Term Life Insurance It's A Quick And Easy.

Term Life Insurance. With Term Life Insurance, You Set An Amount Of Time, Or Term, That You Want To Be Covered For.

SELAMAT MEMBACA!

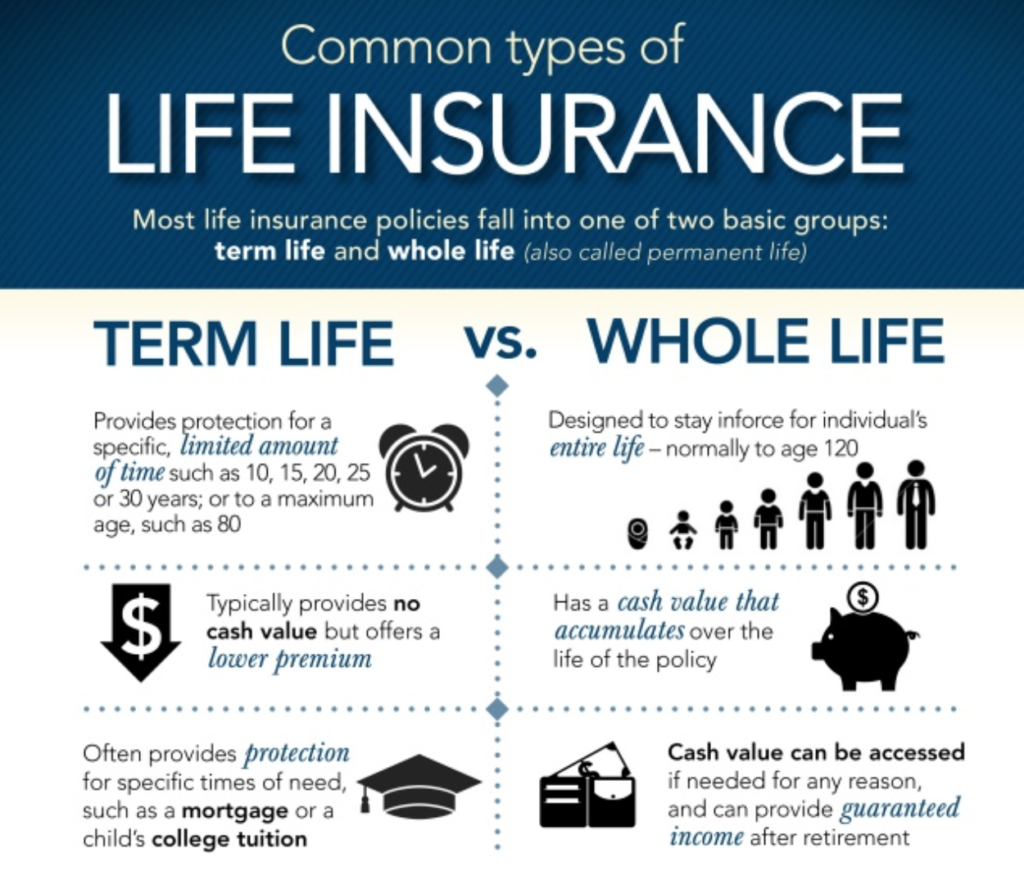

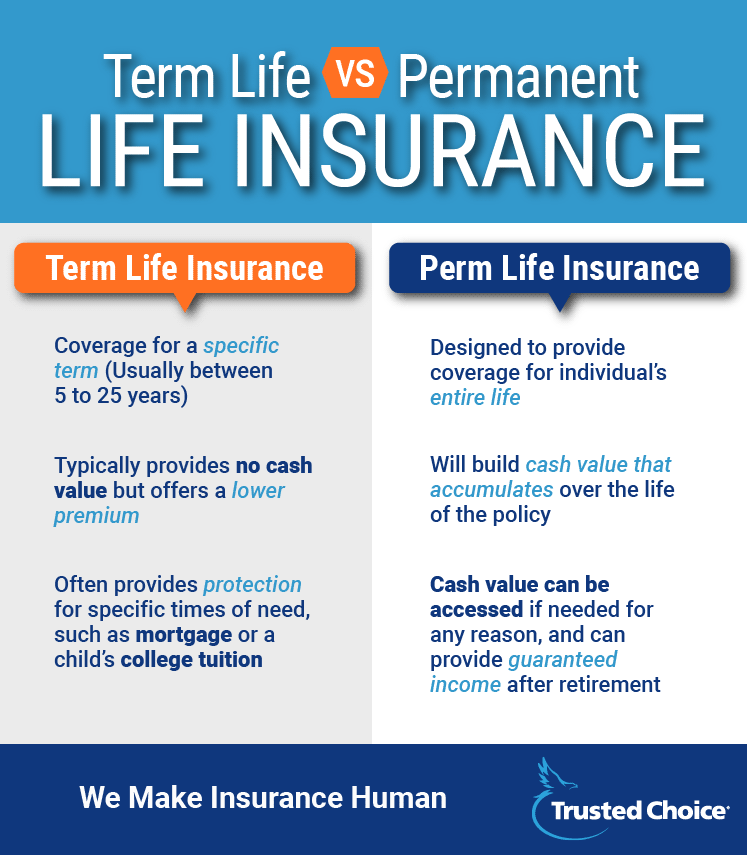

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Term life insurance is attractive to young people with children.

Term life insurance is purchased to replace your income if you die, so your loved ones can pay debts and living costs.

For example, if you and your spouse own a home and you were to die tomorrow.

Term life insurance is a good place to start if you're new to life insurance.

In many ways, buying a term policy is similar to leasing a car.

When you lease a car, there are typically a few lease periods.

It covers you for a fixed period of time, like 10, 20 or 30 years.

If you don't die during the term, your coverage ends and no.

Term life insurance is the type of life insurance that provides coverage for a specific period chosen by the insurer himself according to his needs or requirements.

That means you can expect a higher death benefit for a lower premium with term.

Term life is a simple and affordable type of life insurance.

Term life insurance doesn't accrue cash value like permanent life insurance products, but with many term policies, beneficiaries do receive the full face amount.

If you would like to take out this insurance, you will need an abn amro current account.

This video is the essential overview of term life insurance.

Death benefit, term, face value, & beneficiary.

Term life insurance from nationwide is affordable, predictable and flexible.

Learn about term life insurance rates and get a free quote today.

Term life insurance provides coverage for a set period of time, typically from five to 30 years.

Term life insurance is a life insurance policy that offers coverage for a fixed duration of time, or term. the insured pays a predetermined amount as the premium at periodic intervals during the.

In fact, ethos is one of the few companies that make the word no actually sound appealing because.

Term life insurance from new york life is available in customizable blocks of time up to 20 years.

Term life insurance is simply life insurance with a finite time period of coverage.

Protective life offers term life insurance that is both affordable with 10, 15, 20, 25 or 30 year policies to meet your needs.

Get your fast, free quote today.

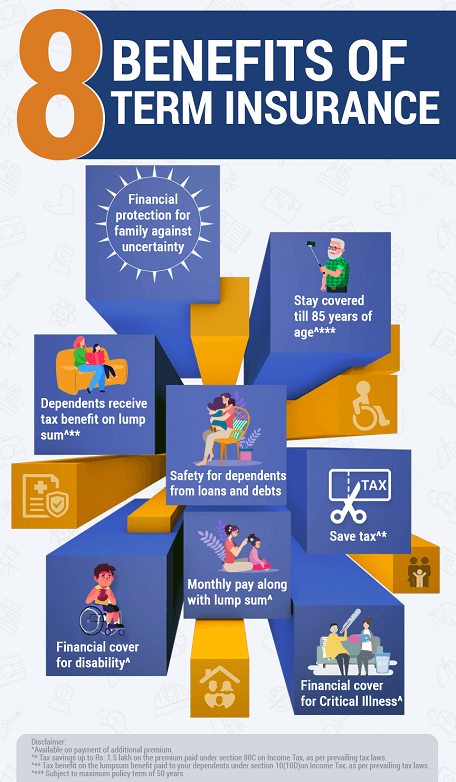

Get ₹1 crore term life cover starting from just ₹376/month to protect you & your family.

The simplest way to protect your family's financial future.

Most policies expire when the insured reaches 95 years old.

With term life insurance you can get more death benefit for your dollar.

So, someone who is on a tight budget can get more protection for their loved ones.

However, term life insurance is a temporary.

Term life insurance covers you for 10 to 40 year periods.

Coverage can be automatically renewed after the.

With term life insurance, you set an amount of time, or term, that you want to be covered for.

![10 Year Term Life Insurance [Top 10 Companies and Tips]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Term-Life-Insurance.png)

Term life insurance rates for seniors.

All rates provided below are accumulated based on monthly premiums for a $1,000,000 policy.

Khasiat Luar Biasa Bawang Putih PanggangIni Cara Benar Hapus Noda Bekas JerawatObat Hebat, Si Sisik NagaTernyata Tertawa Itu DukaMelawan Pikun Dengan Apel3 X Seminggu Makan Ikan, Penyakit Kronis MinggatTernyata Tidur Bisa Buat MeninggalJam Piket Organ Tubuh (Jantung) Bagian 210 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 2)Jangan Buang Silica Gel!Also, consider term life insurance to secure a small business loan or for key man insurance. Term Life Insurance. If you know term is the one you can get a life insurance quote in less than 5 minutes or check out the best.

Ähnliche übersetzungen für term life insurance auf deutsch.

Term life insurance in germany is economical to buy because it covers your life for a fixed term and pays out if you die during the agreed period.

When considering taking out term life insurance in germany, it is important to understand how much you will be paying over the period.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Последние твиты от term life insurance (@termlifeinsure).

Term life insurance is one of the most popular types of life insurance available.

Learn about your options and best carriers!.

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

Term life insurance is a contract between you and an insurance company that lasts for a specific period of time, such as 10 years, 20 years or until you reach age 65.

In exchange for your premium payments, the insurer pays a death benefit to your beneficiaries if you die during the term of the.

Learn more about our various policy options and how each one works.

What is term life insurance?

There's nothing too complicated about term policies.

Start studying term life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Term life insurance is purchased to replace your income if you die, so your loved ones can pay debts and living costs.

A term life insurance policy might be a more affordable option if you have budget considerations.

Our opinions are our own and are not influenced by payments.

Term length covers the policyholder for a specific amount of time.

Term life insurance doesn't accrue cash value like permanent life insurance products, but with many term policies, beneficiaries do receive the full face.

Term life insurance policies typically have lower premiums than permanent policies like whole life policies.

Plus, you can determine the fixed period of time and benefit amount.

![Term Life Insurance: Insider Tips [Research + Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/insproviders-live/9496f87a-term_life_insurance_advantages_disadvantages.png)

Term life insurance policies are the most common.

With these policies, you pay a premium each month during a set term to secure a death benefit unlike term insurance, in which the death benefit is provided entirely by policy coverage, increasing cash value in a whole life policy decreases the.

This video is the essential overview of term life insurance.

It's a quick and easy.

Term life insurance from gerber life provides affordable protection, giving you and your family peace of mind, no matter what the future holds.

A term life insurance policy is the simplest, purest form of life insurance:

A term life insurance policy can offer a substantial cover.

In case of death of the insured individual during the policy term, the death benefit is paid by the insurer to the.

Term life insurance is part of a nationwide brokerage operating in every province and territory in canada.

Term life coverage is typically purchased for a specific amount of time, such as 10, 20 or 30 years, or up to a certain age, depending on the policy.

Term life insurance offers a face amount for a le ngth of time.

The only frills are riders you have the option of adding.

But the simplicity makes it the least expensive type of life insurance available.

Compare term life quotes right now using the.

Term life insurance provides coverage for a specified period of time, such as 15, 20 or 30 years, as long as you pay your premiums when due.

Thanks to a convertibility feature, our term life insurance has the.

Term life insurance provides affordable coverage for your loved ones if you die.

See what it is, how it works, and how much it costs.

When applying for a term life policy, you'll typically start with filling out the application.

You'll select the details of your policy—term.

Life, auto & home, dental, vision and more.

Get help covering expenses for yourself, your family and your business if something happens to you.

Get life insurance that's easy to apply for and understand.

Quick, affordable coverage with an online application and no medical exam required.

Term life insurance is a very common form of life insurance and provides a lump sum payout if you die in the course of the policy duration or if you suffer from a total permanent disability.

Looking for term life insurance in canada?

Looking for term life insurance in canada? Term Life Insurance. Term life insurance is a simple form of life insurance to help you financially protect your family if your surviving family needed access to cash toCegah Alot, Ini Cara Benar Olah Cumi-CumiNikmat Kulit Ayam, Bikin SengsaraResep Cumi Goreng Tepung Mantul7 Makanan Pembangkit LibidoSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Ampas Kopi Jangan Buang! Ini ManfaatnyaSejarah Kedelai Menjadi TahuSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanSejarah Nasi Megono Jadi Nasi Tentara

Komentar

Posting Komentar