Term Life Insurance Rates You'll Have Numerous Options To Make, In Addition To The Most Effective Alternatives For You Might Not Coincide As The Greatest.

Term Life Insurance Rates. The Website Is Not Owned By Geico Insurance Agency Llc.

SELAMAT MEMBACA!

Life insurance premiums are based primarily on life expectancy, so many factors help determine rates, including gender, age, health and whether you smoke.

Insurers typically class applicants using terms like super preferred, preferred.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

Get a free term life insurance quote online today.

Coverage starts as low as $15 per month.

This life insurance information is provided for general consumer educational purposes and is not intended to provide legal, tax or investment advice.

Save money on life insurance by making companies compete for your business.

So, now that you have found the ultimate resource that allows you to compare life insurance rates, what type of coverage do you need?

Life insurance companies mostly base their rates on your age and health status, but they also factor in your job, your weight, whether you smoke and even besides age, life insurance quotes will vary depending on your gender.

Sex plays a big role in life insurance rate.

For the same insurance policy, a female and male will pay different amounts for coverage each month.

You can't put a dollar if you choose to get a rate quote online, you will be taken to the website of life quotes, inc.

Our opinions are our own and are not influenced by payments from advertisers.

Learn about our independent review process and partners in our advertiser disclosure.

How to find the best term life insurance rates.

You'll have numerous options to make, in addition to the most effective alternatives for you might not coincide as the greatest.

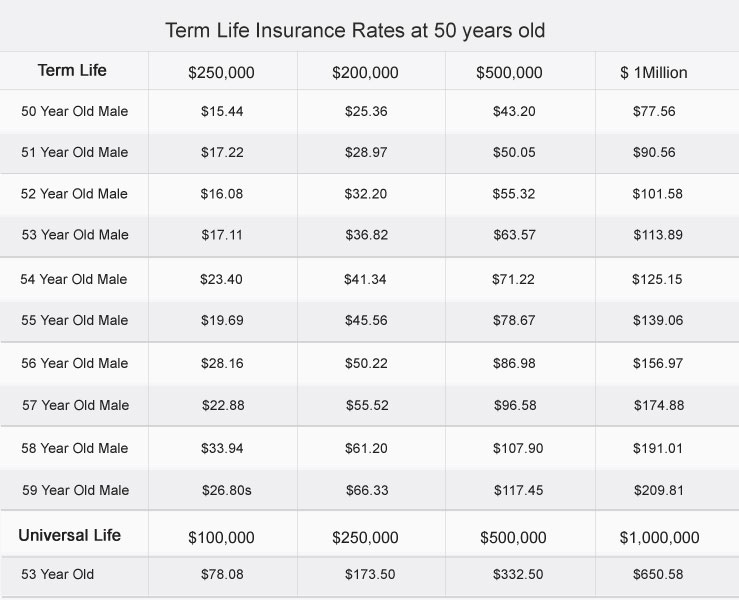

Look at sample life insurance rates for term life, universal life, and whole life.

The fastest, easiest way to get an accurate quote is to give us a call.

(note that probate fees are applicable if the death benefit is paid to your estate.)

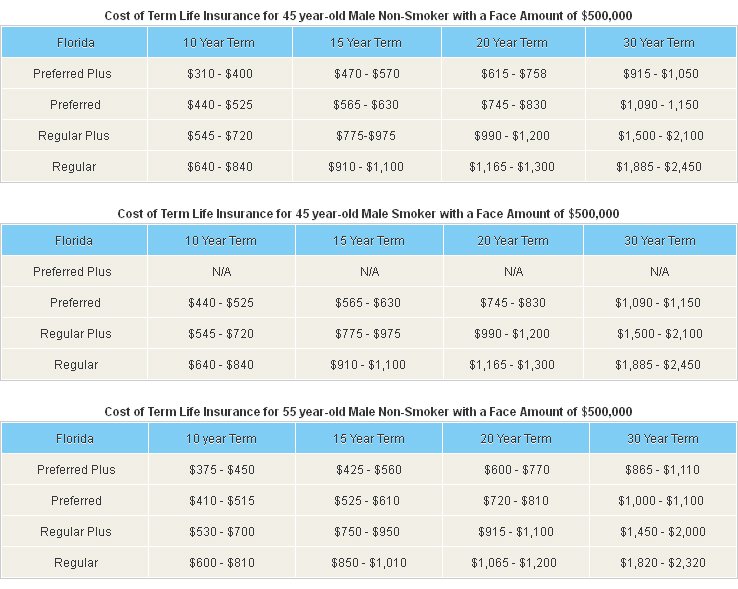

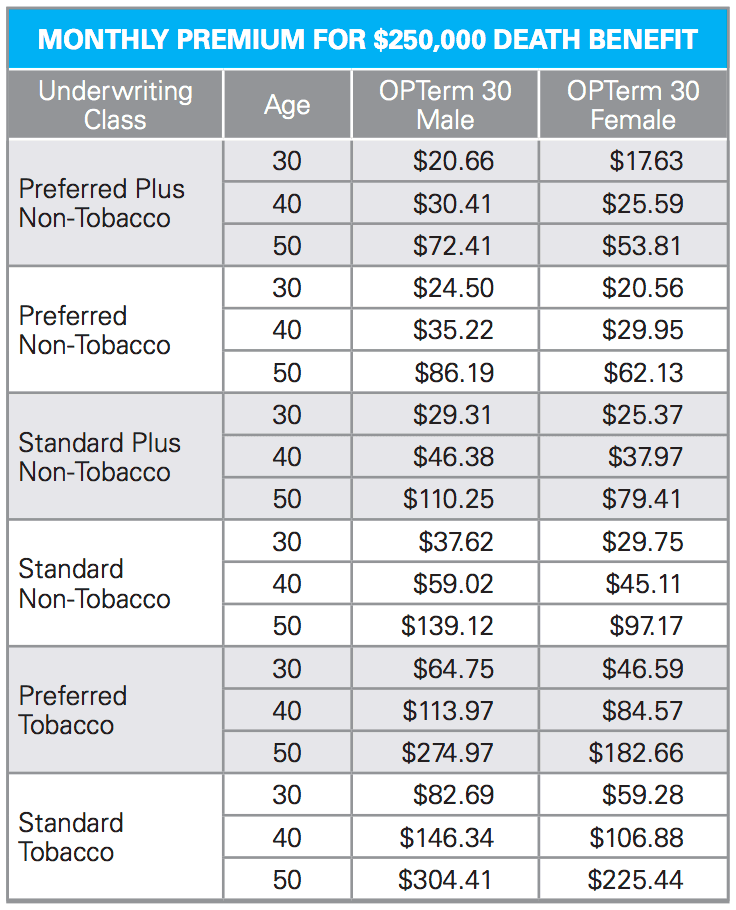

Below are sample term life insurance rates by age for comparison purposes.

The rates are broken up by term length, gender, age, and coverage amounts.

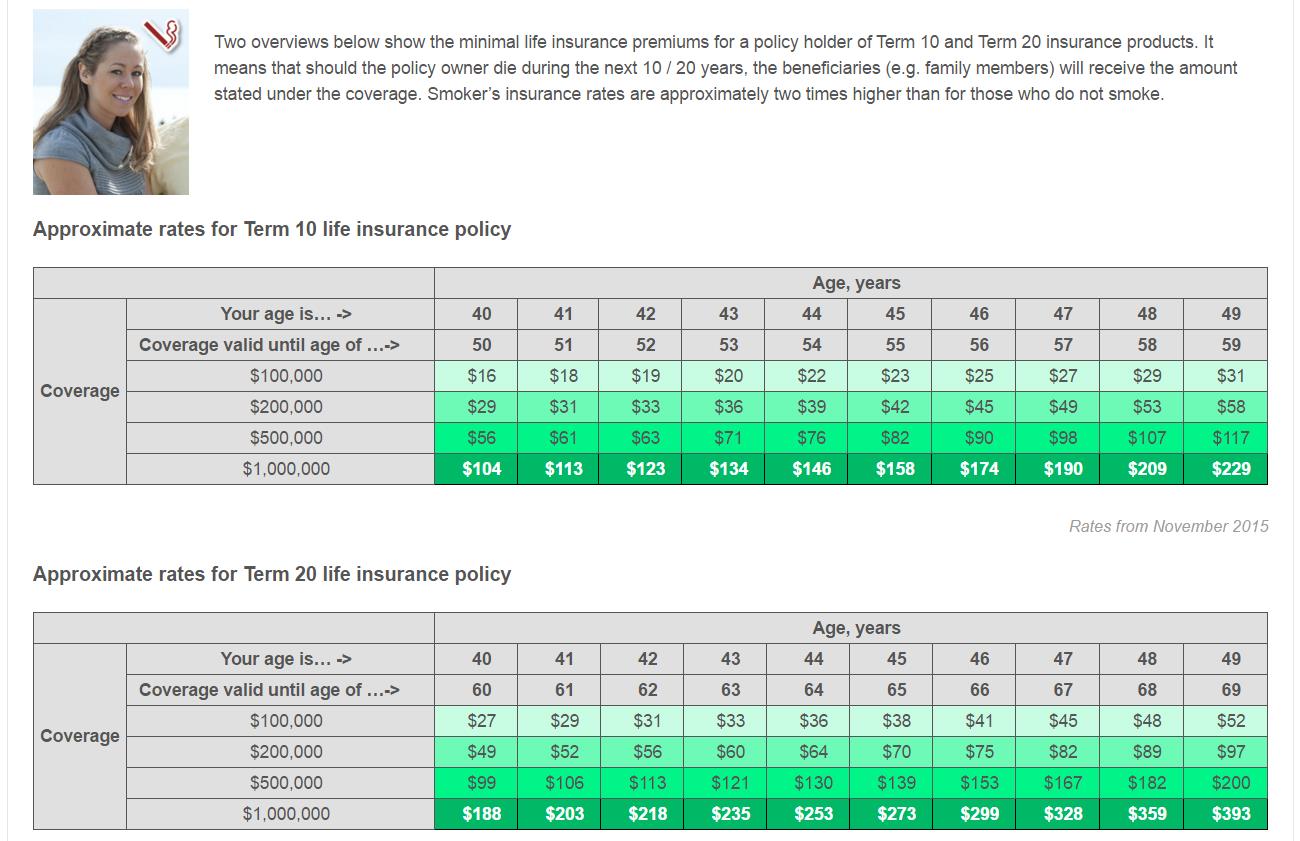

It will offer a level premium for 10 years.

Since permanent life insurance allows you to lock in a rate for the duration, it is generally more expensive than a comparable term policy.

Most permanent policies also having a savings feature, which accumulates value over time depending on the terms of the policy.

These are not the top tier, best rates available for these demographics, but standard (or average) rates!

Term life insurance is a type of life insurance that guarantees payment of a death benefit during a specified time period.

Interest rates, the financials of the insurance company, and state regulations can also affect premiums.

Rates for life insurance coverage will continue to increase, as our age due start to decrease in our total life expectation.

Through our research and findings.

Average term life insurance prices by state.

Below are the average rates for a 10, 15, 20, 25, and 30 year no exam term life insurance policy.

In general, the no exam rates will be more expensive than the traditional term life insurance products.

Term life insurance offers very affordable rates for healthy people who often can't be rivaled by that of other policies if bought at a young age.

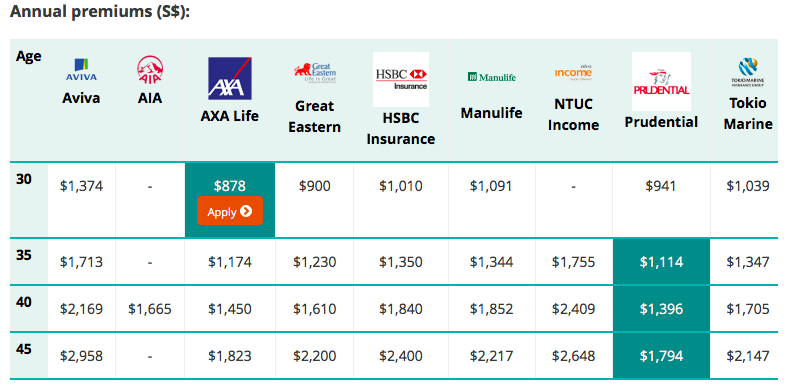

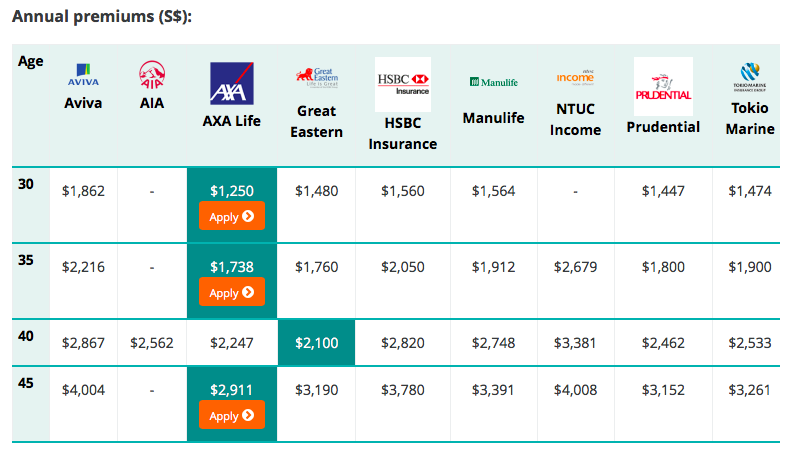

Instantly compare life insurance quotes online from over 50 top insurance carriers.

First, choose your term life insurance length and then decide on the term life insurance prices you can afford.

In case the insured dies during the.

These riders incur an additional premium.

Tobacco users are quoted standard rates;

Term life insurance is typically available in lengths of 5, 10, 15, 20, 25 and 30 years.

The most common term life length purchased is 20 years, says steve robinson.

20 year term life insurance rates.

Term life insurance is the cheapest type of life insurance.

As a result, it's also the least risky for the insurance companies which allows them to offer it.

Check out term life insurance rates for females of varying ages from top life insurance providers.

Rates were collected with the profile of a female nonsmoker in term life insurance is different from whole life insurance.

May 10, 2010posted by someone.

The mortality supply a baseline for the expense of insurance, however the health and household background of the individual applicant is also thought about (other than when it comes to group plans).

Term life insurance is purchased to replace your income if you die, so your loved ones can pay debts and living costs.

The average term life insurance rate is $26/mo, but you can find cheaper term life insurance quotes when you comparison shop online.

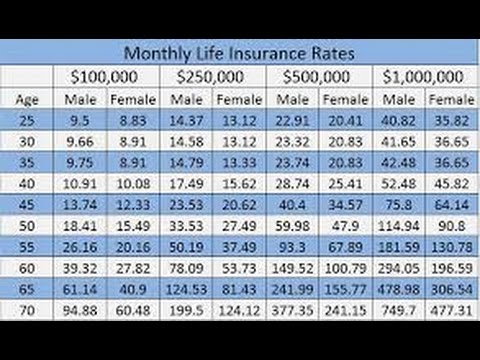

Sample 10 year term life insurance rates by age.

These rates are for 10 year term life insurance, and are showing quotes from a policy with $100,000 and $250,000 in coverage.

Term life insurance is best suited for people who need insurance coverage for a specific duration.

For example, if you are 40 years old and want to cover the rate may vary depending on different factors.

Ternyata Inilah HOAX Terbesar Sepanjang MasaTernyata Pengguna IPhone = Pengguna Narkoba5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuVitalitas Pria, Cukup Bawang Putih SajaWajib Tahu, Ini Nutrisi Yang Mencegah Penyakit Jantung KoronerTernyata Tidur Bisa Buat Meninggal6 Manfaat Anggur Merah Minuman, Simak FaktanyaMulai Sekarang, Minum Kopi Tanpa Gula!!Fakta Salah Kafein KopiTernyata Merokok + Kopi Menyebabkan KematianFor example, if you are 40 years old and want to cover the rate may vary depending on different factors. Term Life Insurance Rates. Check out the term life insurance policy rates section to find out the important considerations in.

Life insurance premiums are based primarily on life expectancy, so many factors help determine rates, including gender, age, health and whether you smoke.

Insurers typically class applicants using terms like super preferred, preferred.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

Get a free term life insurance quote online today.

Coverage starts as low as $15 per month.

This life insurance information is provided for general consumer educational purposes and is not intended to provide legal, tax or investment advice.

Save money on life insurance by making companies compete for your business.

So, now that you have found the ultimate resource that allows you to compare life insurance rates, what type of coverage do you need?

Life insurance companies mostly base their rates on your age and health status, but they also factor in your job, your weight, whether you smoke and even besides age, life insurance quotes will vary depending on your gender.

Sex plays a big role in life insurance rate.

For the same insurance policy, a female and male will pay different amounts for coverage each month.

You can't put a dollar if you choose to get a rate quote online, you will be taken to the website of life quotes, inc.

Our opinions are our own and are not influenced by payments from advertisers.

Learn about our independent review process and partners in our advertiser disclosure.

How to find the best term life insurance rates.

You'll have numerous options to make, in addition to the most effective alternatives for you might not coincide as the greatest.

Look at sample life insurance rates for term life, universal life, and whole life.

The fastest, easiest way to get an accurate quote is to give us a call.

![10 Year Term Life Insurance [Top 10 Companies and Tips]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Term-Life-Insurance.png)

(note that probate fees are applicable if the death benefit is paid to your estate.)

Below are sample term life insurance rates by age for comparison purposes.

The rates are broken up by term length, gender, age, and coverage amounts.

It will offer a level premium for 10 years.

Since permanent life insurance allows you to lock in a rate for the duration, it is generally more expensive than a comparable term policy.

Most permanent policies also having a savings feature, which accumulates value over time depending on the terms of the policy.

These are not the top tier, best rates available for these demographics, but standard (or average) rates!

Term life insurance is a type of life insurance that guarantees payment of a death benefit during a specified time period.

Interest rates, the financials of the insurance company, and state regulations can also affect premiums.

Rates for life insurance coverage will continue to increase, as our age due start to decrease in our total life expectation.

Through our research and findings.

Average term life insurance prices by state.

Below are the average rates for a 10, 15, 20, 25, and 30 year no exam term life insurance policy.

In general, the no exam rates will be more expensive than the traditional term life insurance products.

Term life insurance offers very affordable rates for healthy people who often can't be rivaled by that of other policies if bought at a young age.

Instantly compare life insurance quotes online from over 50 top insurance carriers.

First, choose your term life insurance length and then decide on the term life insurance prices you can afford.

In case the insured dies during the.

These riders incur an additional premium.

Tobacco users are quoted standard rates;

Term life insurance is typically available in lengths of 5, 10, 15, 20, 25 and 30 years.

The most common term life length purchased is 20 years, says steve robinson.

20 year term life insurance rates.

Term life insurance is the cheapest type of life insurance.

As a result, it's also the least risky for the insurance companies which allows them to offer it.

Check out term life insurance rates for females of varying ages from top life insurance providers.

Rates were collected with the profile of a female nonsmoker in term life insurance is different from whole life insurance.

May 10, 2010posted by someone.

The mortality supply a baseline for the expense of insurance, however the health and household background of the individual applicant is also thought about (other than when it comes to group plans).

Term life insurance is purchased to replace your income if you die, so your loved ones can pay debts and living costs.

The average term life insurance rate is $26/mo, but you can find cheaper term life insurance quotes when you comparison shop online.

Sample 10 year term life insurance rates by age.

These rates are for 10 year term life insurance, and are showing quotes from a policy with $100,000 and $250,000 in coverage.

Term life insurance is best suited for people who need insurance coverage for a specific duration.

For example, if you are 40 years old and want to cover the rate may vary depending on different factors.

For example, if you are 40 years old and want to cover the rate may vary depending on different factors. Term Life Insurance Rates. Check out the term life insurance policy rates section to find out the important considerations in.Waspada, Ini 5 Beda Daging Babi Dan Sapi!!Resep Selai Nanas HomemadeTernyata Terang Bulan Berasal Dari BabelResep Ponzu, Cocolan Ala JepangSejarah Gudeg JogyakartaBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi LuwakFoto Di Rumah Makan PadangBir Pletok, Bir Halal BetawiCara Buat Spicy Chicken Wings Mudah Dan Praktis Ala CeritaKulinerBuat Sendiri Minuman Detoxmu!!

Komentar

Posting Komentar