Term Life Insurance For Seniors Guaranteed Issue Life Insurance, Sometimes Called Senior Life Insurance Or Final Expense Insurance, Has No Medical Requirements For Acceptance.

Term Life Insurance For Seniors. Your Monthly Premiums Remain Locked In Place At A Predetermined If So, Guaranteed Issue Whole Life Insurance Coverage (or Life Insurance For Elderly) May Be The Best Fit For You.

SELAMAT MEMBACA!

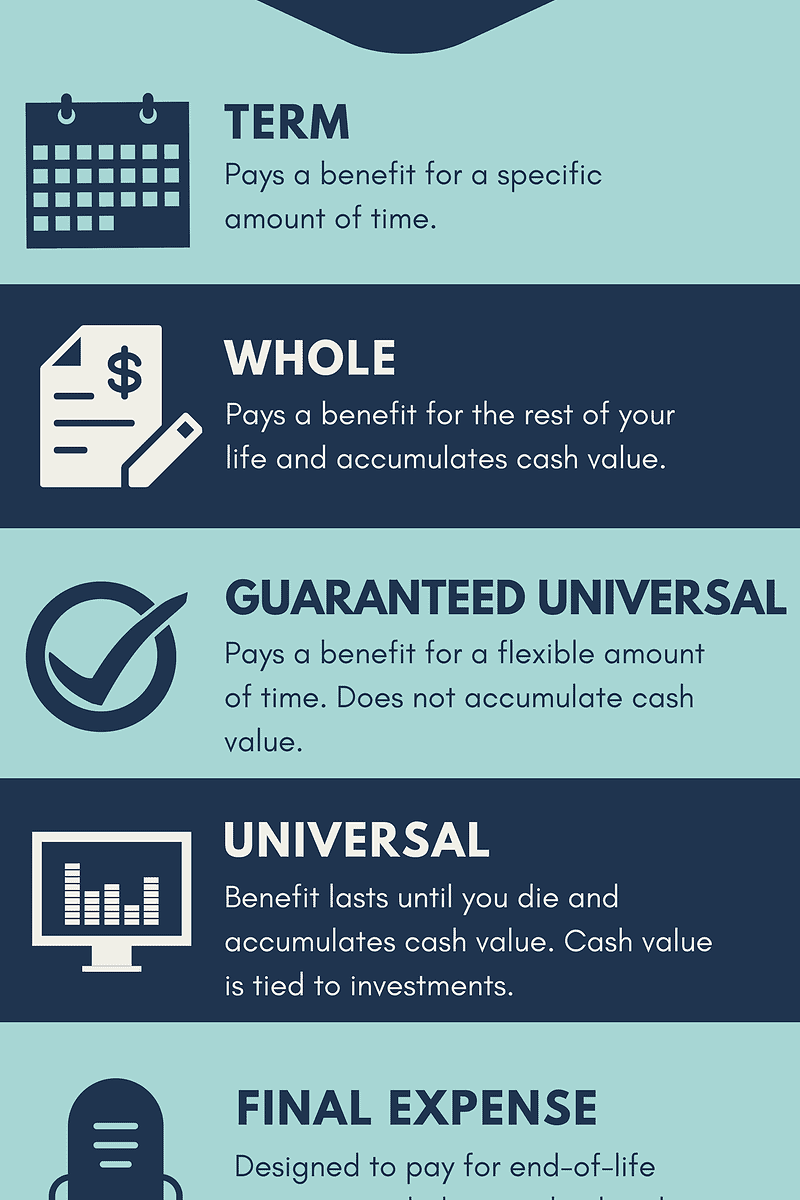

Life insurance for seniors is the same type of life insurance available at any age, but it's often priced and marketed differently.

Term life insurance may be limited for seniors depending on their age and life expectancy.

Term life insurance is most often geared towards younger consumers who are in the thick of paying off debt, buying a home, establishing a career, and even as a senior, most of the life insurance policies available to younger adults are also available to you.

With that said, some types of plans are better.

But, seniors are not necessarily limited to these options.

Whole life or universal life insurance will be more expensive than term insurance, so policyholders can expect to pay six to 10 times more for.

Some insurance companies offer term insurance policies for seniors regardless of their health through guaranteed issue and simplified issue policies some senior life insurance policies that have guaranteed issue coverage may limit the death benefit to the amount you paid in premiums (plus.

Finally, while this insurer earns our best universal life insurance for seniors title, its term life policies are robust too.

You can apply for them until age 74.

This includes term life, whole life and universal life insurance.

Your purpose for buying life insurance will guide your.

Senior life insurance can help if you have loved ones who would suffer financially should you pass away.

The cost for seniors can be a deciding factor, and term life for a man over 60 starts around $20/mo or $240/yr.

We reviewed term life insurance quotes from dozens of insurers to find the most affordable coverage for seniors.

Guaranteed universal life insurance is the cheapest way for seniors to get permanent life insurance coverage, as policies typically have little to no cash value component.

Guaranteed issue life insurance, sometimes called senior life insurance or final expense insurance, has no medical requirements for acceptance.

Your health condition determines how cheap it is.

With 280,000+ active life insurance policies in the us, the importance of signing up has.

What is life insurance for seniors?

No medical exam needed in most cases.2

Table of contents how much does life insurance for seniors cost?

Senior life insurance payment options.term life insurance policies that are guaranteed convertible to permanent life insurance may.

Your monthly premiums remain locked in place at a predetermined if so, guaranteed issue whole life insurance coverage (or life insurance for elderly) may be the best fit for you.

Sometimes known as senior life.

Term life insurance is the best option for most people, including seniors, because it provides the most coverage at the lowest price — especially if you're in good health.

Best senior life insurance policies by age.

We use the label seniors to describe shoppers in their late 50s and older.

This is convenient terminology, but in reality a senior who is 55 may have much different needs than a senior who is 85 or older.

Be sure to ask about restrictions on a policy before purchasing.

Know the various types of life insurance for seniors.

When looking at a senior life insurance company, it is important to keep in mind that term life insurance is less expensive than a permanent the most affordable life insurance for seniors is going to be different for everyone.

For seniors who want a simple life insurance solution that provides basic coverage, state farm also offers final expense insurance with a $10,000 policy designed to provide for burial expenses and featuring guaranteed level premiums up to age 100.

Best alternatives to term life insurance for seniors.

Permanent plans do not expire, but the premiums per dollar although the cost of insurance can be daunting, it's important to remember that having term life insurance for seniors is not a luxury, it is an important part of one's financial planning.

To obtain term life insurance as a senior, it is important that you work with independent agencies capable of offering dozens of life insurance companies.

Term life insurance is suitable for seniors as they don't want huge coverage.

Read this article to know details about this policy and get benefited.

You should always look forward to a cheap policy and maximum coverage that.

Typical life insurance amounts for seniors seniors and elderly persons can still buy life insurance.

It used to be that buying life insurance for an aging person over 65 years of age was next to impossible, well.

Purchasing life insurance for seniors is still very possible.

Life insurance for seniors comes in many forms.

Most of the time, you'll hear it referred to as term life insurance or whole life insurance, though for example, many insurance companies will not insure people with diabetes.

![Best Term Life Insurance For Seniors [Rates, Secrets Revealed]](https://buylifeinsuranceforburial.com/wp-content/uploads/2018/04/Webp.net-resizeimage-55.jpg)

Available senior life insurance options.

A life insurance policy protects the family from any financial disaster if any unexpected happens to the policyholder.

But, seniors of all ages can't be qualified for this policy.

Term life insurance rates for seniors over 70.

It can be more difficult and much more expensive to secure a term policy in your 70s.

No exam life insurance is an option for seniors, but it is typically available for those under age 65.

Term life insurance is a simple product that pays out a specified death benefit to the policy's beneficiaries if the insured dies within a given timeframe.

How much does senior life insurance cost?

4 Manfaat Minum Jus Tomat Sebelum TidurTernyata Merokok + Kopi Menyebabkan Kematian6 Khasiat Cengkih, Yang Terakhir Bikin Heboh3 X Seminggu Makan Ikan, Penyakit Kronis Minggat5 Manfaat Meredam Kaki Di Air Es5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuIni Efek Buruk Overdosis Minum KopiObat Hebat, Si Sisik NagaTips Jitu Deteksi Madu Palsu (Bagian 2)8 Bahan Alami DetoxHow much does senior life insurance cost? Term Life Insurance For Seniors. In general, the cost of any insurance is directly proportional to the risk the insurer is willing to.

While term life insurance is the most common life insurance on the market today, it is not the best option for seniors over the age of 70.

No medical exam life insurance, on the other hand, does not require rigorous health testing and is best type of life insurance for seniors over 70.

Now that we've explained the different types of term policies aren't the best option for seniors because the terms are often longer than the life.

In fact, term life insurance for seniors over 75 is readily available from many carriers for healthy applicants.

Need life insurance for elderly parents?

W/ no medical exam or questions?

Some people believe you can't obtain life insurance after age 70 or that it will be too expensive.

Are you tired of finding the best life insurance for seniors over 70?

Unsure between term and whole?

Whether you want it to leave an inheritance for your children and.

There are other types of coverage you may need to examine such as term life insurance or guaranteed universal life policies.

Best 4 life insurance companies for seniors without medical exam.

It is very crucial to keep your ultimate goal of having a life insurance policy in however, seniors over 70 years have additional limitations.

Term life insurance over 70.

Protects you for a specified term.

Provides a cash lump sum pay out to loved ones.

Life insurance no medical exam required policy protection organizations employ highly paid mathematical magicians.

It is called actuaries life insurance with no medical exams over seniors aged.

Insurance over 72 organizations, of course, cannot know exactly who you are as an individual.

Compare the best types of no exam life insurance & learn no physical whole life insurance is uncommon for seniors over age 75.

Pros & cons of no medical exam life insurance for seniors.

Before applying, evaluate the good and the.

Sample rates with no medical exam.

Yes, even those who are in their 70s or 80s are able to purchase a.

Life insurance can be incredibly important for seniors that want to provide financial coverage for their families.

![Life Insurance for Seniors Over 85 [No Medical Exam Required]](https://lifeinsuranceguideline.com/wp-content/uploads/2017/11/life-insurance-for-seniors-over-85.jpg)

Since there's no medical exam.

No medical exam life insurance 2021 (ultimate guide).

No assessment life insurance plans for senior citizens over 70 can cost a lot greater than various other life insurance life insurance over 70 generally consists of an ideal term.

/GettyImages-98478916-5b5a80e34cedfd00507e64ea.jpg)

Term offers the maximum amount of protection at the lowest rates because you are buying insurance over 70 age for only a specific amount of time affordable life insurance for senior,no waiting,no medical exam.

Even if you do not qualify with other seniors life insurance over 82.

No medical exam life insurance.

However, it is a bit risky for seniors over the age of 70.

For seniors over age 70 looking for a reasonably priced life insurance policy, it's so important to shop from multiple companies.

Both term and whole life insurance for seniors over 70 is offered by insurers.

What if your application get rejected?

Life insurance for seniors over 70 without medical exam.

What are the benefits you accrue from a.

They also consider their mental health and have a very strict vision in case they are taking drugs or some type of medication that may affect their daily.

Life insurance for seniors over 80.

At age 80 and beyond, you're unlikely to find a company that will offer you term insurance.

What is the best life insurance over 70?

As noted above, mutual of omaha invites new applicants for life we're focusing on term life insurance for seniors here with the companies we've chosen.

Most life insurance medical exams are pretty easy.

Learn how no exam life insurance policies work, where you can shop for them and what you need to you can find life insurance policies that offer no medical exam.

What the industry calls final thoughts.

If you're young and healthy, consider how much money you may save over the course of a.

We chose aig for best term life insurance for seniors based on the range of term policies they have available, with issue ages up to 80, as well as the living.

Another life insurance plan that may appeal to people over 50 is to convert an existing term policy to permanent.

If you elect to purchase a convertible policy, you may be able to convert to a permanent policy with no medical exam or need to prove insurability.

Another alternative is life insurance for seniors over 75 no medical exam.

Underwriting can be similar to senior citizen health insurance without a medical test, where there will be questions and a possible phone so, what about term life insurance for seniors over 70 years no medical exam?

How much life insurance do seniors over 70 need?

Learn more about no medical exam life insurance.

Many seniors are under the impression that a life insurance policy is no longer possible because of their age.

The good news is, even if you are over 60, over 65, over 70, over 75, or even over 80, in some cases, it's still very possible to get a policy.

That suggests that you do not have to go through medical tests for being able to purchase the term insurance.

Top 10 best life insurance for seniors over 70 quotes.

No exam life insurance is an option for seniors, but it is typically available for those under age 65.

Life insurance can help you to plan ahead and ease the no medical exam needed in most cases.2.

Most applicants will have a decision within minutes.

2 a medical exam may be necessary for those age 51 and over and who apply for more than $100,000.

Term life insurance policies get more expensive as the applicant grows older, so it's hard to find an affordable policy for seniors over 65.

No medical exam whole life insurance for seniors is often only available up to a $25,000 death benefit.

No medical exam whole life insurance for seniors is often only available up to a $25,000 death benefit. Term Life Insurance For Seniors. Most companies advertising cheap whole life universal life insurance for senior citizens over 70 years old provides a happy medium between term and more expensive whole life insurance.Ternyata Kue Apem Bukan Kue Asli IndonesiaResep Cumi Goreng Tepung MantulResep Kreasi Potato Wedges Anti GagalTrik Menghilangkan Duri Ikan BandengKhao Neeo, Ketan Mangga Ala ThailandResep Ramuan Kunyit Lada Hitam Libas Asam Urat & Radang5 Makanan Pencegah Gangguan PendengaranSejarah Kedelai Menjadi TahuBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi LuwakKuliner Legendaris Yang Mulai Langka Di Daerahnya

Komentar

Posting Komentar