Term Life Insurance Term Life Coverage Is Typically Purchased For A Specific Amount Of Time, Such As.

Term Life Insurance. Term Life Insurance Is Purchased To Replace Your Income If You Die, So Your Loved Ones Can Pay Debts And Living Costs.

SELAMAT MEMBACA!

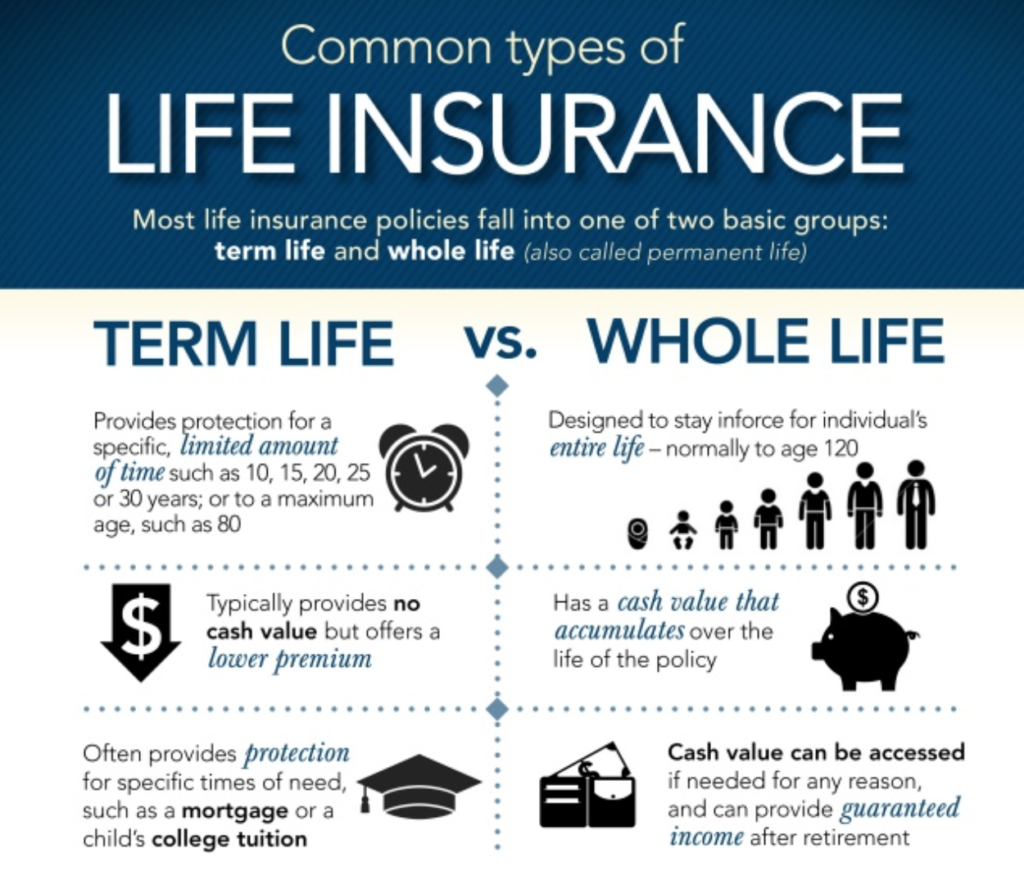

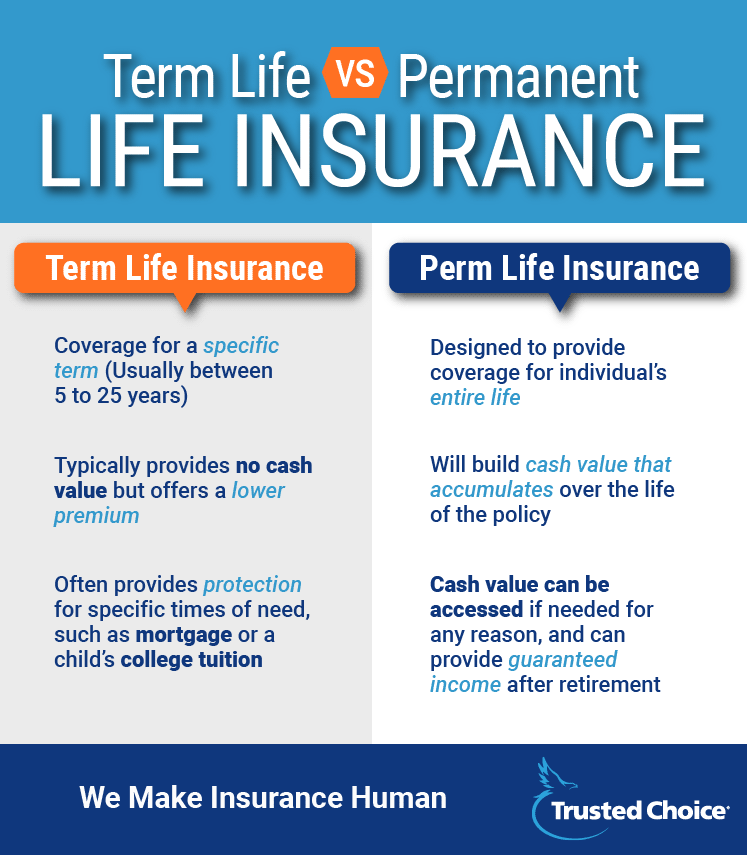

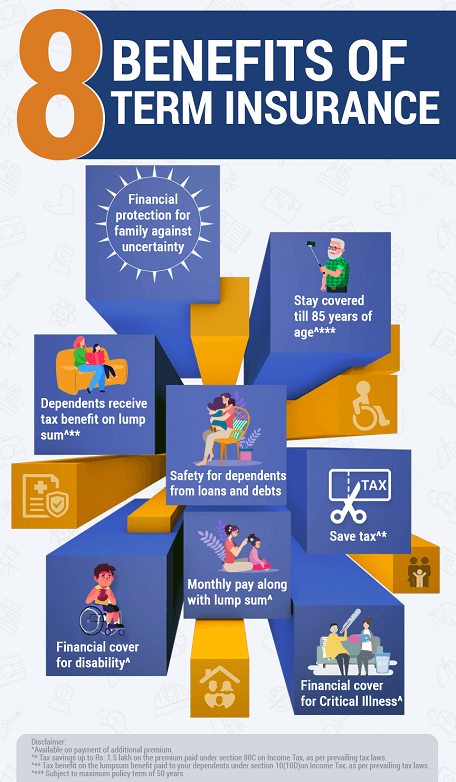

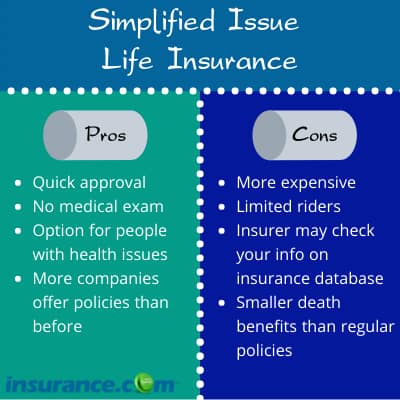

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

Term life insurance is attractive to young people with children.

Term life insurance isn't as complicated as whole life, but choosing a policy isn't always simple.

Term life insurance is purchased to replace your income if you die, so your loved ones can pay debts and living costs.

Term life is a simple and affordable type of life insurance.

Term life insurance covers you for a specific amount of time.

When you purchase term life insurance, you are entering into a contract with a life insurance company for a specific amount of money and period of time, usually 10 to 30 years.

Term life insurance is the type of life insurance that provides coverage for a specific period chosen by the insurer himself according to his needs or requirements.

Term life insurance is a good place to start if you're new to life insurance.

In many ways, buying a term policy is similar to leasing a car.

Term life insurance is designed to offer an affordable way to protect your loved ones from financial burden in your absence.

Term life insurance is the more economical option, since the insurance company is betting on you surviving the term.

That means you can expect a higher death benefit for a lower premium with term.

Term life insurance provides coverage for a set period of time, typically from five to 30 years.

The insurance company pays a benefit to your beneficiary if you die within this term.

What is term life insurance?

If you would like to take out this insurance, you will need an abn amro current account.

This video is the essential overview of term life insurance.

Death benefit, term, face value, & beneficiary.

Protective life offers term life insurance that is both affordable with 10, 15, 20, 25 or 30 year policies to meet your needs.

Get your fast, free quote today.

Term life insurance is a life insurance policy that offers coverage for a fixed duration of time, or term. the insured pays a predetermined amount as the premium at periodic intervals during the.

Learn about term life insurance rates and get a free quote today.

Term life insurance is a legal contract between you and rbc life insurance company.

Term life insurance covers you for 10 to 40 year periods.

Term life insurance is simply life insurance with a finite time period of coverage.

The term in term life insurance refers to the amount of time a policy is active for.

Term life insurance from new york life is available in customizable blocks of time up to 20 years.

You may continue with your current policy.

With term life insurance you can get more death benefit for your dollar.

So, someone who is on a tight budget can get more protection for their loved ones.

Term life insurance is a fixed premium product purchased for a specific period of time.

As long as premium payments are made the payout for a death is a fixed sum.

Melawan Pikun Dengan ApelHindari Makanan Dan Minuman Ini Kala Perut KosongSegala Penyakit, Rebusan Ciplukan ObatnyaVitalitas Pria, Cukup Bawang Putih SajaTips Jitu Deteksi Madu Palsu (Bagian 1)4 Manfaat Minum Jus Tomat Sebelum Tidur6 Khasiat Cengkih, Yang Terakhir Bikin HebohTernyata Merokok + Kopi Menyebabkan KematianSehat Sekejap Dengan Es BatuKhasiat Luar Biasa Bawang Putih PanggangAs long as premium payments are made the payout for a death is a fixed sum. Term Life Insurance. A term life insurance policy can give you the peace of mind that comes with knowing that your family will be able to do things like stay in your home and pay for your funeral costs if you pass.

Besides age, life insurance quotes will vary depending on your gender.

![10 Year Term Life Insurance [Top 10 Companies and Tips]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Term-Life-Insurance.png)

Average life insurance rates by age were calculated based on quotes from five of the largest insurers:

John hancock, massmutual, new york life.

Our life insurance cost calculator can help you estimate how much a term life policy could cost, based on national averages.

Your age can also significantly affect premium costs.

The older you are, the more.

Look at sample life insurance rates for term life, universal life, and whole life.

They represent the best prices a person in excellent health can get.

Below are sample term life insurance rates by age for comparison purposes.

The rates are broken up by term length, gender, age, and coverage amounts.

Use our comparison tool for a personalized quote.

10 year term life insurance rate chart by age.

Whole life policy rates do rise with age, however.

And they increase at each successive age because each year there is a bigger drain on the cash.

Whole life insurance to age 100.

This policy is paid up at age 100, so you pay premiums until you die or reach 100.

![Term Life Insurance: Insider Tips [Research + Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/insproviders-live/9496f87a-term_life_insurance_advantages_disadvantages.png)

However, overtime whole life comes out ahead because your premium is fixed and you have paid into.

Sample 20 year term life insurance quotes by age.

Here are actual rates for a 20 year term policy with and without a medical exam for $100 can i get life insurance over age 50, 60, or 70?

Average no exam term life insurance costs by age, gender, & policy length.

Below are the average rates for a 10, 15, 20, and 30 year term life insurance policy.

The 10 year term is going to give you the most affordable rates, while the 30 year term is going to be the most expensive option.

The term life insurance rate chart below offers sample pricing people that are age 20 and over.

Average life insurance cost by age.

How much do people pay for life insurance?

Sex plays a big role in life insurance rate.

For the same insurance policy, a female and male will pay different amounts for coverage each month.

The sooner you buy life insurance, the more affordable it's likely to be.

This guide will help you gain insight into life insurance rates by age — and why there's no time to buy like the present.

In your 20s, life insurance is inexpensive and easy to get.

At this age, you can expect an enormous number of term life options at affordable prices.

Two overviews below show the minimal life insurance premiums for a policy holder of term 10 and term 20 insurance products.

It means that should a policy owner die during the next 10 / 20 years, the beneficiaries (e.g.

If you are reading this then you fit in between this bracket and probably had an epiphany and realized that life insurance right now is super important.

Life insurance rates increase with age accordingly to account for this risk.

Now, this really just applies to when you submit an application for a new policy.

Term life insurance offers the cheapest form of life insurance coverage for people who are in good health.

Did you know that term life insurance rates are even more affordable depending on your age?

Find out how your age and health can get you the lowest as with most forms of insurance, companies want to see a healthier, younger aged clients signing up.

The rate of increase for premiums goes up.

To determine life insurance rates, insurance companies calculate the likelihood that a person dies during the policy term.

The higher your risk, the more likely it is that you will pass away before paying the full coverage.

See term life insurance rates for men and women at different ages and for a variety of coverage amounts.

Expect whole life premiums to cost between $250 to $1,000 a month if you're young and healthy, and that price increases significantly as you age.

Since whole life policies offer lifelong coverage and build cash value, they're more expensive than term life insurance.

How life insurance rates are determined.

In an overall sense, life insurance ladder offers affordable term life insurance that's easy to understand and quick to set up online.

It only takes a few minutes to apply and you get.

How much does term life insurance cost at different ages?

Don't guess, we have listed our life insurance rates by age for term insurance and final expense policies.

If you are younger than 30 or older than 79 you can get your life insurance rates by age by completing this quote request:

It seems like now more than.

The amount you pay each year for your term or whole life insurance depends on several factors.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

Your age matters far more in a whole life policy scenario than a term life one.

When a younger client purchases a whole life policy, they generally have many years of monthly premiums built up before a.

Sample life insurance rates are provided on this page because we believe it's a good business practice to show all the rates before we ask for your age and gender:

Term life insurance rates are greatly affected by your age.

It's easy for an insurance agent to tell you that it's in your best interest to buy a policy while you're still young, but what are the real advantages to doing such a thing?

You need to look at your current age, your level of health and the term of your.

This is due to life expectancy.

Females live longer than males on.

This is due to life expectancy. Term Life Insurance. Females live longer than males on.Petis, Awalnya Adalah Upeti Untuk RajaWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Sejarah Gudeg JogyakartaNanas, Hoax Vs FaktaKhao Neeo, Ketan Mangga Ala ThailandResep Racik Bumbu Marinasi IkanTernyata Jajanan Pasar Ini Punya Arti Romantis5 Makanan Pencegah Gangguan PendengaranResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangPete, Obat Alternatif Diabetes

Komentar

Posting Komentar