Term Life Insurance Rates Interest Rates, The Financials Of The Insurance Company, And State Regulations Can Also Affect Premiums.

Term Life Insurance Rates. May 10, 2010posted By Someone.

SELAMAT MEMBACA!

Life insurance premiums are based primarily on life expectancy, so many factors help determine rates, including gender, age, health and whether you smoke.

Insurers typically class applicants using terms like super preferred, preferred.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

Get a free term life insurance quote online today.

Coverage starts as low as $15 per month.

This life insurance information is provided for general consumer educational purposes and is not intended to provide legal, tax or investment advice.

Save money on life insurance by making companies compete for your business.

So, now that you have found the ultimate resource that allows you to compare life insurance rates, what type of coverage do you need?

Life insurance companies mostly base their rates on your age and health status, but they also factor in your job, your weight, whether you smoke and even besides age, life insurance quotes will vary depending on your gender.

Sex plays a big role in life insurance rate.

For the same insurance policy, a female and male will pay different amounts for coverage each month.

You can't put a dollar if you choose to get a rate quote online, you will be taken to the website of life quotes, inc.

Our opinions are our own and are not influenced by payments from advertisers.

Learn about our independent review process and partners in our advertiser disclosure.

How to find the best term life insurance rates.

You'll have numerous options to make, in addition to the most effective alternatives for you might not coincide as the greatest.

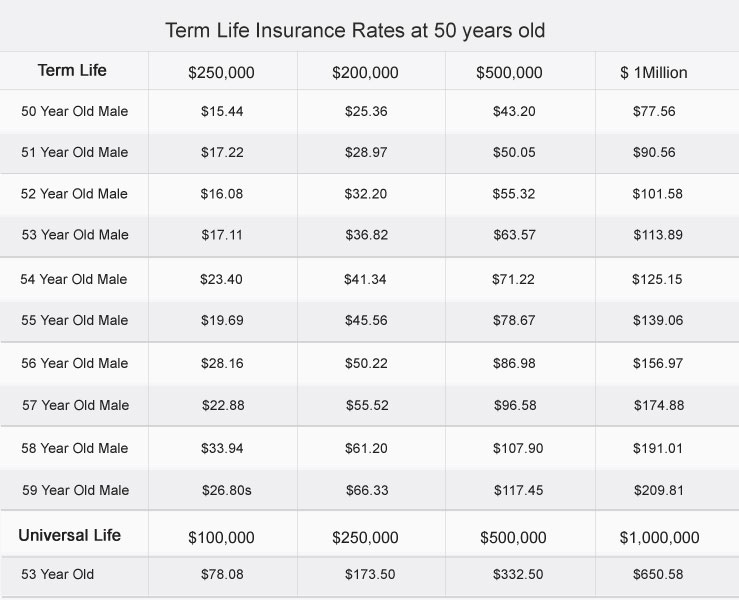

Look at sample life insurance rates for term life, universal life, and whole life.

The fastest, easiest way to get an accurate quote is to give us a call.

(note that probate fees are applicable if the death benefit is paid to your estate.)

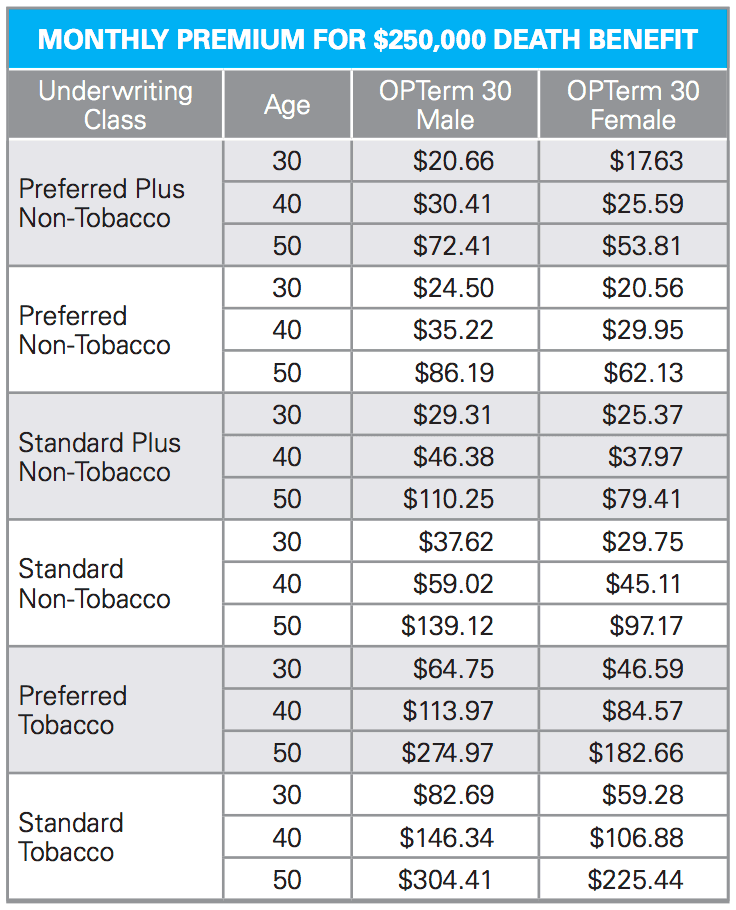

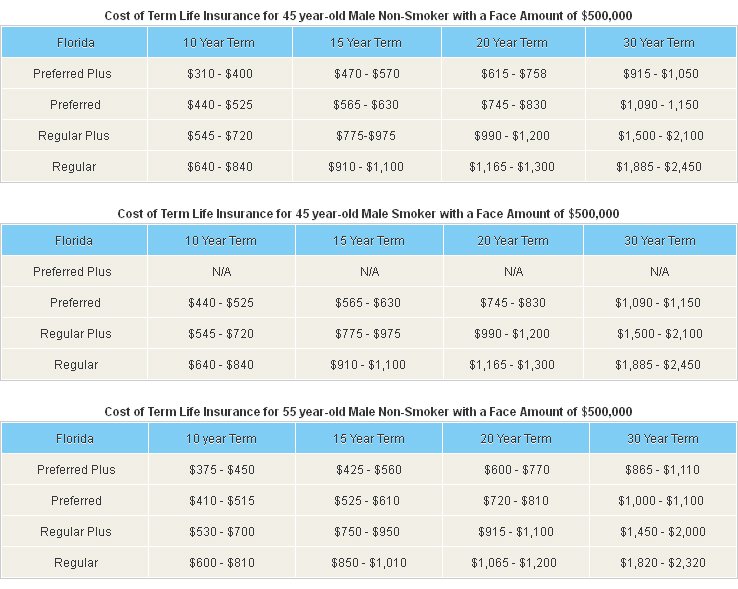

Below are sample term life insurance rates by age for comparison purposes.

The rates are broken up by term length, gender, age, and coverage amounts.

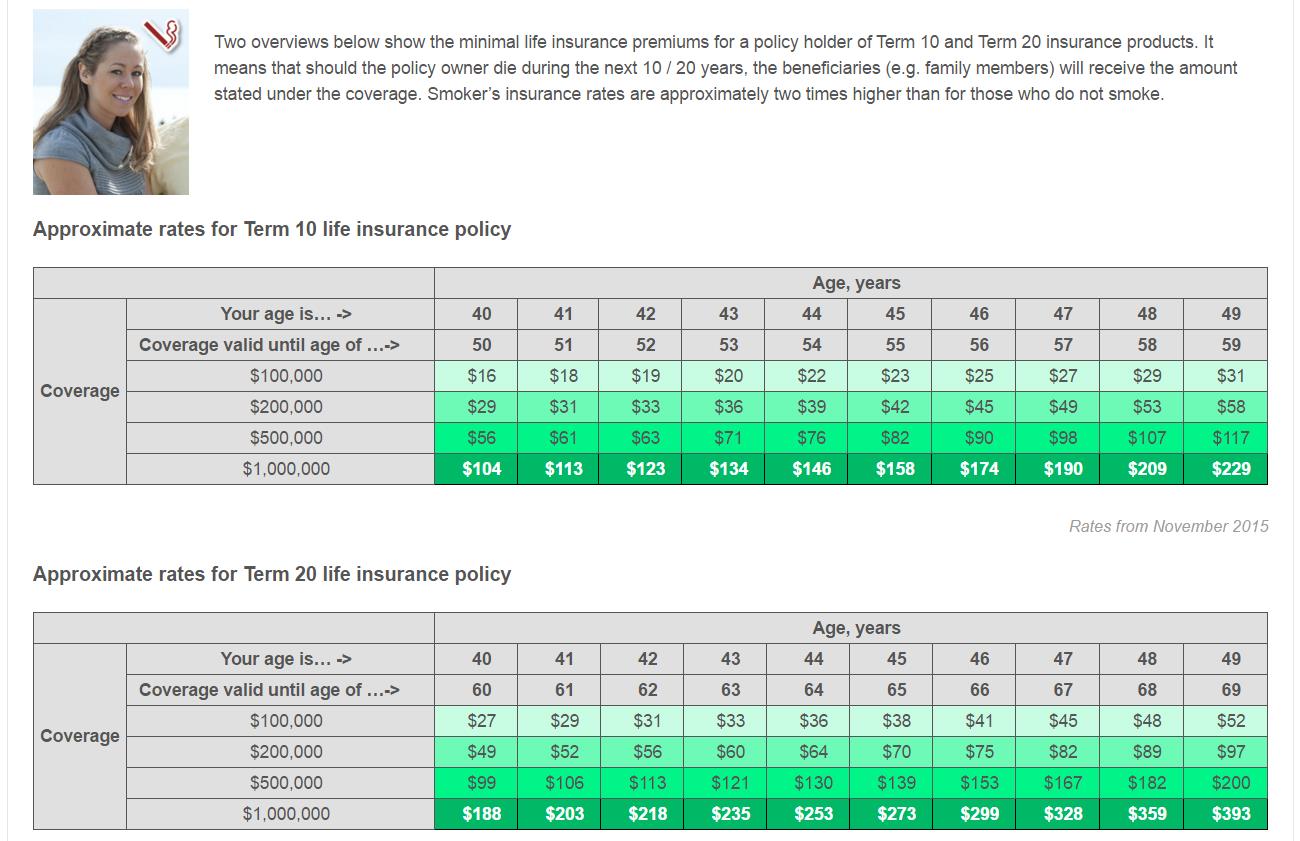

It will offer a level premium for 10 years.

Since permanent life insurance allows you to lock in a rate for the duration, it is generally more expensive than a comparable term policy.

Most permanent policies also having a savings feature, which accumulates value over time depending on the terms of the policy.

These are not the top tier, best rates available for these demographics, but standard (or average) rates!

Term life insurance is a type of life insurance that guarantees payment of a death benefit during a specified time period.

Interest rates, the financials of the insurance company, and state regulations can also affect premiums.

Rates for life insurance coverage will continue to increase, as our age due start to decrease in our total life expectation.

Through our research and findings.

Average term life insurance prices by state.

Below are the average rates for a 10, 15, 20, 25, and 30 year no exam term life insurance policy.

In general, the no exam rates will be more expensive than the traditional term life insurance products.

Term life insurance offers very affordable rates for healthy people who often can't be rivaled by that of other policies if bought at a young age.

Instantly compare life insurance quotes online from over 50 top insurance carriers.

First, choose your term life insurance length and then decide on the term life insurance prices you can afford.

In case the insured dies during the.

These riders incur an additional premium.

Tobacco users are quoted standard rates;

Term life insurance is typically available in lengths of 5, 10, 15, 20, 25 and 30 years.

The most common term life length purchased is 20 years, says steve robinson.

20 year term life insurance rates.

Term life insurance is the cheapest type of life insurance.

As a result, it's also the least risky for the insurance companies which allows them to offer it.

Check out term life insurance rates for females of varying ages from top life insurance providers.

Rates were collected with the profile of a female nonsmoker in term life insurance is different from whole life insurance.

May 10, 2010posted by someone.

The mortality supply a baseline for the expense of insurance, however the health and household background of the individual applicant is also thought about (other than when it comes to group plans).

Term life insurance is purchased to replace your income if you die, so your loved ones can pay debts and living costs.

The average term life insurance rate is $26/mo, but you can find cheaper term life insurance quotes when you comparison shop online.

Sample 10 year term life insurance rates by age.

These rates are for 10 year term life insurance, and are showing quotes from a policy with $100,000 and $250,000 in coverage.

Term life insurance is best suited for people who need insurance coverage for a specific duration.

For example, if you are 40 years old and want to cover the rate may vary depending on different factors.

Multi Guna Air Kelapa HijauTernyata Einstein Sering Lupa Kunci Motor4 Manfaat Minum Jus Tomat Sebelum TidurGawat! Minum Air Dingin Picu Kanker!Awas, Bibit Kanker Ada Di Mobil!!Ternyata Kalau Mau Hamil Bayi Kembar Wajib Makan Gorengan IniTernyata Ini Beda Basil Dan Kemangi!!Pentingnya Makan Setelah Olahraga3 X Seminggu Makan Ikan, Penyakit Kronis MinggatTak Hanya Manis, Ini 5 Manfaat Buah SawoFor example, if you are 40 years old and want to cover the rate may vary depending on different factors. Term Life Insurance Rates. Check out the term life insurance policy rates section to find out the important considerations in.

Look at sample life insurance rates for term life, universal life, and whole life.

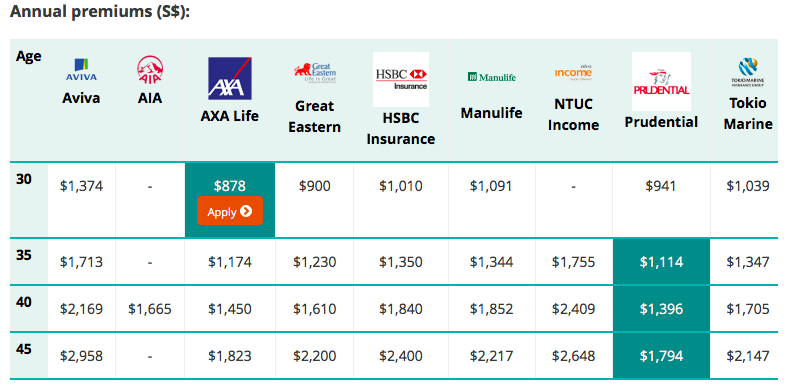

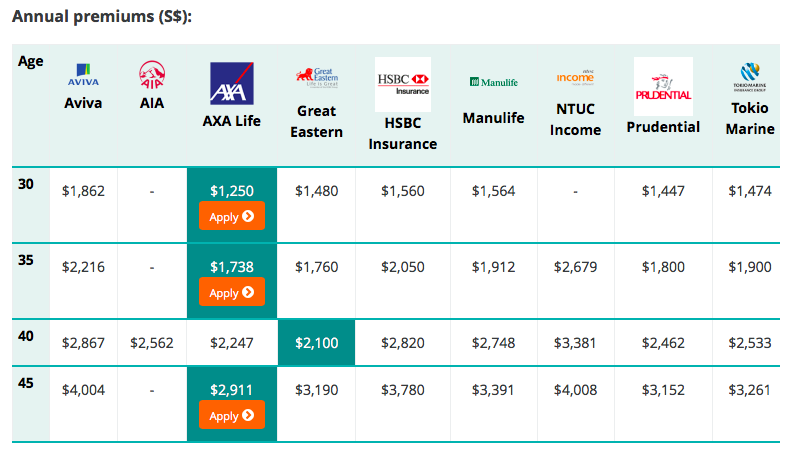

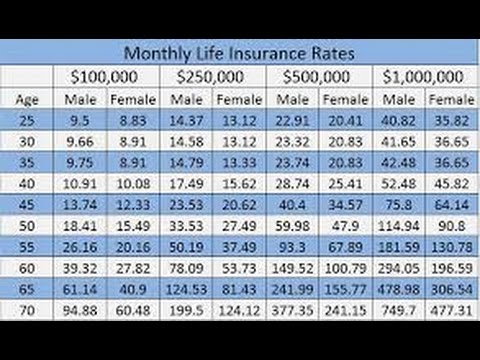

Besides age, life insurance quotes will vary depending on your gender.

On average, men will pay 23% more for term life insurance than women.

Additionally, gender life insurance rate charts used the same insurers and included applicants in excellent health.

But these charts only tell half the story.

Please give us a call for specific rates tailored to your individual needs and goals.

You may also be interested in our charts showing term life insurance.

It is important to note once you buy a term life policy, the rates do not increase over the term period of the policy.

How much does life insurance cost at different ages?

Use our charts to compare sample life insurance rates at every age.

Life insurance premiums are based primarily on life expectancy, so many factors help determine rates, including gender, age, health and whether you smoke.

In general, the healthier you are, the cheaper your premiums.

Insurers typically class applicants using terms like super preferred, preferred.

The term life insurance rate chart below offers sample pricing people that are age 20 and over.

Sample 20 year term life insurance quotes by age.

Here are actual rates for a 20 year term policy with and without a medical exam for $100 can i get life insurance over age 50, 60, or 70?

Insurance rates term life insurance rates by age, term life insurance plan pdf, life insurance over 70 how to find the right coverage, hdfc life term ebaa6termlife77 posts.

Usba basic value group level term military life insurance.

Life insurance infographic globe life insurance rate chart.

Since life insurance becomes more expensive as you age, the sooner you buy it, the more affordable it will be.

Life insurance gets increasingly more expensive as you age, but that not the only factor that determines your costs.

All insurance companies use calculators that determine your life insurance cost.

![10 Year Term Life Insurance [Top 10 Companies and Tips]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Term-Life-Insurance.png)

See examples of typical life insurance rates and compare life insurance quotes online instantly with over 60 a rated companies.

We believe anyone can get a life insurance policy regardless of age whether term, whole, guaranteed issue, or final expense insurance.

Term, whole and universal life rates by age.

Our life insurance rate comparison charts cover term life insurance rates, the average cost of whole life insurance, life insurance rates by age, and more.

Life insurance rates can vary by individual due to their age, gender, health history, and even their driving record.

If you're young and healthy, you.

No physical exam options available.

Filling out a quote form on multiple sites is the worst way to shop for life insurance.

Once you've run your quotes and found a policy you like, then you need to find out what the guidelines are to qualify for it.

When is the best time to buy life insurance?

Below are the average rates for a 10, 15, 20, 25, and 30 year no exam term life insurance policy.

In general, the no exam rates will be more expensive than the traditional term life insurance products.

How much do people pay for life insurance?

Other factors that can influence life insurance rates.

Sex plays a big role in life insurance rate.

Term life insurance is the most affordable policy because it offers coverage for a limited number of years.

If you do not use your coverage during the term most insurance companies will not sell new life insurance policies to people over a certain age, usually around 70.

For people who are older or.

Don't guess, we have listed our life insurance rates by age for term insurance and final expense policies.

Term life insurance rates by age chart.

By reviewing sample life insurance rates by age, term, and coverage, you can estimate quotes before applying.

Through our research and findings, you can see that the increase in monthly premiums, as our age is much smaller if we are young, compared to when we become older.

Term life insurance rates by age.

To determine life insurance rates, insurance companies calculate the likelihood that a person dies during the policy term.

Life insurance rates increase with age accordingly to account for this risk.

Now, this really just applies to when you submit an application for a new policy.

If, for example, you take out a whole life insurance policy, something permanent, then the company already rolls that increase per age cost into the.

The premiums are determined by the insurance carrier each year based on actuarial tables.

And they increase at each successive age because each year there is a bigger drain on the cash.

Aarp term life insurance rates chart facebook lay chart.

Learn about insurance benefits va dod veterans group life.

Life insurance policy comparison chart life insurance.

Life insurance aarp quotes best image 2017.

Premiums are guaranteed by cmfg life insurance company.* based on your health and other factors affecting your insurability, you may be denied coverage.

In general, whole life insurance is much more expensive than term life insurance.

The difference can be anywhere from 5 to 7 times more premium.

Why price is not everything.

Whole life insurance rates by age chart.

Factors that impact your cost.

Posted april 24, 2019 by amy danise.

See term life insurance rates for men and women at different ages and for a variety of coverage amounts. Term Life Insurance Rates. Posted april 24, 2019 by amy danise.Ternyata Inilah Makanan Paling Buat Salah Paham5 Kuliner Nasi Khas Indonesia Yang Enak Di LidahAmit-Amit, Kecelakaan Di Dapur Jangan Sampai Terjadi!!Ternyata Asal Mula Soto Bukan Menggunakan DagingTernyata Bayam Adalah Sahabat WanitaTernyata Makanan Ini Hasil NaturalisasiResep Beef Teriyaki Ala CeritaKulinerWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Sejarah Kedelai Menjadi TahuTernyata Inilah Makanan Indonesia Yang Tertulis Dalam Prasasti

Komentar

Posting Komentar