Term Life Insurance Quotes Term Life Insurance Can Be A Very Inexpensive And Extremely Valuable Way To Make.

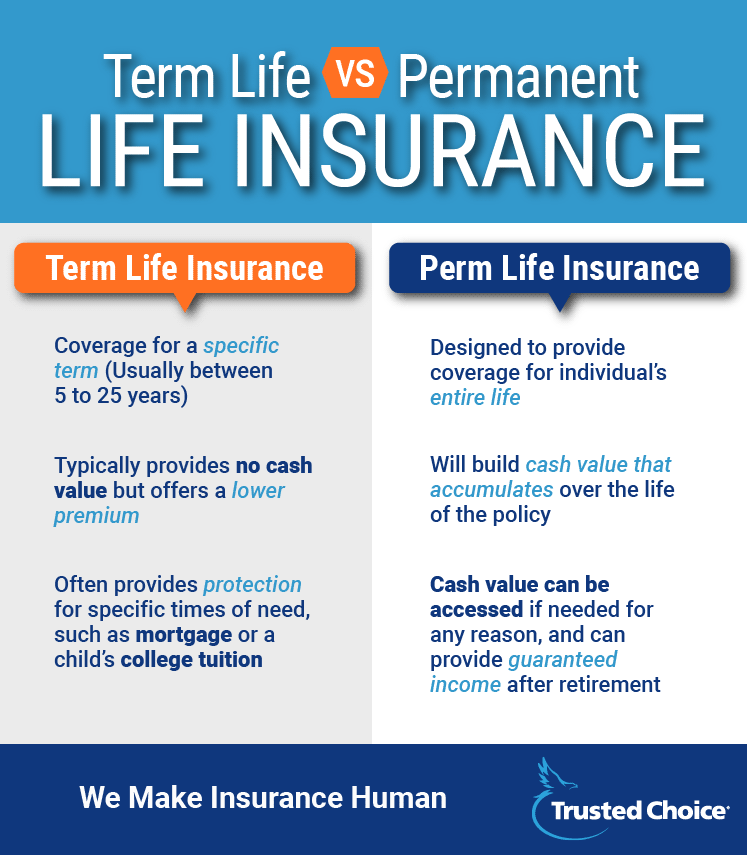

Term Life Insurance Quotes. There Are Several Types Of Life Insurance Policies In Canada, But They Generally Fall Into Two Categories:

SELAMAT MEMBACA!

Life insurance pays out after you die and can be an important safety net for your family.

However, whole life insurance and other forms of permanent coverage can be useful if you want to provide.

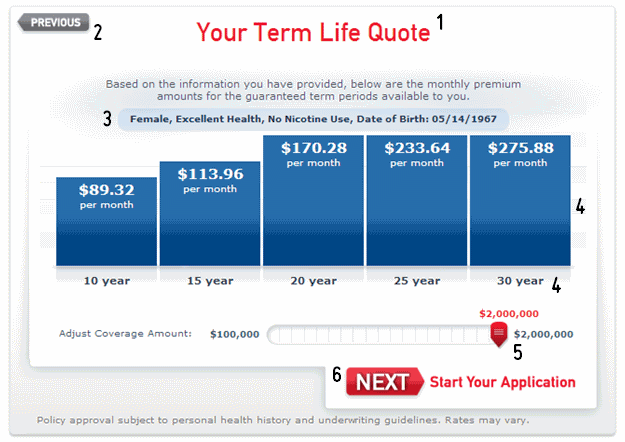

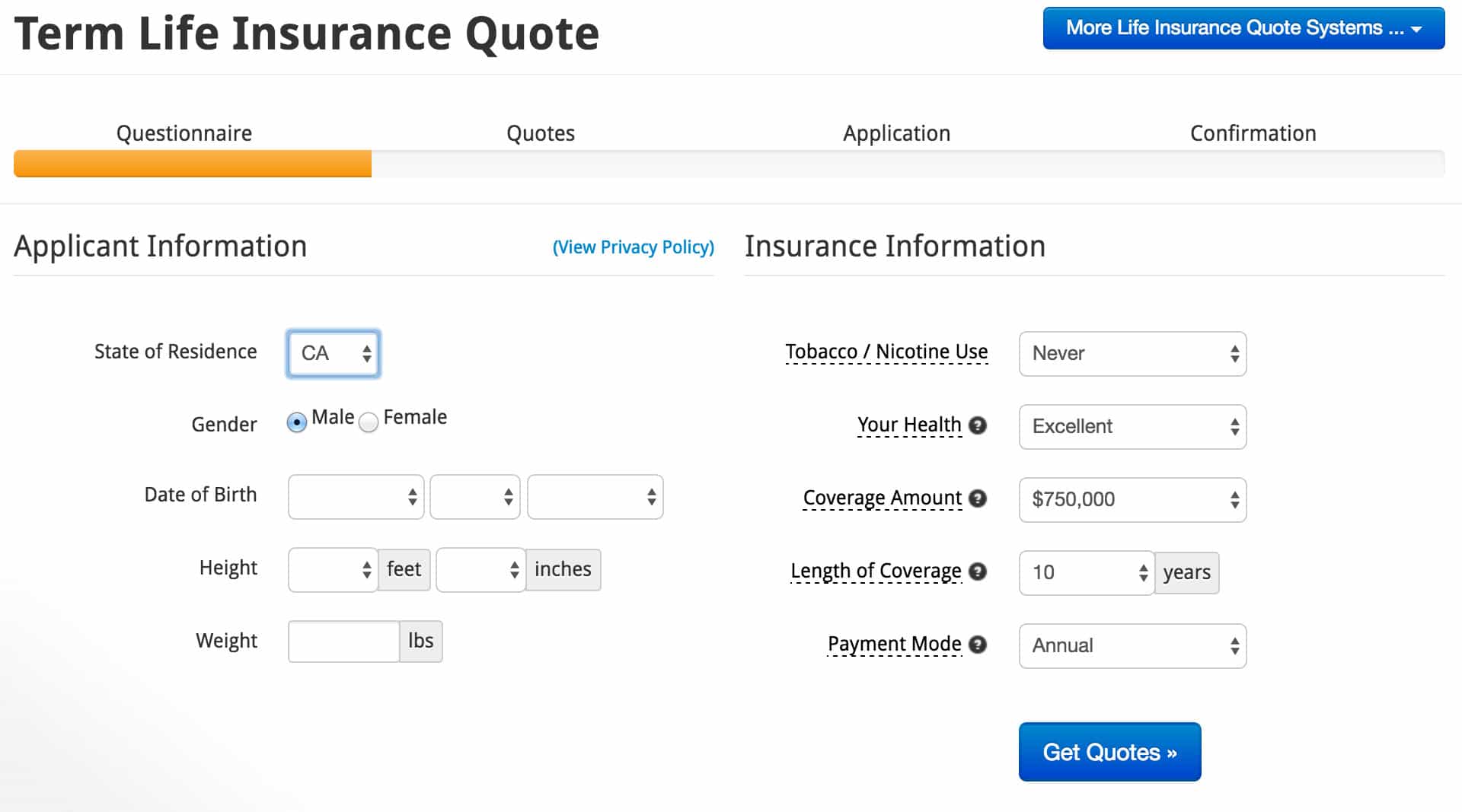

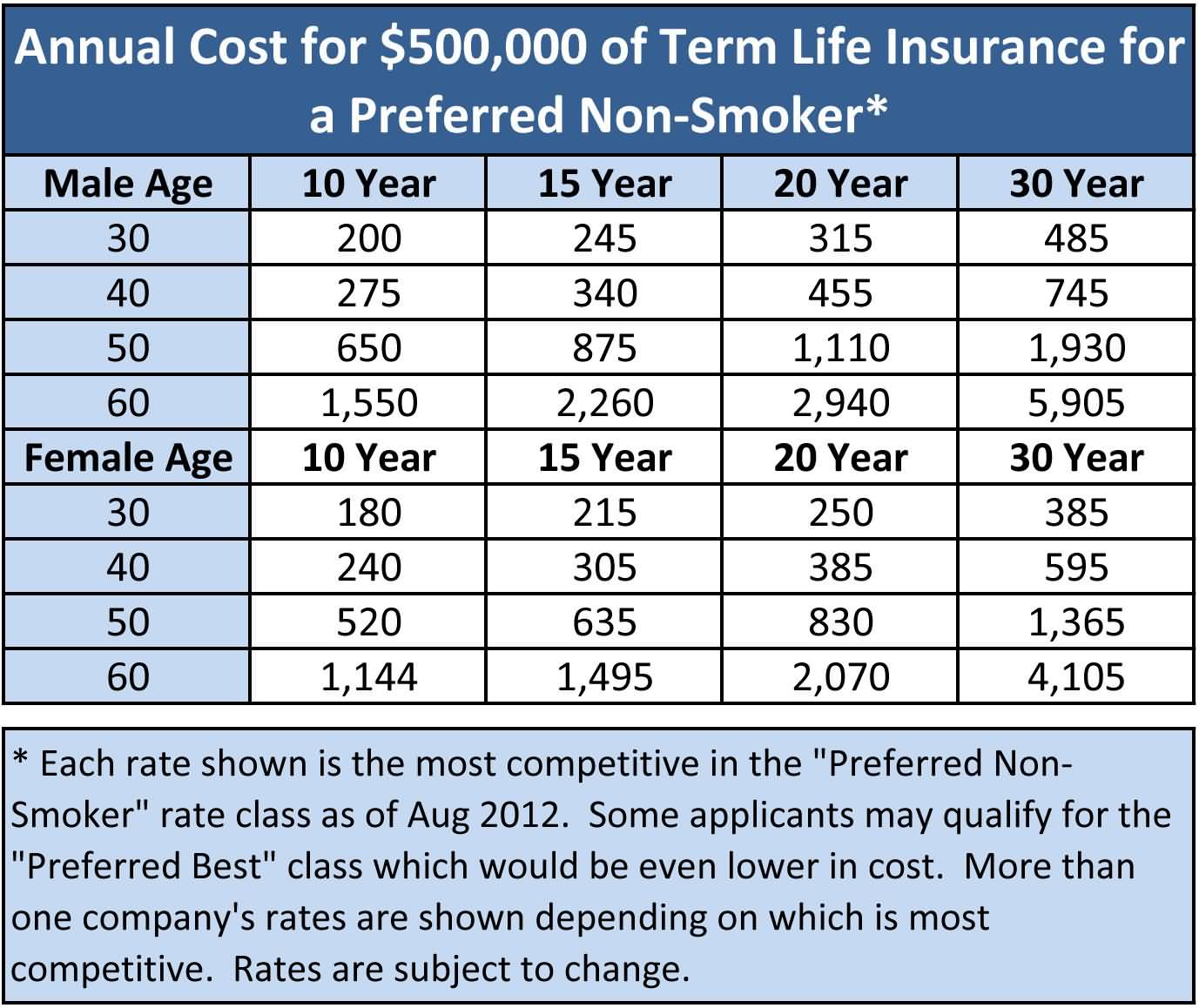

Getting term life insurance quotes online is simple and easy, especially with free online comparison tools that give you affordable term life insurance your term life insurance rates are determined based on factors such as health history, lifestyle, occupation, and more.

Since term life insurance provides temporary coverage, it's generally the cheapest type of life insurance you can find.

Term life insurance is simply life insurance with a finite time period of coverage.

For term life insurance policies, the premium will usually stay the same throughout the entire term.

You can see term life insurance quotes for all the term levels below by clicking the button on top of this post.

All life insurance quotes will be free and you can request quotes from as many companies as you like.

You can get quotes from agents who work for.

£200.000 term life cover for £7.

Why get term life insurance.

If you have a family who depends on you for their basic needs, you need life insurance.

'fun is like life insurance;

The training facility was a medicaid hospital.

Online term life insurance quotes will allow you to instantly narrow down your results to the absolute best price.

There is no longer a need to travel to an instant online term life insurance quotes made simple.

Term life insurance is a product designed to financially protect your family in the event you die with some companies offering the ability to add a rider that can offer a payout if you become permanently disabled.

Check out your best options for term life insurance, get a quote and see if you're eligible.

Get free life insurance quotes from termlife2go!

Life insurance prices vary widely and are highly personalized.

Getting a quote is the fastest, easiest.

Instantly compare term life insurance quotes online for free to find the best term life insurance policy and coverage options that are right for you.

Why intelliquote® for your life insurance quotes.

Intelliquote is a combination of an.

Get term life insurance quotes and coverage from zander insurance in nashville tn who is endorsed by dave ramsey and compare options.

Well, life insurance in general, and term life insurance in particular can help you have them covered in case something happens and you pass away.

The table only reflects the average life insurance cost per month.

It is best to compare rates and get term life insurance quote that is tailored to you.

Let netquote help you choose your life insurance.

When it comes to a life insurance policy, you could just start getting quotes, but if you don't understand what they mean, there's a very good chance you.

You can get anonymous life insurance quotes through simply insurance, we don't collect any personal information for a quote.

Term life is a simple and affordable type of life insurance.

Get a free term life insurance quote online today.

Coverage starts as low as $15 per month.

Get a competitive term life insurance quote online with aig direct and speak with a licensed agent about all the life insurance options available for you!

* example assumes a 40 year old male buying a 10 year term life insurance policy, in the preferred plus underwriting class.

Life insurance is something that everyone needs to have.

You can use our free service to get all kinds of quotes for your insurance, and start planning for your retirement today.

Life insurance is more abstract than most things you buy, so you can't always tell whether the lowest quote will deliver the best coverage.

Haven life has been revolutionizing online access to term life insurance for the past several years.

The insurance however provides protection for a specified time period also stated on the policy document.

Term life insurance policies don't build cash values.

Get the coverage you need for as low as $12* a month.

Typically, a term life insurance policy will be 5, 10, 15, 20 or even 30 years in length.

Term life insurance is already the most affordable type of life insurance but if you want to get the absolute rock bottom quotes continue reading.

With the help of the internet, it is not hard to compare instant term life insurance quotes completely online from the comfort of the nearest electronic device.

Which company provides you with the best life insurance quotes based on your individual needs?

With universal life insurance quotes, you have many options available from no lapse death benefit guarantees to cash value accumulation policies.

A term life insurance quote is an estimate of how much your policy might cost, based on some basic information you give us.

Because of that, its monthly premium depends.

Term life insurance is to protect against loss of income in case of death, so their loved ones will be financially secure and can cover essential expenses.

Find the best term life insurance quotes from top insurers today.

This page educates you about everything you need to know about term life insurance in canada and offers free term life insurance quotes.

Compare life insurance quotes from canada's top providers.

Find a great rate and protect your family's future.

Term life insurance and permanent/whole life insurance.

Term life insurance is the most popular type of life insurance available today, but what is term life insurance, really?

As the name implies, term insurance it is designed for a specific term (length of time).

It is not easy to shop around for suitable term life insurance quotes.

You might have already visited some price comparison sites, and found that the coverage offered was not.

Term life insurance can be a solution to consider for anyone who wants affordable coverage with the option to transition to a permanent policy in the future.

Tobacco users are quoted standard rates;

PD Hancur Gegara Bau Badan, Ini Solusinya!!6 Khasiat Cengkih, Yang Terakhir Bikin HebohCara Baca Tanggal Kadaluarsa Produk MakananIni Efek Buruk Overdosis Minum KopiAwas, Bibit Kanker Ada Di Mobil!!10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 1)Saatnya Minum Teh Daun Mint!!Awas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Ternyata Einstein Sering Lupa Kunci Motor4 Titik Akupresur Agar Tidurmu NyenyakThese riders incur an additional premium. Term Life Insurance Quotes. Tobacco users are quoted standard rates;

Your no exam term life insurance policy could be implemented within a couple of days to several weeks.

A traditional life insurance policy would require you to undergo a medical examination which requires a nurse to you at the time and place of your choosing.

Anico offers three amazing no medical exam policies called freedom term life insurance, valueguard whole life insurance, and legacy.

A medical exam for life insurance coverage typically involves having your blood pressure taken and some blood drawn for lab analysis.

When shopping for a no medical exam life insurance policy, you can save up to 70% by comparing rates using our instant online quote comparison tool!

No medical exam term life insurance is the most popular of all the types of life insurance coverage.

Term insurance is available in contract.

To find the ones that offer no medical exam life insurance policies.

Life insurance costs do depend in part on the assigned health rating, which is determined through a full medical exam and underwriting.

To get a comparison of life insurance quotes from different providers, simply start by entering your zip code above.

Whole life insurance without a medical exam is only one of many types of insurances.

You can buy this life insurance whatever your current health might be.

It is easy to get term life insurance quotes no medical exam as it is not required to ask almost any questions about your health.

(most insurance companies do not accept a medical exam from your primary physician.)

We will provide you life insurance quotes with no medical exam.

See here, how affordable life insurance coverage can be.

Depending on your situation, you may want to first apply for medically underwritten coverage.

Free no medical life insurance quotes tailored for you.

No medical exam policies are term life insurance policies that pay a death benefit if the insured person dies within the policy term, such as 10, 20, or 30 years.

To help you find the right option, we researched and nearly everyone is eligible for a no medical exam life insurance policy, from healthy individuals looking to get a term insurance policy to seniors looking to.

You can find life insurance policies that offer no medical exam.

Some insurance companies will send someone to do your exam at.

Specializing in both no exam term and permanent life insurance.

Finally, apply for term life insurance coverage without the hassle of an exam or physical.

Find the best life insurance plan for you.

Certain term life policies can be converted into a permanent policy without an exam.

We explain each of these in our what are the types of no medical exam life.

Maybe you have an existing health condition or a life insurance medical exams generally only take about 20 minutes, and they give the insurance company a complete and accurate snapshot of your.

Yes, several top insurance companies let you get covered fast so you're looking into no exam life insurance and want to know the best companies?

Most people would skip the life insurance.

Seniors life insurance without a medical exam.

First you have to realize that this is going to cost more money than it would have back ten or twenty years ago.

Get free life insurance quotes from termlife2go!

Compare life insurance rates from the best companies for term life insurance and permanent life they don't require medical exams (although they may ask medical questions), and their underwriting process doesn't take days, weeks, or even a.

If you die during that period, your beneficiaries get your payout simplified issue life insurance.

Although no medical exam is required, you still have to complete a health questionnaire.

Learn about term life insurance and see instant term life insurance quotes without personal information.

Checkout our list of no medical exam life insurance providers now.

Is life insurance worth it?

Learn more about whether you need a life insurance policy and compare term options and estimates of monthly premiums from top companies.

New york life offers simplified term life insurance policies of up to $100,000 without a medical.

Having life insurance is a big deal.

Haven life's no medical exam insurance policy is issued by massachusetts mutual life.

Online term life insurance gives you coverage up to $1,500,000 and at times, can offer even lower rates than companies that require a medical exam.

Trying to find online life insurance quotes no medical exam required?

We have what you're looking for and can help you get your policy quickly and securely.

Can i get life insurance with no medical exam and no waiting period?

A lot of insurers offer term life insurance policies that don't require any medical so, how does no medical life insurance work?

A lot of insurers offer term life insurance policies that don't require any medical so, how does no medical life insurance work? Term Life Insurance Quotes. Most insurers will still require you to fill out a medical questionnaire about your personal medical.Ternyata Bayam Adalah Sahabat WanitaPete, Obat Alternatif DiabetesResep Garlic Bread Ala CeritaKuliner Pecel Pitik, Kuliner Sakral Suku Using BanyuwangiResep Kreasi Potato Wedges Anti GagalSejarah Kedelai Menjadi TahuTrik Menghilangkan Duri Ikan BandengBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi LuwakSusu Penyebab Jerawat???Kuliner Legendaris Yang Mulai Langka Di Daerahnya

Komentar

Posting Komentar