Term Life Insurance Rates By Age To Determine Life Insurance Rates, Insurance Companies Calculate The Likelihood That A Person Dies During The Policy Term.

Term Life Insurance Rates By Age. How Much Does Term Life Insurance Cost At Different Ages?

SELAMAT MEMBACA!

Besides age, life insurance quotes will vary depending on your gender.

Average life insurance rates by age were calculated based on quotes from five of the largest insurers:

John hancock, massmutual, new york life.

Our life insurance cost calculator can help you estimate how much a term life policy could cost, based on national averages.

Your age can also significantly affect premium costs.

The older you are, the more.

Look at sample life insurance rates for term life, universal life, and whole life.

They represent the best prices a person in excellent health can get.

Below are sample term life insurance rates by age for comparison purposes.

The rates are broken up by term length, gender, age, and coverage amounts.

Use our comparison tool for a personalized quote.

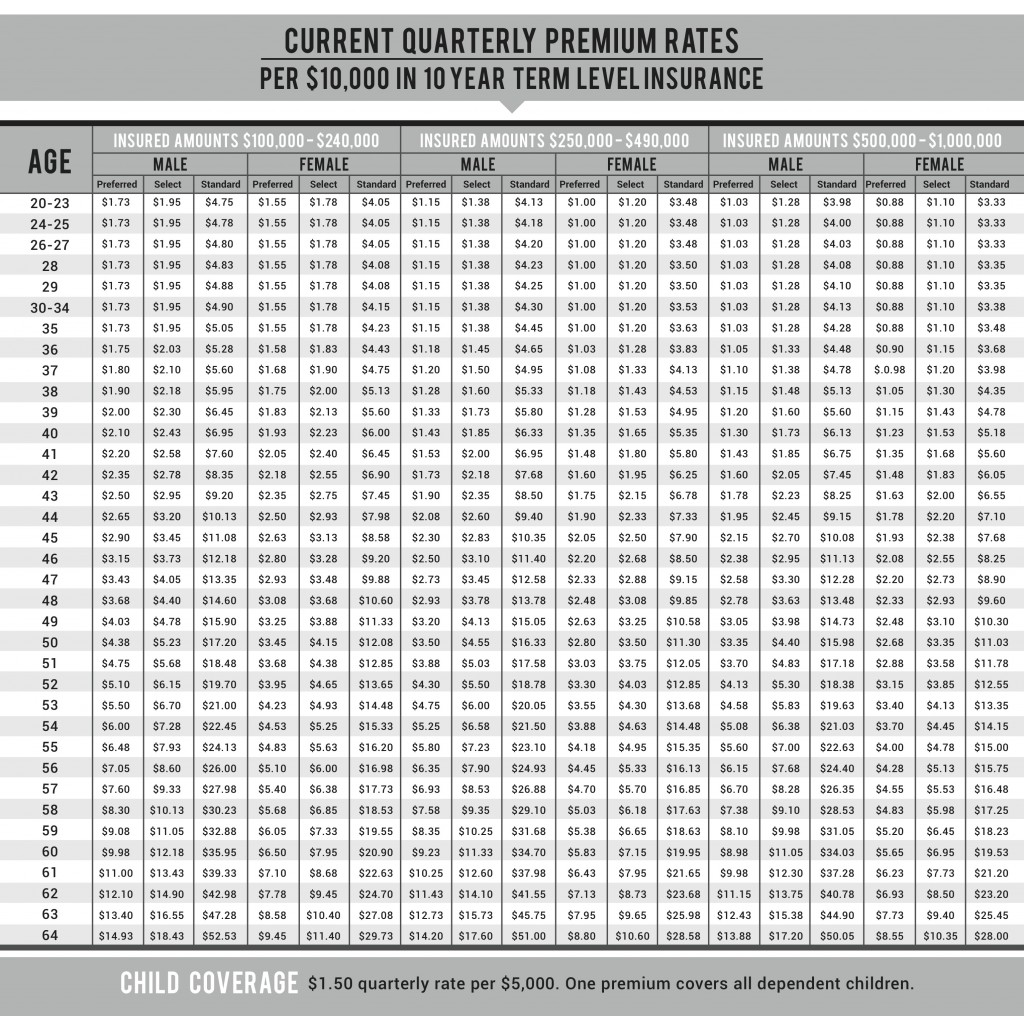

10 year term life insurance rate chart by age.

Whole life policy rates do rise with age, however.

And they increase at each successive age because each year there is a bigger drain on the cash.

Whole life insurance to age 100.

This policy is paid up at age 100, so you pay premiums until you die or reach 100.

However, overtime whole life comes out ahead because your premium is fixed and you have paid into.

Sample 20 year term life insurance quotes by age.

Here are actual rates for a 20 year term policy with and without a medical exam for $100 can i get life insurance over age 50, 60, or 70?

Average no exam term life insurance costs by age, gender, & policy length.

Below are the average rates for a 10, 15, 20, and 30 year term life insurance policy.

The 10 year term is going to give you the most affordable rates, while the 30 year term is going to be the most expensive option.

The term life insurance rate chart below offers sample pricing people that are age 20 and over.

Average life insurance cost by age.

How much do people pay for life insurance?

Sex plays a big role in life insurance rate.

For the same insurance policy, a female and male will pay different amounts for coverage each month.

The sooner you buy life insurance, the more affordable it's likely to be.

This guide will help you gain insight into life insurance rates by age — and why there's no time to buy like the present.

In your 20s, life insurance is inexpensive and easy to get.

At this age, you can expect an enormous number of term life options at affordable prices.

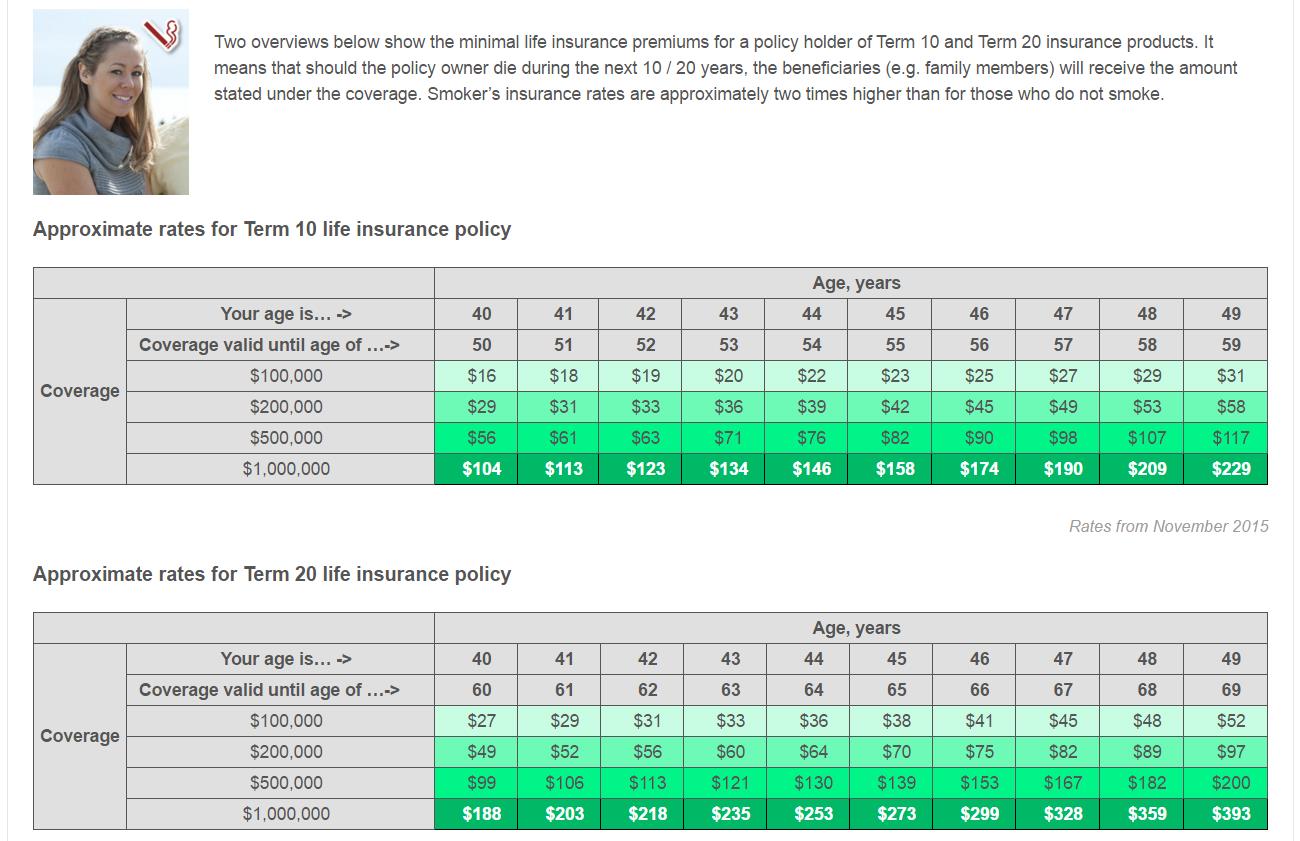

Two overviews below show the minimal life insurance premiums for a policy holder of term 10 and term 20 insurance products.

It means that should a policy owner die during the next 10 / 20 years, the beneficiaries (e.g.

If you are reading this then you fit in between this bracket and probably had an epiphany and realized that life insurance right now is super important.

Life insurance rates increase with age accordingly to account for this risk.

Now, this really just applies to when you submit an application for a new policy.

Term life insurance offers the cheapest form of life insurance coverage for people who are in good health.

Did you know that term life insurance rates are even more affordable depending on your age?

Find out how your age and health can get you the lowest as with most forms of insurance, companies want to see a healthier, younger aged clients signing up.

The rate of increase for premiums goes up.

To determine life insurance rates, insurance companies calculate the likelihood that a person dies during the policy term.

The higher your risk, the more likely it is that you will pass away before paying the full coverage.

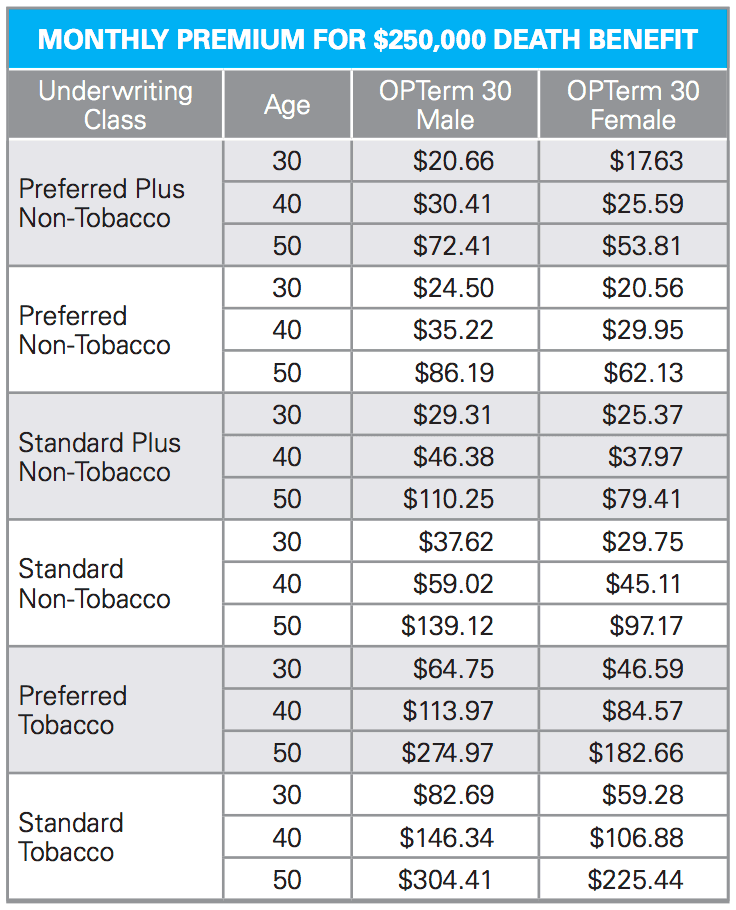

See term life insurance rates for men and women at different ages and for a variety of coverage amounts.

Expect whole life premiums to cost between $250 to $1,000 a month if you're young and healthy, and that price increases significantly as you age.

Since whole life policies offer lifelong coverage and build cash value, they're more expensive than term life insurance.

How life insurance rates are determined.

In an overall sense, life insurance ladder offers affordable term life insurance that's easy to understand and quick to set up online.

It only takes a few minutes to apply and you get.

How much does term life insurance cost at different ages?

Don't guess, we have listed our life insurance rates by age for term insurance and final expense policies.

If you are younger than 30 or older than 79 you can get your life insurance rates by age by completing this quote request:

It seems like now more than.

The amount you pay each year for your term or whole life insurance depends on several factors.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

Your age matters far more in a whole life policy scenario than a term life one.

When a younger client purchases a whole life policy, they generally have many years of monthly premiums built up before a.

Sample life insurance rates are provided on this page because we believe it's a good business practice to show all the rates before we ask for your age and gender:

Term life insurance rates are greatly affected by your age.

It's easy for an insurance agent to tell you that it's in your best interest to buy a policy while you're still young, but what are the real advantages to doing such a thing?

You need to look at your current age, your level of health and the term of your.

This is due to life expectancy.

Females live longer than males on.

5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuCegah Celaka, Waspada Bahaya Sindrom HipersomniaManfaat Kunyah Makanan 33 KaliTernyata Mudah Kaget Tanda Gangguan MentalTernyata Einstein Sering Lupa Kunci Motor4 Manfaat Minum Jus Tomat Sebelum Tidur4 Titik Akupresur Agar Tidurmu NyenyakMelawan Pikun Dengan ApelTernyata Tidur Bisa Buat Meninggal8 Bahan Alami DetoxThis is due to life expectancy. Term Life Insurance Rates By Age. Females live longer than males on.

Besides age, life insurance quotes will vary depending on your gender.

Average life insurance rates by age were calculated based on quotes from five of the largest insurers:

John hancock, massmutual, new york life.

Our life insurance cost calculator can help you estimate how much a term life policy could cost, based on national averages.

Your age can also significantly affect premium costs.

The older you are, the more.

Look at sample life insurance rates for term life, universal life, and whole life.

They represent the best prices a person in excellent health can get.

Below are sample term life insurance rates by age for comparison purposes.

The rates are broken up by term length, gender, age, and coverage amounts.

Use our comparison tool for a personalized quote.

10 year term life insurance rate chart by age.

Whole life policy rates do rise with age, however.

And they increase at each successive age because each year there is a bigger drain on the cash.

Whole life insurance to age 100.

This policy is paid up at age 100, so you pay premiums until you die or reach 100.

However, overtime whole life comes out ahead because your premium is fixed and you have paid into.

Sample 20 year term life insurance quotes by age.

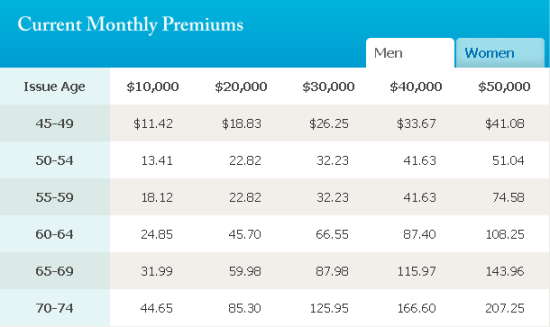

Here are actual rates for a 20 year term policy with and without a medical exam for $100 can i get life insurance over age 50, 60, or 70?

Average no exam term life insurance costs by age, gender, & policy length.

Below are the average rates for a 10, 15, 20, and 30 year term life insurance policy.

The 10 year term is going to give you the most affordable rates, while the 30 year term is going to be the most expensive option.

The term life insurance rate chart below offers sample pricing people that are age 20 and over.

Average life insurance cost by age.

How much do people pay for life insurance?

Sex plays a big role in life insurance rate.

For the same insurance policy, a female and male will pay different amounts for coverage each month.

The sooner you buy life insurance, the more affordable it's likely to be.

This guide will help you gain insight into life insurance rates by age — and why there's no time to buy like the present.

In your 20s, life insurance is inexpensive and easy to get.

At this age, you can expect an enormous number of term life options at affordable prices.

Two overviews below show the minimal life insurance premiums for a policy holder of term 10 and term 20 insurance products.

It means that should a policy owner die during the next 10 / 20 years, the beneficiaries (e.g.

If you are reading this then you fit in between this bracket and probably had an epiphany and realized that life insurance right now is super important.

Life insurance rates increase with age accordingly to account for this risk.

Now, this really just applies to when you submit an application for a new policy.

Term life insurance offers the cheapest form of life insurance coverage for people who are in good health.

Did you know that term life insurance rates are even more affordable depending on your age?

Find out how your age and health can get you the lowest as with most forms of insurance, companies want to see a healthier, younger aged clients signing up.

The rate of increase for premiums goes up.

To determine life insurance rates, insurance companies calculate the likelihood that a person dies during the policy term.

The higher your risk, the more likely it is that you will pass away before paying the full coverage.

See term life insurance rates for men and women at different ages and for a variety of coverage amounts.

Expect whole life premiums to cost between $250 to $1,000 a month if you're young and healthy, and that price increases significantly as you age.

Since whole life policies offer lifelong coverage and build cash value, they're more expensive than term life insurance.

How life insurance rates are determined.

In an overall sense, life insurance ladder offers affordable term life insurance that's easy to understand and quick to set up online.

It only takes a few minutes to apply and you get.

How much does term life insurance cost at different ages?

Don't guess, we have listed our life insurance rates by age for term insurance and final expense policies.

If you are younger than 30 or older than 79 you can get your life insurance rates by age by completing this quote request:

It seems like now more than.

The amount you pay each year for your term or whole life insurance depends on several factors.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

Your age matters far more in a whole life policy scenario than a term life one.

When a younger client purchases a whole life policy, they generally have many years of monthly premiums built up before a.

Sample life insurance rates are provided on this page because we believe it's a good business practice to show all the rates before we ask for your age and gender:

Term life insurance rates are greatly affected by your age.

It's easy for an insurance agent to tell you that it's in your best interest to buy a policy while you're still young, but what are the real advantages to doing such a thing?

You need to look at your current age, your level of health and the term of your.

This is due to life expectancy.

Females live longer than males on.

This is due to life expectancy. Term Life Insurance Rates By Age. Females live longer than males on.Sejarah Nasi Megono Jadi Nasi TentaraKuliner Legendaris Yang Mulai Langka Di DaerahnyaSejarah Gudeg JogyakartaTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiFoto Di Rumah Makan PadangResep Segar Nikmat Bihun Tom YamResep Nikmat Gurih Bakso LeleResep Stawberry Cheese Thumbprint CookiesResep Kreasi Potato Wedges Anti GagalResep Cumi Goreng Tepung Mantul

Komentar

Posting Komentar