Term Life Insurance Rates By Age The Good News Is That You Are Totally Right And Another Good Thing Is That You Are Still Considered Young.

Term Life Insurance Rates By Age. Average Life Insurance Cost By Age.

SELAMAT MEMBACA!

Besides age, life insurance quotes will vary depending on your gender.

Average life insurance rates by age were calculated based on quotes from five of the largest insurers:

John hancock, massmutual, new york life.

Our life insurance cost calculator can help you estimate how much a term life policy could cost, based on national averages.

Your age can also significantly affect premium costs.

The older you are, the more.

Look at sample life insurance rates for term life, universal life, and whole life.

They represent the best prices a person in excellent health can get.

Below are sample term life insurance rates by age for comparison purposes.

The rates are broken up by term length, gender, age, and coverage amounts.

Use our comparison tool for a personalized quote.

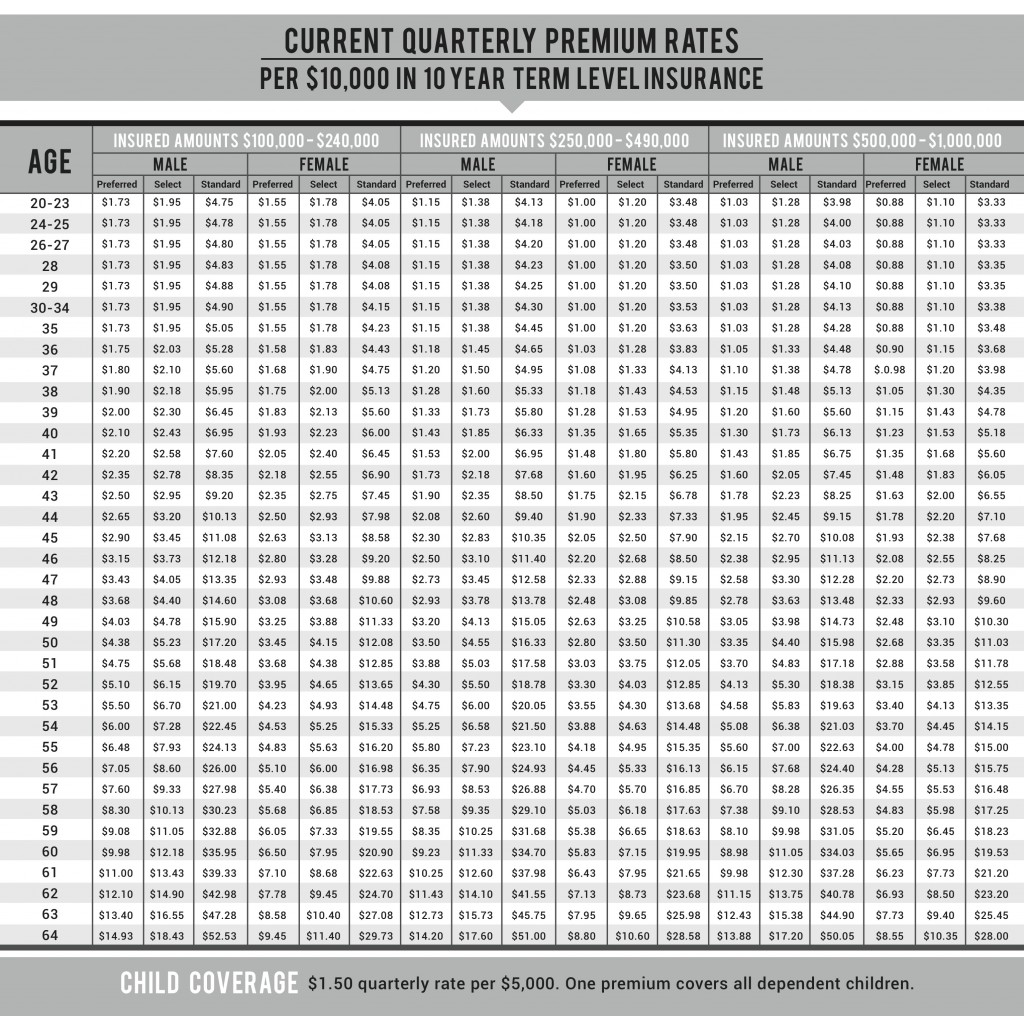

10 year term life insurance rate chart by age.

Whole life policy rates do rise with age, however.

And they increase at each successive age because each year there is a bigger drain on the cash.

Whole life insurance to age 100.

This policy is paid up at age 100, so you pay premiums until you die or reach 100.

However, overtime whole life comes out ahead because your premium is fixed and you have paid into.

Sample 20 year term life insurance quotes by age.

Here are actual rates for a 20 year term policy with and without a medical exam for $100 can i get life insurance over age 50, 60, or 70?

Average no exam term life insurance costs by age, gender, & policy length.

Below are the average rates for a 10, 15, 20, and 30 year term life insurance policy.

The 10 year term is going to give you the most affordable rates, while the 30 year term is going to be the most expensive option.

The term life insurance rate chart below offers sample pricing people that are age 20 and over.

Average life insurance cost by age.

How much do people pay for life insurance?

Sex plays a big role in life insurance rate.

For the same insurance policy, a female and male will pay different amounts for coverage each month.

The sooner you buy life insurance, the more affordable it's likely to be.

This guide will help you gain insight into life insurance rates by age — and why there's no time to buy like the present.

In your 20s, life insurance is inexpensive and easy to get.

At this age, you can expect an enormous number of term life options at affordable prices.

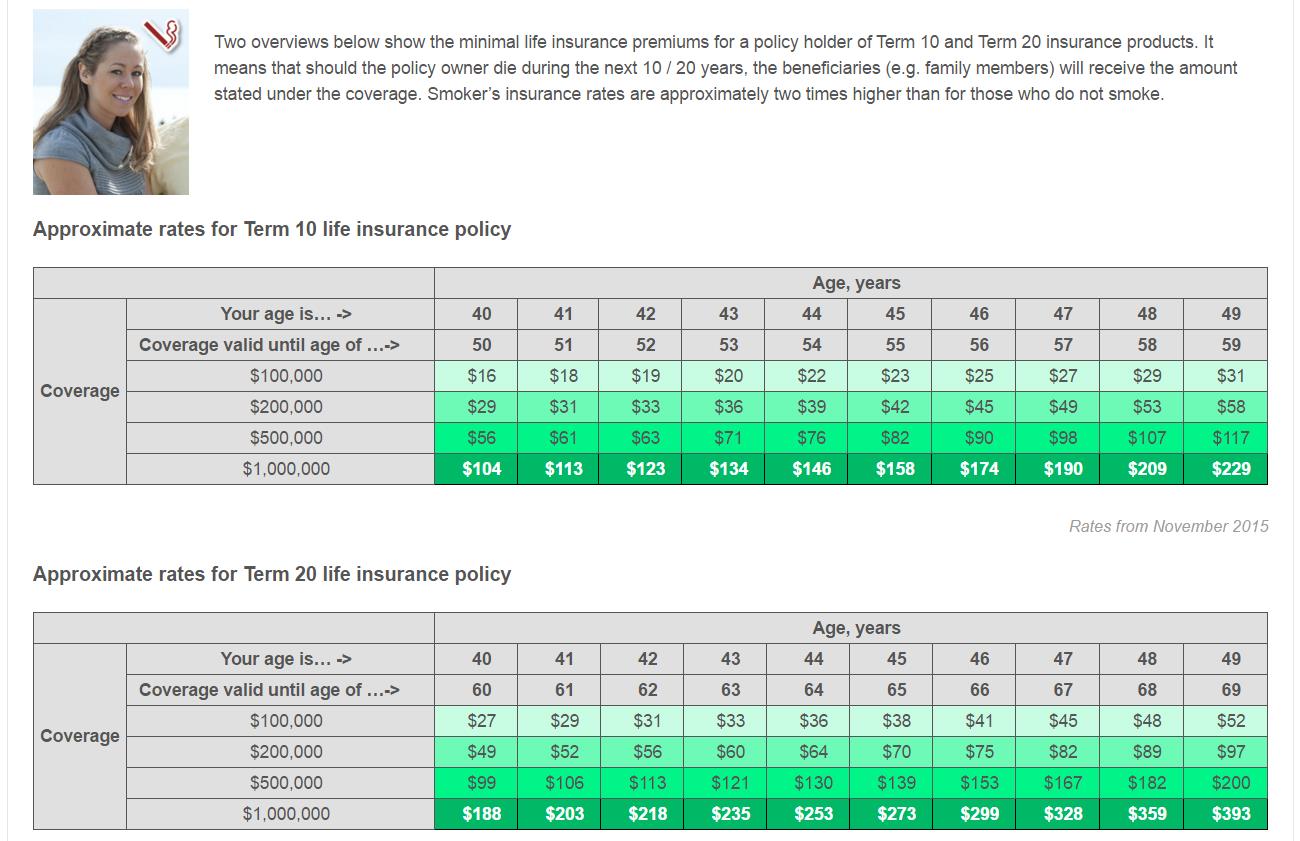

Two overviews below show the minimal life insurance premiums for a policy holder of term 10 and term 20 insurance products.

It means that should a policy owner die during the next 10 / 20 years, the beneficiaries (e.g.

If you are reading this then you fit in between this bracket and probably had an epiphany and realized that life insurance right now is super important.

Life insurance rates increase with age accordingly to account for this risk.

Now, this really just applies to when you submit an application for a new policy.

Term life insurance offers the cheapest form of life insurance coverage for people who are in good health.

Did you know that term life insurance rates are even more affordable depending on your age?

Find out how your age and health can get you the lowest as with most forms of insurance, companies want to see a healthier, younger aged clients signing up.

The rate of increase for premiums goes up.

To determine life insurance rates, insurance companies calculate the likelihood that a person dies during the policy term.

The higher your risk, the more likely it is that you will pass away before paying the full coverage.

See term life insurance rates for men and women at different ages and for a variety of coverage amounts.

Expect whole life premiums to cost between $250 to $1,000 a month if you're young and healthy, and that price increases significantly as you age.

Since whole life policies offer lifelong coverage and build cash value, they're more expensive than term life insurance.

How life insurance rates are determined.

In an overall sense, life insurance ladder offers affordable term life insurance that's easy to understand and quick to set up online.

It only takes a few minutes to apply and you get.

How much does term life insurance cost at different ages?

Don't guess, we have listed our life insurance rates by age for term insurance and final expense policies.

If you are younger than 30 or older than 79 you can get your life insurance rates by age by completing this quote request:

It seems like now more than.

The amount you pay each year for your term or whole life insurance depends on several factors.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term.

After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or.

Your age matters far more in a whole life policy scenario than a term life one.

When a younger client purchases a whole life policy, they generally have many years of monthly premiums built up before a.

Sample life insurance rates are provided on this page because we believe it's a good business practice to show all the rates before we ask for your age and gender:

Term life insurance rates are greatly affected by your age.

It's easy for an insurance agent to tell you that it's in your best interest to buy a policy while you're still young, but what are the real advantages to doing such a thing?

You need to look at your current age, your level of health and the term of your.

This is due to life expectancy.

Females live longer than males on.

Awas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Gawat! Minum Air Dingin Picu Kanker!Pentingnya Makan Setelah OlahragaSegala Penyakit, Rebusan Ciplukan ObatnyaTernyata Tidur Bisa Buat MeninggalTernyata Merokok + Kopi Menyebabkan KematianSehat Sekejap Dengan Es Batu5 Manfaat Meredam Kaki Di Air EsTernyata Ini Beda Basil Dan Kemangi!!6 Khasiat Cengkih, Yang Terakhir Bikin HebohThis is due to life expectancy. Term Life Insurance Rates By Age. Females live longer than males on.

Life insurance calculator life insurance finder how medical conditions affect your life insurance rate income replacement calculator car insurance rate estimator.

Find out how much life insurance you need with bankrate.com's free life insurance calculator.

Passive income ideas to help you make money.

Compare quotes from more than 12 insurance carriers.

Compare life insurance rates by age with our free rate calculator tool.

See rates for your age from reputable companies here.

Our philosophy is to go above and beyond without any expectation for something in return.

Each issuing insurance company is responsible for financial obligations of their respective insurance.

Look at sample life insurance rates for term life, universal life, and whole life.

Below, you'll find tables of sample life insurance rates for a term life insurance and no exam term policy.

Term life insurance protects your family financially—but it doesn't have to cost a fortune.

Our life insurance calculator lets you know how much you'll need.

Fortunately, most term life insurance costs a lot less than people think.

Age—the longer you put off life insurance.

See life insurance rates from over 60 companies in clear charts, based on age, gender, and product.

Quotes are subject to underwriting requirements.

Below we discuss how life insurance rates are calculated.

Below are the average rates for a 10, 15, 20, 25, and 30 year no exam term life insurance policy.

In general, the no exam rates will be more expensive than the traditional term life insurance products.

On average, men will pay 23% more for term life insurance than women.

Average life insurance rates by age were calculated based on quotes from five of the largest insurers:

John hancock, massmutual, new york life.

It is an insurer's anticipation of deaths amongst a particular group of insured lives at a certain age.

How life insurance companies calculate the age component often confuses many of our clients.

Gender plays an important role in determining how life insurance rates are calculated.

Compare and buy life insurance term life insurance whole life insurance permanent life insurance simplified please enter some text to search.

Determining the precise amount of coverage can be complex, but our life insurance calculator helps you analyze.

Term life insurance rates are lower initially than whole life insurance rates.

(once again, it is important that the policy is properly designed for.

We calculated the average monthly cost of life insurance — all you need to do is find your age and type of policy.

Term life insurance can be a solution to consider for anyone who wants affordable coverage with the option to transition to a permanent policy in the future.

Term, whole and universal life rates by age.

To help better understand how to determine your life insurance rate you need to first understand how life.

Expect whole life premiums to cost between $250 to $1,000 a month if you're young and healthy, and that price increases significantly as you age.

How much would you need to leave behind?

Erie family life insurance company has earned a.m.

Best's rating of a (excellent).

If you are reading this then you fit in between this bracket and we believe anyone can get a life insurance policy regardless of age whether term, whole.

Calcxml's insurance calculator will help you determine how much life insurance you need to protect you and your family.

This step may require the purchase of a life insurance policy to ensure that your family's needs will continue to be age, income and assumptions.

We offer different types of life insurance including term insurance, permanent insurance and insurance for children.

Get a life insurance quote today!

Tell us a bit about yourself and we'll calculate the amount of life insurance you need to protect your family.

Instant term life insurance quotes.

Should a breadwinner die, the financial impact for dependents is the loss of the breadwinner's income.

The date your policy is issued determines your insurance age.

Use our life insurance calculator to work out how much life insurance you will need, as well as the costs involved in taking out a policy.

It's also worth remembering that it's not just life insurance, there are other covers that can help protect you and your family in the event of long term or serious illness.

Calculate insurance premium online with max life insurance premium calculator.

Calculate your term insurance premium, health while there are several factors that need to be taken into consideration, including your income, age, lifestyle, if you conclusion.

Calculate how much life insurance you might need to protect the people you love if you die.

This cost range is based on the information you gave us, and applies to term life insurance the actual cost of life insurance depends on your health, age and lifestyle. Term Life Insurance Rates By Age. An advisor can give you a.Tips Memilih Beras BerkualitasTrik Menghilangkan Duri Ikan BandengTernyata Kue Apem Bukan Kue Asli IndonesiaSegarnya Carica, Buah Dataran Tinggi Penuh Khasiat5 Makanan Pencegah Gangguan PendengaranResep Stawberry Cheese Thumbprint CookiesTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiFoto Di Rumah Makan PadangSusu Penyebab Jerawat???Buat Sendiri Minuman Detoxmu!!

Komentar

Posting Komentar