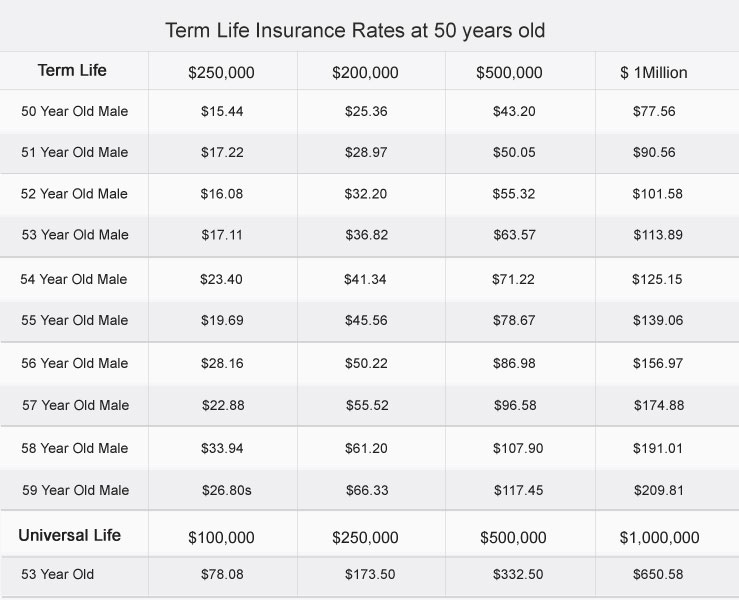

Term Life Insurance Rates Sample 10 Year Term Life Insurance Rates By Age.

Term Life Insurance Rates. These Rates Are For 10 Year Term Life Insurance, And Are Showing Quotes From A Policy With $100,000 And $250,000 In Coverage.

SELAMAT MEMBACA!

Our life insurance cost calculator can help you estimate how much a term life policy could cost, based on national averages.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

Term life is a simple and affordable type of life insurance.

Get a free term life insurance quote online today.

This life insurance information is provided for general consumer educational purposes and is not intended to provide legal, tax or investment advice.

Life insurance companies mostly base their rates on your age and health status, but they also factor in your job, your weight, whether you smoke and even besides age, life insurance quotes will vary depending on your gender.

On average, men will pay 23% more for term life insurance than women.

Save money on life insurance by making companies compete for your business.

So, now that you have found the ultimate resource that allows you to compare life insurance rates, what type of coverage do you need?

Sex plays a big role in life insurance rate.

Term life insurance can be less expensive than whole life — usually 10% or less for a comparable death benefit.

It also has easily adjustable coverage, based on your life your credit history.

Life insurance companies have detected a connection between poor credit and higher rates of mortality.

Most permanent policies also having a savings feature, which accumulates value over time depending on the terms of the policy.

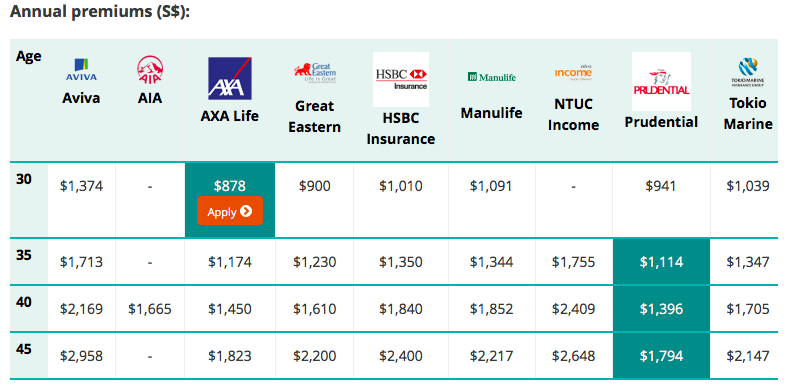

Look at sample life insurance rates for term life, universal life, and whole life.

The fastest, easiest way to get an accurate quote is to give us a call.

Our opinions are our own and are not influenced by payments from advertisers.

Learn about our independent review process and partners in our advertiser disclosure.

Term life insurance is a legal contract between you and rbc life insurance company.

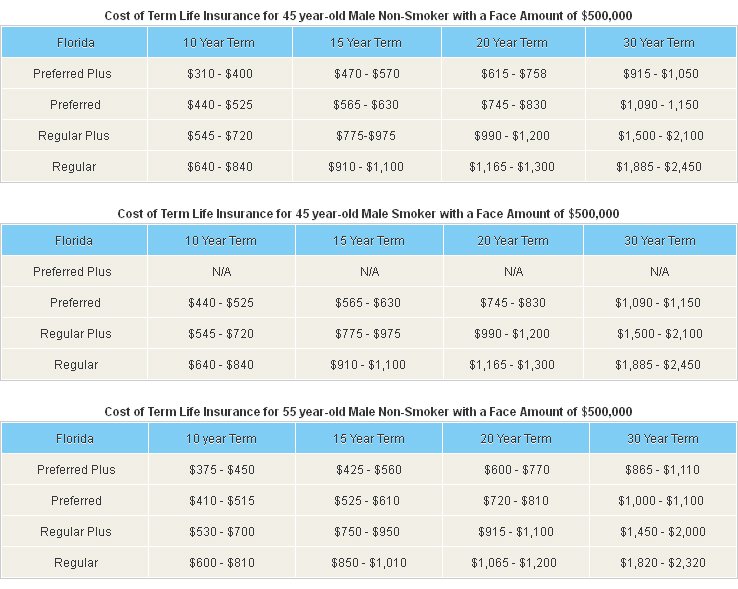

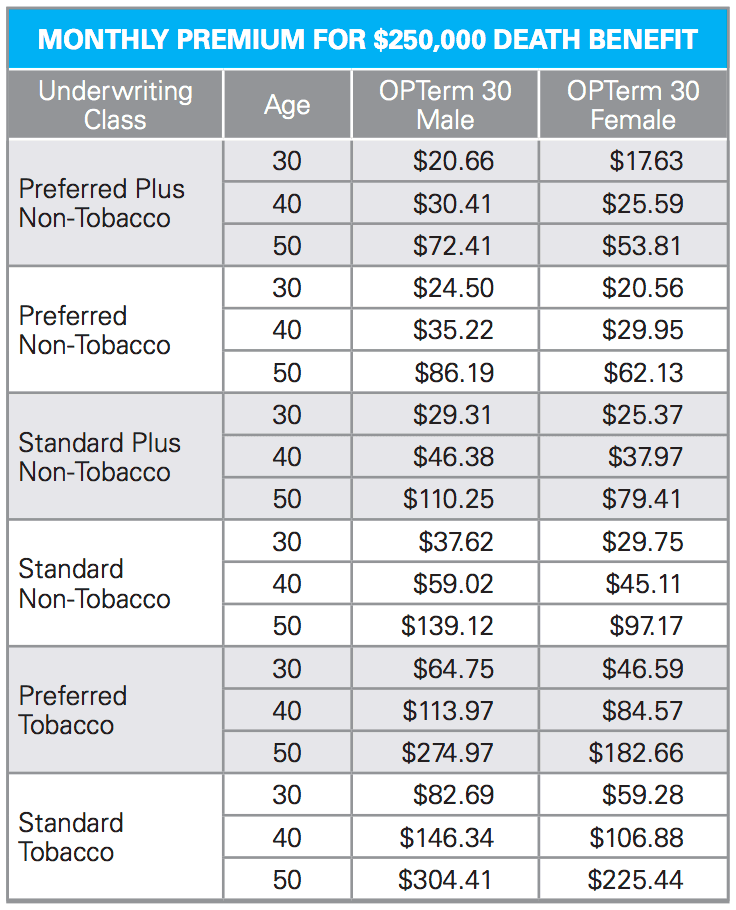

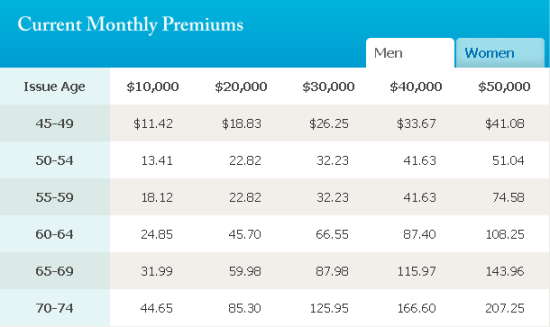

Below are sample term life insurance rates by age for comparison purposes.

The rates are broken up by term length, gender, age, and coverage amounts.

10 year term life insurance rate chart by age.

Term life insurance doesn't accrue cash value like permanent life insurance products, but with many term policies, beneficiaries do receive the full face amount.

Examples of term life insurance rates.

*rates reflect policies in the preferred plus rate class issues by american general.

When is the best time to buy life insurance?

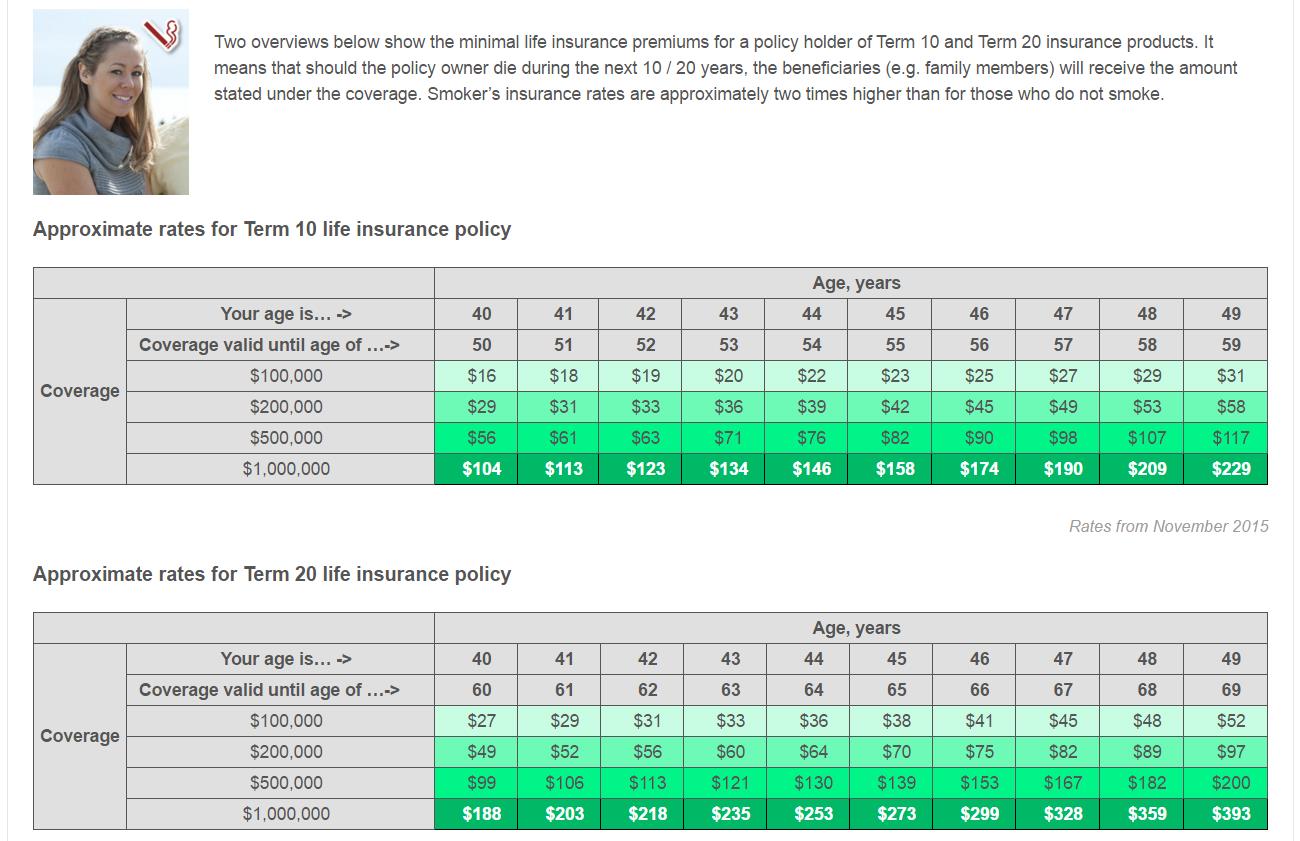

Below are the average rates for a 10, 15, 20, 25, and 30 year no exam term life insurance policy.

In general, the no exam rates will be more expensive than the traditional term life insurance products.

Through our research and findings.

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

Once the term expires, the policyholder can either renew it for another term, convert the policy to permanent.

For example, if you and your spouse own a home and you were to die tomorrow, your spouse would the calculations behind life insurance rates are all about life expectancy and risk.

Check out term life insurance rates for females of varying ages from top life insurance providers.

Rates were collected with the profile of a female nonsmoker in term life insurance is different from whole life insurance.

Term life insurance can be a solution to consider for anyone who wants affordable coverage with the option to transition to a permanent policy in the future.

These riders incur an additional premium.

Tobacco users are quoted standard rates;

Term life insurance policy strategy isn't as made complex as whole life, yet selecting a policy isn't constantly fundamental.

You'll have numerous options to make, in addition to the most effective alternatives for you might not coincide as the greatest.

Compare term life insurance quotes and rates for free!

Team life insurance policy often allows members leaving the group to keep their protection by purchasing private coverage.

Term life insurance is a good place to start if you're new to life insurance.

In many ways, buying a term policy is similar to leasing a car.

What's more, they're designed to be flexible when life changes.

Term life insurance is a life insurance product that covers you for a specific period of time, typically from 5 to 30 years.

Term life insurance rates can vary wildly, and you won't know what you're eligible for until you get a quote.

20 year term life insurance rates.

Term life insurance is the cheapest type of life insurance.

Because it's temporary, and not intended to last a lifetime.

Life insurance doesn't have to be expensive.

Get the cheapest rates on life insurance from the top insurers in whatever province or territory you live in.

Term life insurance is bought for a specified period of time, typical for 10, 15, 20, 25 or 30 years.

Compare free term life insurance rates now and get the protection your family needs.

Sample 10 year term life insurance rates by age.

These rates are for 10 year term life insurance, and are showing quotes from a policy with $100,000 and $250,000 in coverage.

In most cases, medical exams or lab tests are not required3, and you may get a.

Manfaat Kunyah Makanan 33 Kali5 Khasiat Buah Tin, Sudah Teruji Klinis!!Ini Manfaat Seledri Bagi KesehatanIni Efek Buruk Overdosis Minum KopiObat Hebat, Si Sisik NagaSehat Sekejap Dengan Es Batu6 Khasiat Cengkih, Yang Terakhir Bikin HebohPentingnya Makan Setelah Olahraga3 X Seminggu Makan Ikan, Penyakit Kronis MinggatTernyata Menikmati Alam Bebas Ada ManfaatnyaTerm life insurance is affordable life insurance with premiums guaranteed to remain level, often with the greatest amount of coverage for the farmers simple term2 life insurance has an automated underwriting process. Term Life Insurance Rates. In most cases, medical exams or lab tests are not required3, and you may get a.

Our life insurance cost calculator can help you estimate how much a term life policy could cost, based on national averages.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

Term life is a simple and affordable type of life insurance.

Get a free term life insurance quote online today.

This life insurance information is provided for general consumer educational purposes and is not intended to provide legal, tax or investment advice.

Life insurance companies mostly base their rates on your age and health status, but they also factor in your job, your weight, whether you smoke and even besides age, life insurance quotes will vary depending on your gender.

On average, men will pay 23% more for term life insurance than women.

Save money on life insurance by making companies compete for your business.

So, now that you have found the ultimate resource that allows you to compare life insurance rates, what type of coverage do you need?

Sex plays a big role in life insurance rate.

Term life insurance can be less expensive than whole life — usually 10% or less for a comparable death benefit.

It also has easily adjustable coverage, based on your life your credit history.

Life insurance companies have detected a connection between poor credit and higher rates of mortality.

Most permanent policies also having a savings feature, which accumulates value over time depending on the terms of the policy.

Look at sample life insurance rates for term life, universal life, and whole life.

The fastest, easiest way to get an accurate quote is to give us a call.

Our opinions are our own and are not influenced by payments from advertisers.

Learn about our independent review process and partners in our advertiser disclosure.

Term life insurance is a legal contract between you and rbc life insurance company.

Below are sample term life insurance rates by age for comparison purposes.

The rates are broken up by term length, gender, age, and coverage amounts.

10 year term life insurance rate chart by age.

Term life insurance doesn't accrue cash value like permanent life insurance products, but with many term policies, beneficiaries do receive the full face amount.

Examples of term life insurance rates.

*rates reflect policies in the preferred plus rate class issues by american general.

When is the best time to buy life insurance?

Below are the average rates for a 10, 15, 20, 25, and 30 year no exam term life insurance policy.

In general, the no exam rates will be more expensive than the traditional term life insurance products.

Through our research and findings.

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

Once the term expires, the policyholder can either renew it for another term, convert the policy to permanent.

![10 Year Term Life Insurance [Top 10 Companies and Tips]](https://www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Term-Life-Insurance.png)

For example, if you and your spouse own a home and you were to die tomorrow, your spouse would the calculations behind life insurance rates are all about life expectancy and risk.

Check out term life insurance rates for females of varying ages from top life insurance providers.

Rates were collected with the profile of a female nonsmoker in term life insurance is different from whole life insurance.

Term life insurance can be a solution to consider for anyone who wants affordable coverage with the option to transition to a permanent policy in the future.

These riders incur an additional premium.

Tobacco users are quoted standard rates;

Term life insurance policy strategy isn't as made complex as whole life, yet selecting a policy isn't constantly fundamental.

You'll have numerous options to make, in addition to the most effective alternatives for you might not coincide as the greatest.

Compare term life insurance quotes and rates for free!

Team life insurance policy often allows members leaving the group to keep their protection by purchasing private coverage.

Term life insurance is a good place to start if you're new to life insurance.

In many ways, buying a term policy is similar to leasing a car.

What's more, they're designed to be flexible when life changes.

Term life insurance is a life insurance product that covers you for a specific period of time, typically from 5 to 30 years.

Term life insurance rates can vary wildly, and you won't know what you're eligible for until you get a quote.

20 year term life insurance rates.

Term life insurance is the cheapest type of life insurance.

Because it's temporary, and not intended to last a lifetime.

Life insurance doesn't have to be expensive.

Get the cheapest rates on life insurance from the top insurers in whatever province or territory you live in.

Term life insurance is bought for a specified period of time, typical for 10, 15, 20, 25 or 30 years.

Compare free term life insurance rates now and get the protection your family needs.

Sample 10 year term life insurance rates by age.

These rates are for 10 year term life insurance, and are showing quotes from a policy with $100,000 and $250,000 in coverage.

In most cases, medical exams or lab tests are not required3, and you may get a.

Term life insurance is affordable life insurance with premiums guaranteed to remain level, often with the greatest amount of coverage for the farmers simple term2 life insurance has an automated underwriting process. Term Life Insurance Rates. In most cases, medical exams or lab tests are not required3, and you may get a.Ampas Kopi Jangan Buang! Ini ManfaatnyaResep Beef Teriyaki Ala CeritaKuliner5 Cara Tepat Simpan TelurKuliner Jangkrik Viral Di JepangStop Merendam Teh Celup Terlalu Lama!Ternyata Asal Mula Soto Bukan Menggunakan DagingSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatPecel Pitik, Kuliner Sakral Suku Using Banyuwangi5 Trik Matangkan Mangga9 Jenis-Jenis Kurma Terfavorit

Komentar

Posting Komentar