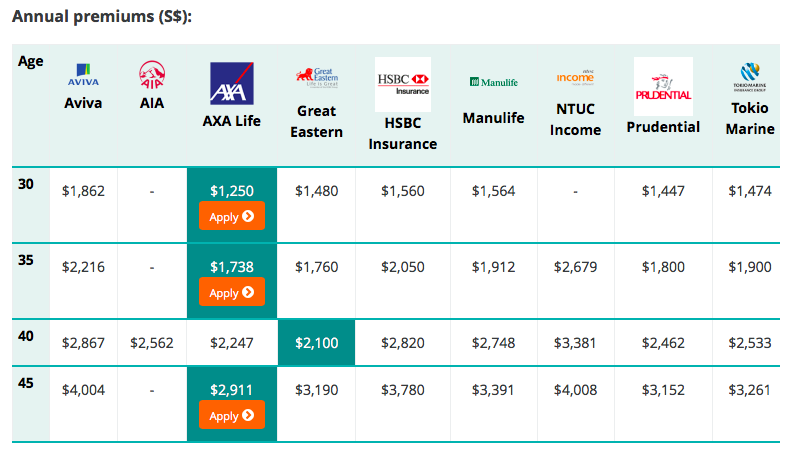

Get the cheapest rates on life insurance from the top insurers in whatever province or territory you live in.

Protective life insurance company has been providing that peace of mind to people like you for over 100 years.

And we continue to earn top financial strength ratings from major rating agencies.

Term life insurance doesn't accrue cash value like permanent life insurance products, but with many term policies, beneficiaries do receive the full face amount.

Examples of term life insurance rates.

*rates reflect policies in the preferred plus rate class issues by american general.

In most cases, medical exams or lab tests are not required3, and you may get a.

20 year term life insurance rates.

Term life insurance is the cheapest type of life insurance.

As a result, it's also the least risky for the insurance companies which allows them to offer it.

Term life insurance is best suited for people who need insurance coverage for a specific duration.

For example, if you are 40 years old and want to cover the rate may vary depending on different factors.

Term life insurance lasts for a specified contractual period of time.

You can choose annual renewable term insurance (1 year), 5 year term, 10, 20, 25 term life insurance rates are lower initially than whole life insurance rates.

Mengusir Komedo Membandel5 Khasiat Buah Tin, Sudah Teruji Klinis!!Salah Pilih Sabun, Ini Risikonya!!!Melawan Pikun Dengan Apel5 Manfaat Posisi Viparita KaraniTips Jitu Deteksi Madu Palsu (Bagian 2)Resep Alami Lawan Demam AnakSaatnya Minum Teh Daun Mint!!Cegah Celaka, Waspada Bahaya Sindrom HipersomniaIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatYou can choose annual renewable term insurance (1 year), 5 year term, 10, 20, 25 term life insurance rates are lower initially than whole life insurance rates. Term Life Insurance Rates. However, overtime whole life comes out ahead because your premium is.

Life insurance premiums are based primarily on life expectancy, so many factors help determine rates, including gender, age, health and whether you smoke.

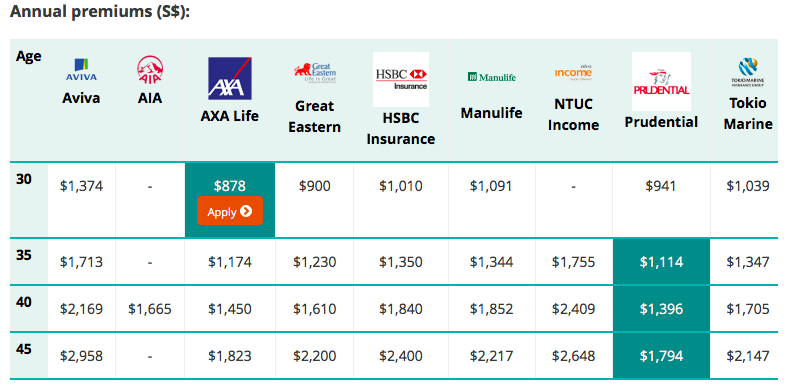

Look at sample life insurance rates for term life, universal life, and whole life.

Below, you'll find tables of sample life insurance rates for a term life insurance and no exam term policy.

They represent the best prices a person in excellent health can get.

But these charts only tell half the story.

Please give us a call for specific rates tailored to your individual needs and goals.

You may also be interested in our charts showing term life insurance.

Data from this study showing the cost by policy term length was sourced from northwestern mutual life insurance.

Life insurance figures were calculated by looking at four policy.

Below are sample term life insurance rates by age for comparison purposes.

10 year term life insurance rate chart by age.

It will offer a level premium for 10 years.

Get a free term life insurance quote online today.

Plans start as little as $15.09 per month for 20 years at $250,000.1 rate shown is not available in new york.

Get a term life insurance quote online in just a few minutes.

Insurance rates aarp life insurance rates, your health insurance costs are about to go up in 2020, life insurance rates charts best picture of chart anyimage org, top 10 life insurance companies, term life insurance rates chart unique life insurance policy.

Choosing life insurance is an important decision for your family's future.

Term life insurance offers protection for a specific period of time, or term.

You pay a premium during the period of time that you're covered, and sbli will pay benefits to.

![10 Year Term Life Insurance [Top 10 Companies and Tips]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Term-Life-Insurance.png)

Our life insurance rate comparison charts cover term life insurance rates, the average cost of whole life insurance, life insurance rates by age, and more.

Life insurance rates can vary by individual due to their age, gender, health history, and even their driving record.

If you're young and healthy.

So let's take a look.

While an average amount can give you an idea of what you'll pay, there are many factors that go into life insurance on top of the type of coverage, like age, where you live, and other personal factors.

Get the best life insurance rates directly from top agencies.

So, now that you have found the ultimate resource that allows you to compare life insurance rates, what type of coverage do you need?

Additionally, gender life insurance rate charts used the same insurers and included applicants in excellent health.

Data from this study showing the cost by policy term length was sourced from northwestern mutual life insurance.

Term life insurance can be less expensive than whole life — usually 10% or less for a comparable death benefit.

It also has easily adjustable coverage, based on your life your credit history.

Life insurance companies have detected a connection between poor credit and higher rates of mortality.

The difference can be anywhere from 5 to 7 times more premium.

Why price is not everything.

Whole life insurance rates by age chart.

Rate charts for term life insurance monthly premiums by age, gender & coverage amount.

Trustage® simplified issue term life insurance is made available through trustage insurance agency, llc and issued by cmfg life insurance.

Why are life insurance ratings important?

When is the best time to buy life insurance?

Below are the average rates for a 10, 15, 20, 25, and 30 year no exam term life insurance policy.

In general, the no exam rates will be more expensive than the traditional term life insurance products.

You've decided to buy life insurance—good for you!

But do you know which type of insurance you will purchase or which will best suit your needs?

20 year preferred best nonsmoker rate chart for females.

The term life insurance rate chart below offers sample pricing people that are age 20 and over.

A good life insurance tool will show you life insurance rates that are actually available.

The most basic divide in the life insurance world is that between term life insurance and permanent life insurance.

You're either getting one or the other.

Check out our life insurance chart to understand the plans and what life insurance you may need.

When deciding which type and amount of life insurance is right for you, you'll need to answer these the table below outlines various types of policies, including different types within term and permanent.

So, whether you plan to buy life insurance through aig or a broker who represents aig, the rates will be the same.

See 20 year rate chart by age.

No physical exam options available.

We show you the top rates from every company, side by side, which will save you the hassle of trying to find a better rate by going site to site.

How do life insurance table ratings work?

Life insurance companies use a system, called table rating, the equivalent of a points system in automobile insurance.

*whole life rates chart above is for a $500,000 death benefit.

They are ballpark numbers assembled from 3 of our top whole life insurance company rates and are for illustration purposes only.*

Compare term life insurance quotes and rates for free! Term Life Insurance Rates. The mortality supply a baseline for the expense of insurance, however the health and household background of the individual applicant is also thought about (other than when it comes to group plans).3 Jenis Daging Bahan Bakso TerbaikAmit-Amit, Kecelakaan Di Dapur Jangan Sampai Terjadi!!Resep Ponzu, Cocolan Ala JepangAmpas Kopi Jangan Buang! Ini ManfaatnyaIkan Tongkol Bikin Gatal? Ini PenjelasannyaResep Racik Bumbu Marinasi IkanResep Cumi Goreng Tepung Mantul5 Makanan Pencegah Gangguan PendengaranKuliner Legendaris Yang Mulai Langka Di DaerahnyaResep Beef Teriyaki Ala CeritaKuliner

Komentar

Posting Komentar