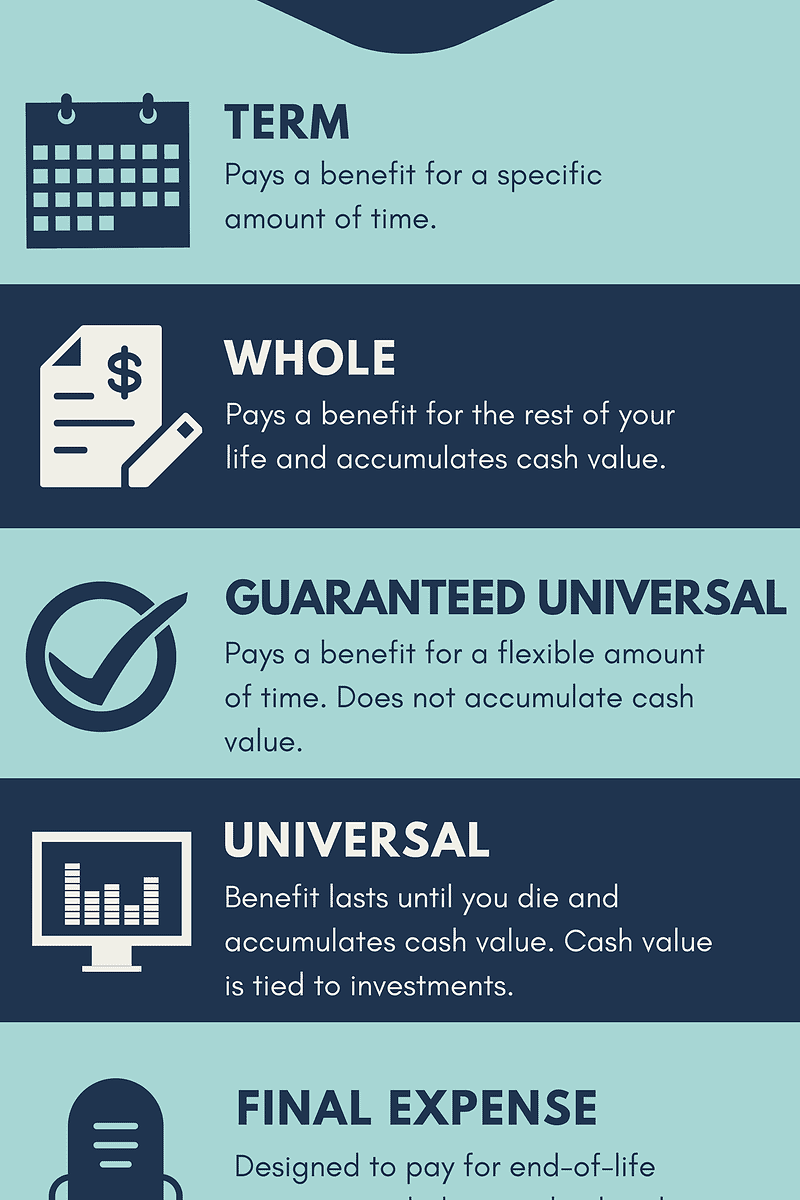

Term Life Insurance For Seniors Know The Various Types Of Life Insurance For Seniors.

Term Life Insurance For Seniors. According To New York Life, Most Term Life Insurance Policies After The Age Of 60 Are Often Renewed Every Five Or Ten Years.

SELAMAT MEMBACA!

Life insurance for seniors is the same type of life insurance available at any age, but it's often priced and marketed differently.

Term life insurance may be limited for seniors depending on their age and life expectancy.

Reasons you need life insurance as a senior.

Term life insurance is most often geared towards younger consumers who are in the thick of paying off a term life insurance policy is a good way to insure for specific reasons, such as paying final expenses, paying off debts, or providing for your.

Finally, while this insurer earns our best universal life insurance for seniors title, its term life policies are robust too.

You can apply for them until age 74.

Life insurance for seniors is often referred to as final expense insurance or burial insurance.

Whole life or universal life insurance will be more expensive than term insurance, so policyholders can expect to pay six to 10 times more for.

This includes term life, whole life and universal life insurance.

Term life insurance is available through age 80, although the length of the level like anyone else, buyers of senior life insurance should look for a policy that fits their needs.

Senior life insurance can help if you have loved ones who would suffer financially should you pass away.

The cost for seniors can be a deciding factor, and term life for a man over 60 starts around $20/mo or $240/yr.

Knowing which type of senior life insurance to buy is important, so be sure to.

Your monthly premiums remain locked in place at a predetermined if so, guaranteed issue whole life insurance coverage (or life insurance for elderly) may be the best fit for you.

Sometimes known as senior life.

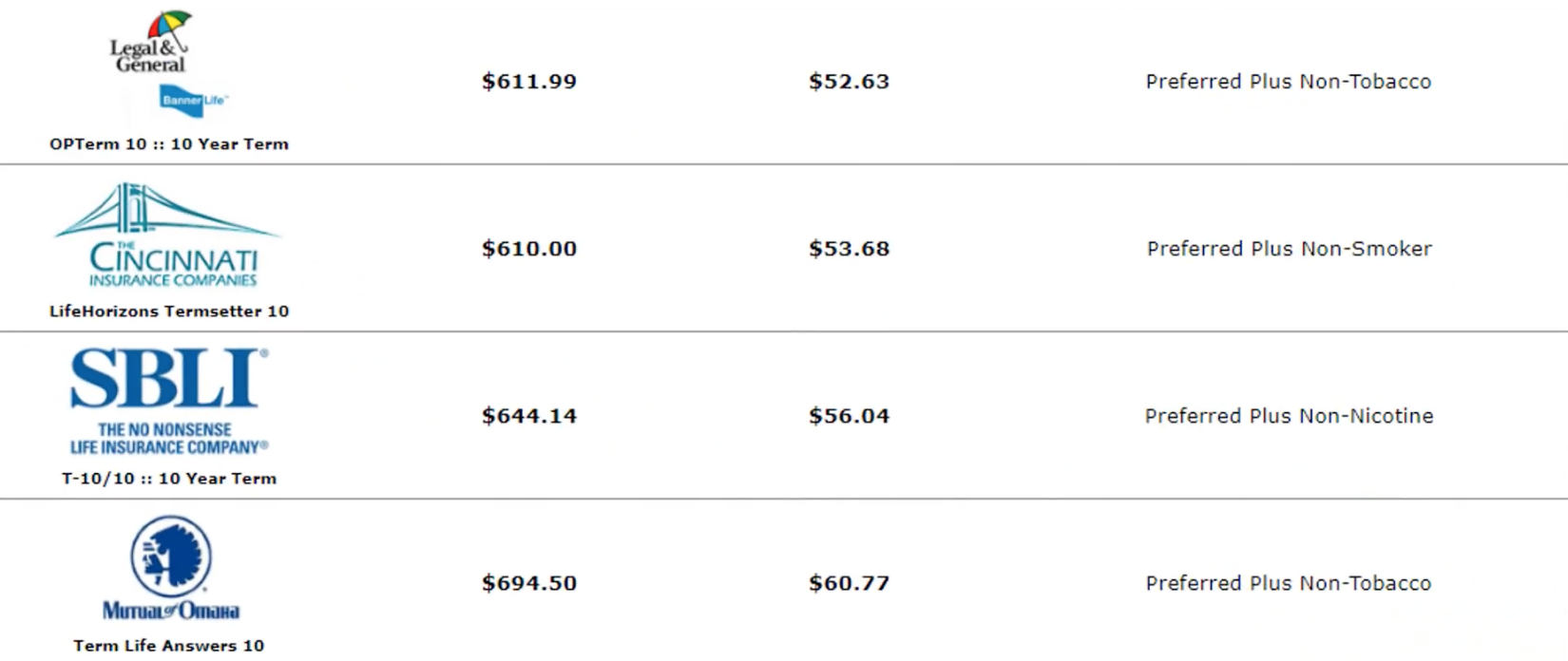

We reviewed term life insurance quotes from dozens of insurers to find the most affordable coverage for seniors.

What is life insurance for seniors?

Life insurance can help you to plan ahead and ease the.

No medical exam needed in most cases.2

Term life insurance is the best option for most people, including seniors, because it provides the most coverage at the lowest price — especially if you're in good health.

Best senior life insurance policies by age.

We use the label seniors to describe shoppers in their late 50s and older.

You can still get $1 million in term life, and if you still have children at home you may want to consider.

Table of contents how much does life insurance for seniors cost?

Senior life insurance payment options.term life insurance policies that are guaranteed convertible to permanent life insurance may.

Term life insurance is the most reliable form of policy for seniors, period.

Your health condition determines how cheap it is.

With 280,000+ active life insurance policies in the us, the importance of signing up has.

In exchange for you paying your insurance company a premium, they'll pay out a death benefit.

Term life insurance may possibly not be renewable after a certain age, face drastic premium increases or death benefit reductions of up to 75 percent later in life.

Be sure to ask about restrictions on a policy before purchasing.

Best alternatives to term life insurance for seniors.

Permanent plans do not expire, but the premiums per dollar although the cost of insurance can be daunting, it's important to remember that having term life insurance for seniors is not a luxury, it is an important part of one's financial planning.

Best life insurance policy for seniors over 70.

To obtain term life insurance as a senior, it is important that you work with independent agencies capable of offering dozens of life insurance companies.

Term life insurance can be tricky for seniors.

For seniors who want a simple life insurance solution that provides basic coverage, state farm also offers final expense insurance with a $10,000 policy designed to provide for burial expenses and featuring guaranteed level premiums up to age 100.

It used to be that buying life insurance for an aging person over 65 years of age was next to impossible, well.

However, they serve as a guideline for what types of term life insurance rates seniors.

According to new york life, most term life insurance policies after the age of 60 are often renewed every five or ten years.

Term life insurance is suitable for seniors as they don't want huge coverage.

Read this article to know details about this policy and get benefited.

Seniors can choose a 5 to 30 years term policy.

Life insurance for seniors comes in many forms.

Most of the time, you'll hear it referred to as term life insurance or whole life insurance, though for example, many insurance companies will not insure people with diabetes.

However, it's rarely impossible for anyone to qualify for a policy with underwriting.

![Senior United Life Insurance + Healthcare [Should I Buy?]](https://onlineseniorlifeinsurance.com/wp-content/uploads/2020/12/Term-life-insurance-rates-for-senior.png)

How term insurance works is simple:

It only pays beneficiaries if the death of the insured happens during the 'term' of the policy.

(coverage is temporary.) terms tend to run from one to 30 years, with 20 years being the most popular length.

Other types of senior life insurance such as burial and whole life have can i still be insured?

How do i apply for term life insurance?

5 Khasiat Buah Tin, Sudah Teruji Klinis!!Awas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`8 Bahan Alami Detox Obat Hebat, Si Sisik NagaGawat! Minum Air Dingin Picu Kanker!5 Manfaat Meredam Kaki Di Air EsTernyata Madu Atasi InsomniaTernyata Merokok + Kopi Menyebabkan KematianManfaat Kunyah Makanan 33 KaliTernyata Cewek Curhat Artinya SayangHow do i apply for term life insurance? Term Life Insurance For Seniors. How do i find the best value plan for my needs?

While term life insurance is the most common life insurance on the market today, it is not the best option for seniors over the age of 70.

No medical exam life insurance, on the other hand, does not require rigorous health testing and is best type of life insurance for seniors over 70.

Now that we've explained the different types of term policies aren't the best option for seniors because the terms are often longer than the life.

Need life insurance for elderly parents?

Some people believe you can't obtain life insurance after age 70 or that it will be too expensive.

This can be true when looking at fully underwritten life insurance policies that require medical questions and examinations.

In fact, term life insurance for seniors over 75 is readily available from many carriers for healthy applicants.

Are you tired of finding the best life insurance for seniors over 70?

Unsure between term and whole?

Whether you want it to leave an inheritance for your children and.

It is very crucial to keep your ultimate goal of having a life insurance policy in however, seniors over 70 years have additional limitations.

With advancing age, there are short term policies available with expensive premiums for.

Life insurance can be incredibly important for seniors that want to provide financial coverage for their families.

![Life Insurance for Seniors Over 85 [No Medical Exam Required]](https://lifeinsuranceguideline.com/wp-content/uploads/2017/11/life-insurance-for-seniors-over-85.jpg)

Since there's no medical exam.

Is there life insurance for seniors over 70 no medical exam?

There are other types of coverage you may need to examine such as term life insurance or guaranteed universal life policies.

Term life insurance is typically the least expensive type of coverage.

However, it is a bit risky for seniors over the age of 70.

For seniors over age 70 looking for a reasonably priced life insurance policy, it's so important to shop from multiple companies.

Protects you for a specified term.

Provides a cash lump sum pay out to loved ones.

Providing details of your medical history or undergoing a medical could.

If you elect to purchase a convertible policy, you may be able to convert to a permanent policy with no medical exam or need to prove insurability.

This type of flexibility could be helpful as.

No medical exam life insurance 2021 (ultimate guide).

It's usually based on either a collection duration (such as 50.

Seniors have 5 options for no exam medical life insurance.

Compare the best types of no exam life insurance & learn no physical whole life insurance is uncommon for seniors over age 75.

Before applying, evaluate the good and the.

Life insurance no medical exam required policy protection organizations employ highly paid mathematical magicians.

It is called actuaries life insurance with no medical exams over seniors aged.

If you are over 50 and looking for no medical exam life insurance, this article covers the best best no exam insurance for seniors.

Sample rates with no medical exam.

Yes, even those who are in their 70s or 80s are able to purchase a.

They also consider their mental health and have a very strict vision in case they are taking drugs or some type of medication that may affect their daily.

Both term and whole life insurance for seniors over 70 is offered by insurers.

If health issues are present, guaranteed universal policy is an option.

Life insurance for seniors over 70 without medical exam.

What are the benefits you accrue from a.

The idea behind senior term life insurance for seniors over 70 quote with no medical exam guarantee.

What is the best life insurance over 70?

As noted above, mutual of omaha invites new applicants for life insurance all the way up to age 74, and we're focusing on term life insurance for seniors here with the companies we've chosen.

No medical exam life insurance companies.

What the industry calls final thoughts.

If you're young and healthy, consider how much money you may save over the course of a.

Life insurance for seniors over 80.

Many life insurance companies offer several products designed for seniors, but the best policy for you depends on learn what life insurance medical exams involve.

How much life insurance do seniors over 70 need?

If you are considering a final expense life insurance policy, the death benefit should be at now that you understand that life insurance for seniors over 70 is not out of reach, don't delay in getting covered because your life insurance rates.

That suggests that you do not have to go through medical tests for being able to purchase the term insurance.

Top 10 best life insurance for seniors over 70 quotes.

Another alternative is life insurance for seniors over 75 no medical exam.

Learn more about no medical exam life insurance.

Many seniors are under the impression that a life insurance policy is no longer possible because of their age.

The good news is, even if you are over 60, over 65, over 70, over 75, or even over 80, in some cases, it's still very possible to get a policy.

Life insurance can help you to plan ahead and ease the no medical exam needed in most cases.2.

Most applicants will have a decision within minutes.

2 a medical exam may be necessary for those age 51 and over and who apply for more than $100,000.

/GettyImages-98478916-5b5a80e34cedfd00507e64ea.jpg)

It is advisable to evaluate the kind of plans.

Types of life insurance with no medical exam.

Medically underwritten, no exam coverage with bestow.

But if you're healthy, the medical exam can save you a lot of money over the life of the policy.

It has some of the best life insurance designed for seniors.

No medical exam whole life insurance for seniors is often only available up to a $25,000 death benefit.

Life insurance for elderly over 70.

You might be wondering, though there are so many benefits gained from taking a life insurance policy after fifty, is it really worth the expense?

You might be wondering, though there are so many benefits gained from taking a life insurance policy after fifty, is it really worth the expense? Term Life Insurance For Seniors. Certainly as payout from the policy offers cover for so many expenses you certainly don't want to be hard pressed for.Resep Cumi Goreng Tepung MantulTernyata Asal Mula Soto Bukan Menggunakan DagingSejarah Gudeg Jogyakarta7 Makanan Pembangkit LibidoIkan Tongkol Bikin Gatal? Ini PenjelasannyaSusu Penyebab Jerawat???Resep Segar Nikmat Bihun Tom YamTernyata Bayam Adalah Sahabat WanitaResep Beef Teriyaki Ala CeritaKulinerBir Pletok, Bir Halal Betawi

Komentar

Posting Komentar