Term Life Insurance Canada You Can Also Talk To A Sun Life Financial Advisor To Learn More About Term Life Insurance And How It Can Help You And Your Family.

Term Life Insurance Canada. Check Them Out With The Insurance Bureau Of Canada Or With The Credit Rating Agencies.

SELAMAT MEMBACA!

Term life insurance pays a death benefit if the person insured dies within a specific period of time or before you reach a certain age.

Your survivors will get payment if you die at any time while your insurance policy is in effect.

Canada life my term™ life insurance provides protection tailored to your needs and what you can afford.

Canada life my term life insurance helps you protect what matters most.

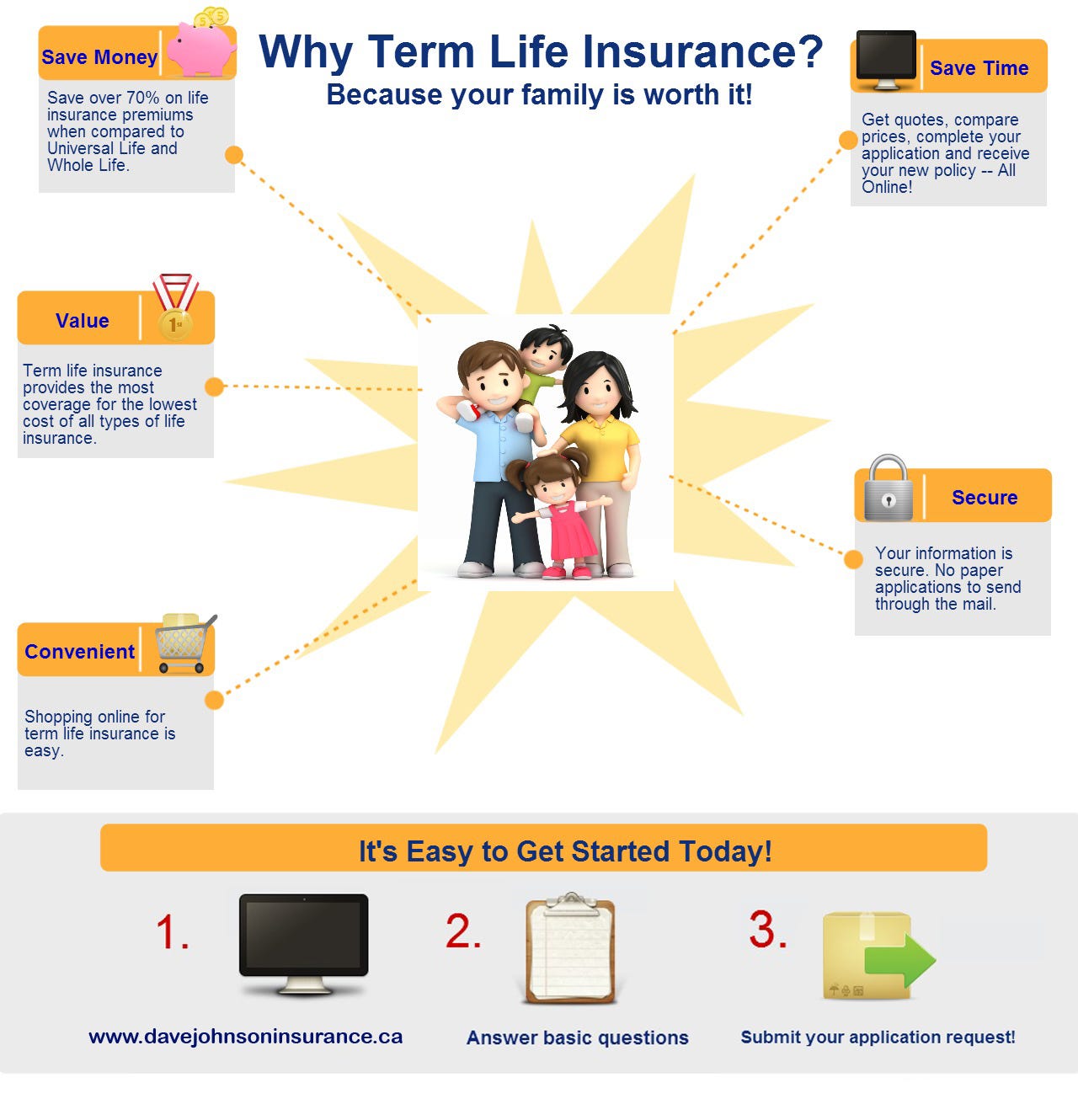

Term life insurance is the most common and affordable form of temporary life insurance bought and owned in canada.

Term life is the perfect life insurance plan for canadians who want reliable coverage that won't break their budget or become an additional burden.

Term life insurance can provide coverage for 10 years, 20 years or for life depending on your needs.

Bmo term life is a flexible and affordable insurance plan.

With term life insurance plans from bmo insurance, you'll get:

A choice of coverage options.

Apply online and get a quote today.

You can also talk to a sun life financial advisor to learn more about term life insurance and how it can help you and your family.

Get help covering expenses for yourself, your family and your business if something happens to you.

Quick, affordable coverage with an online application and no medical exam required.

Term life insurance quotes can be obtained directly from an insurance company, through a licensed broker or by using an online search platform.

Below are some popular online search platforms in canada that offer term life insurance quotes from multiple insurance companies to help you get the.

This is the most popular type of life insurance available in canada mainly because of its affordability and flexibility.

You will find a large resource of information.

Sun life go simplified term life insurance covers you for 10 years, during which time your premiums are guaranteed not to rise.

This coverage is particularly helpful if you have a mortgage, or if you are a parent to young children and want to provide financial support for their needs until they are independent.

For term life insurance the insured gets to choose how long they want the term to be.

It may be for five years, ten years or perhaps twenty years.

Best term life insurance online quotes in canada!

The primary purpose of life insurance in canada is to move the financial risk faced by those you leave behind to the insurance company if you make an early exit.

Term life insurance is the most common type of life insurance in canada, but there are important things to consider before you make a purchase.

At last, term life insurance shopping without the hassle!

Best life insurance quotes termcanada's portfolio of rates from canada's best and most stable companies are continually updated to reflect the very best life insurance canada quotes available.

Why choose lsm insurance for term life insurance a truly an independent agency working for you.

Term insurance is life insurance that will provide you with coverage for a specific duration of time agreed upon at the outset of the policy.

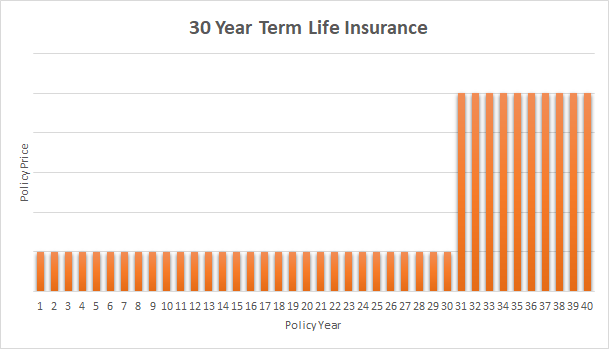

In most cases you will see terms of 10, 20, and 30 years.

Among other considerations, the cost of the premium is dependent on each individual's case and is.

Term life insurance is a contract that guarantees coverage for a set amount of years.

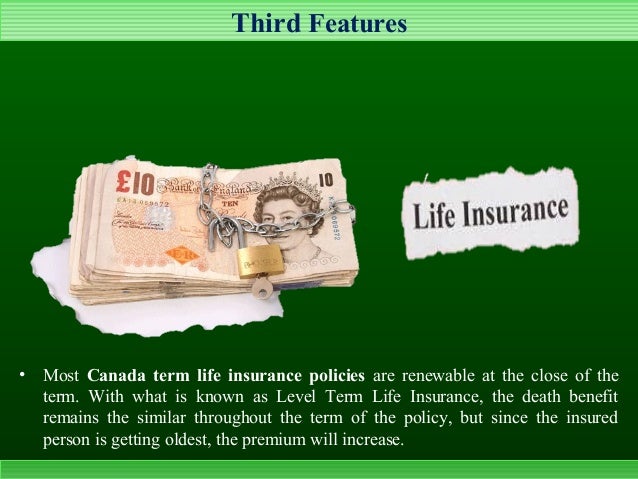

Unless it's renewed, you will lose your coverage.

Canada protection plan term life insurance review what term life insurance coverage does canada protection plan offer?

Term life insurance is part of a nationwide brokerage operating in every province and territory in.

Top 3 life insurance providers in canada.

Need life insurance and want a good place to start?

Essentially, conversion term life insurance gives you the option to convert your term insurance to permanent without having to take another medical exam.

Life insurance in canada is a great way of investing a part of your capital in your family's future.

Get a free online quote in 15 seconds and explore your life insurance coverage for canadian residents.

Term insurance is the least expensive form of life insurance.

Term insurance provides protection during 10 or 40 year terms.

Unlike term insurance which provides pure protection, a universal life insurance policy also includes a savings component.

So, if the cost is a factor loans canada and its partners will never ask you for an upfront fee, deposit or insurance payments on a loan.

Loans canada is not a mortgage broker.

A term life insurance policy is designed to provide protection over a specific number of years e.g.

This type of life insurance is how much does life insurance cost in canada?

Your life insurance premium depends on multiple factors including your age, health status, type of.

There are two major types of life insurance:

Term life insurance covers you for a specific period of time, which is often a year but can be much longer.

A specified amount of insurance is provided during the term for a fixed rate.

Term life insurance tends to cost more as you age, though remove some dangerous sports and it could drive a new policy's premiums down.

Do a quick online search about the carriers to find out which ones pay.

Term life insurance is simple to buy and easy to afford.

Get an online quote now for rbc simplified or yourterm life insurance.

Term life insurance is less costly than whole life insurance and so perhaps a better choice for those on a budget but want to make sure their families have protection.

If you don't die during the term, the policy doesn't pay out and the premiums you've paid are not returned to you.

5 Manfaat Meredam Kaki Di Air EsTernyata Tertawa Itu DukaPD Hancur Gegara Bau Badan, Ini Solusinya!!Khasiat Luar Biasa Bawang Putih Panggang8 Bahan Alami Detox Ternyata Jangan Sering Mandikan Bayi5 Makanan Tinggi KolagenAwas!! Ini Bahaya Pewarna Kimia Pada Makanan6 Khasiat Cengkih, Yang Terakhir Bikin HebohJam Piket Organ Tubuh (Limpa)Term life insurance is less costly than whole life insurance and so perhaps a better choice for those on a budget but want to make sure their families have protection. Term Life Insurance Canada. If you don't die during the term, the policy doesn't pay out and the premiums you've paid are not returned to you.

Term life insurance is the most common type of life insurance in canada, but there are important things to consider before you make a purchase.

Ratehub compares the best life insurance quotes from over 20 of canada's most trusted life insurance companies.

Get a life insurance quote today.

Neither term life insurance nor whole life insurance is best.

Term insurance policies don't include cash value.

This means you can't borrow against your policy and you won't get any cash value back if you cancel your policy.

Compare quotes from top companies and save.

Getting a canadian life insurance quote should never be a time consuming or difficult process.

Neither should the process of life insurance quote comparison be tedious or cumbersome.

We strive to make sure you get a variety of highly competitive life.

The difference can be compared to the difference between renting an apartment and buying a house.

With a term policy, you're essentially renting your coverage for the duration of your.

How does term life insurance work?

Yes (with confirmation by phone or video chat).

We simplify online insurance quote comparison and help canadians find the best rates for the right coverage.

Idc insurance direct canada inc.

Term life insurance is a product that we sell and is offered by over 20 life insurance companies in canada.

You can choose the exact amount of coverage your types of insurances.

Life insurance canada.com provides expert advice and online resources for a variety of different insurance products.

The term is customizable, and you can choose best comparison platforms for life insurance quotes.

Now that you have an idea of what type of insurance you'll need, it's time to start getting quotes.

Why choose lsm insurance for term life insurance a truly an independent agency working for you.

Compare life insurance quotes from canada's top providers.

Find a great rate and protect your family's future.

There are several types of life insurance policies in canada, but they generally fall into two categories:

Term life insurance is purchased over a set period of time—say, 10, 20 or 30 years.

It tends to be cheaper than permanent life insurance for most term and whole are often compared as the best life insurance options in canada.

You should know there are other differences between these two.

In that case, your beneficiary receives a sum of money to help face how long are you insured for?

The coverage term is determined at the start, for a fixed duration (10 or 20 years, t10 or t20), or until a certain age such.

Canada life insurance products are available for purchase in all parts of canada.

Get a free quote through policyadvisor.

Finder.com is an independent comparison platform and information service that aims to provide you.

You can choose coverage for various term lengths including 10, 15, 20, 25 how much does life insurance cost in canada?

Top 3 life insurance providers in canada.

Need life insurance and want a good place to start?

Check out our top rated products right below.

Calculate instant online quotes from top canadian providers.

We offer you the best life insurance quotes from the best insurance companies in canada.

Term life insurance is basically a type of insurance that provides a fixed rate of payments over a set period of.

Bmo term life is a flexible and affordable insurance plan.

Compare term life insurance quotes today!

Insurance hotline is an online comparison platform that was first established in 1994.

Looking for a term or whole life insurance quote?

Compare over 30+ insurance quotes.

Get your free quote today!

Compare life insurance quotes in ontario.

If you died tomorrow, what would happen to the people in your life?

They will be devastated no matter what, but this horrible situation becomes even worse if they are left without enough money.

We found out that many consumers in british columbia are underinsured.

Term life is the perfect life insurance plan for canadians who want reliable coverage that won't break their budget or become an additional burden.

The low cost of term life insurance makes it an excellent fit for families who see the value of financial security, but want something they can easily.

Apply online and get a quote today.

You can also talk to a sun life financial advisor to learn more about term life insurance and how it can help you and your family.

Canada life term life insurance review.

They offer a large range of term life plans at different lengths, and they have multiple rider options for both single and joint policies.

Canada life my term™ life insurance provides protection tailored to your needs and what you can afford.

All comments related to taxation are general in nature and are based on current canadian tax legislation and interpretations for canadian residents, which are subject to change.

Get a free online quote in 15 seconds and explore your life insurance coverage for canadian residents.

Life insurance is a great way of investing a part of your capital in your loved ones' future!

With lifecover.ca comparing term life insurance rates simply involves answering a few questions about your insurance needs.

Once we receive your information, we work with our.

Lifecover.ca is one of canada's leading suppliers of professional, personalized life insurance comparison quotes. Term Life Insurance Canada. Once we receive your information, we work with our.3 Cara Pengawetan CabaiSejarah Prasmanan Alias All You Can EatNikmat Kulit Ayam, Bikin SengsaraResep Pancake Homemade Sangat Mudah Dan Ekonomis5 Makanan Pencegah Gangguan PendengaranAmpas Kopi Jangan Buang! Ini ManfaatnyaAmit-Amit, Kecelakaan Di Dapur Jangan Sampai Terjadi!!Ternyata Bayam Adalah Sahabat Wanita9 Jenis-Jenis Kurma TerfavoritResep Selai Nanas Homemade

Komentar

Posting Komentar