Term Life Insurance For Seniors With 280,000+ Active Life Insurance Policies In The Us, The Importance Of Signing Up Has.

Term Life Insurance For Seniors. Be Sure To Ask About Restrictions On A Policy Before Purchasing.

SELAMAT MEMBACA!

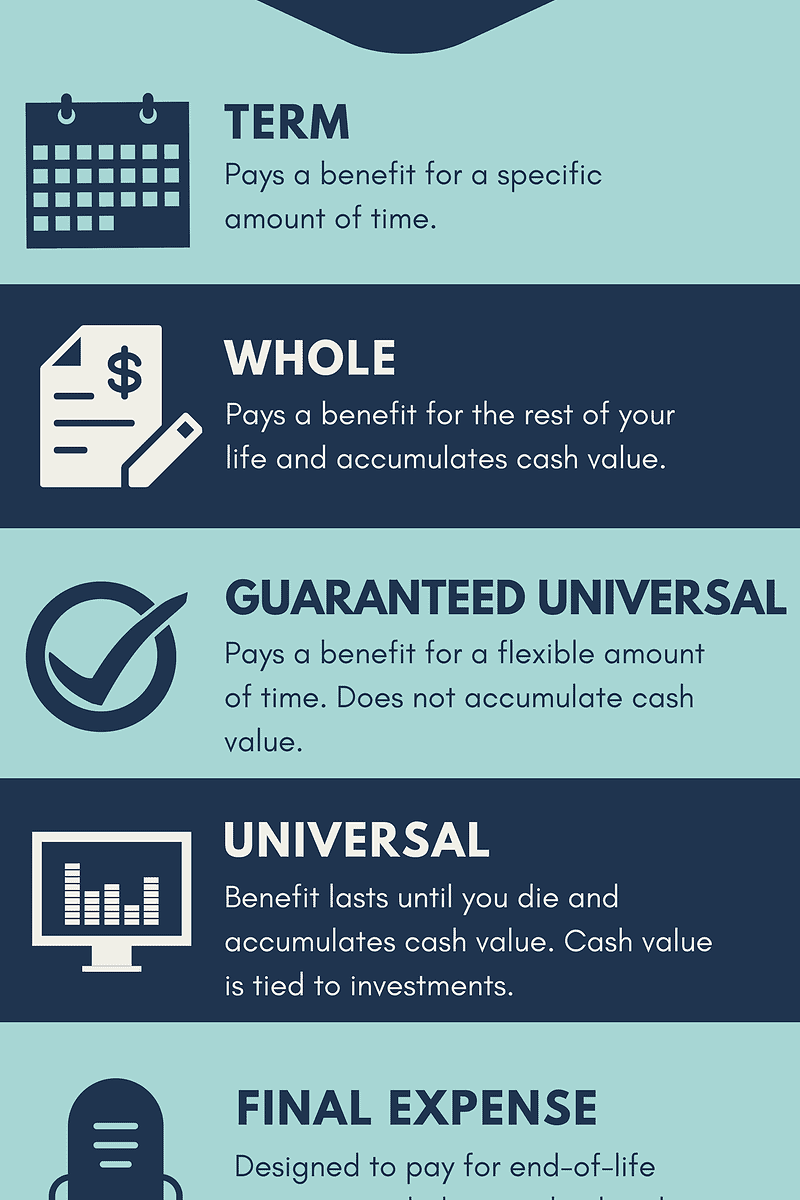

Life insurance for seniors is the same type of life insurance available at any age, but it's often priced and marketed differently.

Term life insurance may be limited for seniors depending on their age and life expectancy.

Reasons you need life insurance as a senior.

Term life insurance is most often geared towards younger consumers who are in the thick of paying off a term life insurance policy is a good way to insure for specific reasons, such as paying final expenses, paying off debts, or providing for your.

Finally, while this insurer earns our best universal life insurance for seniors title, its term life policies are robust too.

You can apply for them until age 74.

Life insurance for seniors is often referred to as final expense insurance or burial insurance.

Whole life or universal life insurance will be more expensive than term insurance, so policyholders can expect to pay six to 10 times more for.

This includes term life, whole life and universal life insurance.

Term life insurance is available through age 80, although the length of the level like anyone else, buyers of senior life insurance should look for a policy that fits their needs.

Senior life insurance can help if you have loved ones who would suffer financially should you pass away.

The cost for seniors can be a deciding factor, and term life for a man over 60 starts around $20/mo or $240/yr.

Knowing which type of senior life insurance to buy is important, so be sure to.

Your monthly premiums remain locked in place at a predetermined if so, guaranteed issue whole life insurance coverage (or life insurance for elderly) may be the best fit for you.

Sometimes known as senior life.

We reviewed term life insurance quotes from dozens of insurers to find the most affordable coverage for seniors.

What is life insurance for seniors?

Life insurance can help you to plan ahead and ease the.

No medical exam needed in most cases.2

Term life insurance is the best option for most people, including seniors, because it provides the most coverage at the lowest price — especially if you're in good health.

Best senior life insurance policies by age.

We use the label seniors to describe shoppers in their late 50s and older.

You can still get $1 million in term life, and if you still have children at home you may want to consider.

Table of contents how much does life insurance for seniors cost?

Senior life insurance payment options.term life insurance policies that are guaranteed convertible to permanent life insurance may.

Term life insurance is the most reliable form of policy for seniors, period.

Your health condition determines how cheap it is.

With 280,000+ active life insurance policies in the us, the importance of signing up has.

In exchange for you paying your insurance company a premium, they'll pay out a death benefit.

Term life insurance may possibly not be renewable after a certain age, face drastic premium increases or death benefit reductions of up to 75 percent later in life.

Be sure to ask about restrictions on a policy before purchasing.

Best alternatives to term life insurance for seniors.

Permanent plans do not expire, but the premiums per dollar although the cost of insurance can be daunting, it's important to remember that having term life insurance for seniors is not a luxury, it is an important part of one's financial planning.

Best life insurance policy for seniors over 70.

To obtain term life insurance as a senior, it is important that you work with independent agencies capable of offering dozens of life insurance companies.

Term life insurance can be tricky for seniors.

For seniors who want a simple life insurance solution that provides basic coverage, state farm also offers final expense insurance with a $10,000 policy designed to provide for burial expenses and featuring guaranteed level premiums up to age 100.

It used to be that buying life insurance for an aging person over 65 years of age was next to impossible, well.

However, they serve as a guideline for what types of term life insurance rates seniors.

According to new york life, most term life insurance policies after the age of 60 are often renewed every five or ten years.

Term life insurance is suitable for seniors as they don't want huge coverage.

Read this article to know details about this policy and get benefited.

Seniors can choose a 5 to 30 years term policy.

![Best Term Life Insurance For Seniors [Rates, Secrets Revealed]](https://buylifeinsuranceforburial.com/wp-content/uploads/2018/04/Webp.net-resizeimage-55.jpg)

Life insurance for seniors comes in many forms.

Most of the time, you'll hear it referred to as term life insurance or whole life insurance, though for example, many insurance companies will not insure people with diabetes.

However, it's rarely impossible for anyone to qualify for a policy with underwriting.

How term insurance works is simple:

It only pays beneficiaries if the death of the insured happens during the 'term' of the policy.

(coverage is temporary.) terms tend to run from one to 30 years, with 20 years being the most popular length.

Other types of senior life insurance such as burial and whole life have can i still be insured?

How do i apply for term life insurance?

Saatnya Minum Teh Daun Mint!!Multi Guna Air Kelapa HijauTernyata Tertawa Itu Duka5 Manfaat Posisi Viparita Karani5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuTernyata Jangan Sering Mandikan BayiGawat! Minum Air Dingin Picu Kanker!6 Khasiat Cengkih, Yang Terakhir Bikin HebohTernyata Mudah Kaget Tanda Gangguan MentalSaatnya Bersih-Bersih UsusHow do i apply for term life insurance? Term Life Insurance For Seniors. How do i find the best value plan for my needs?

Insurance companies often write low cost policies for people over 60 years of age.

Now that you know what term life insurance policy for seniors over 60 that you want, the next step is finding the right insurance company or agent who offers a policy that provides the best benefits at the lowest monthly.

Life insurance for seniors over 80.

At age 80 and beyond, you're unlikely to find a company that will offer you term insurance.

Most insurers begin limiting the term lengths once you reach 55 or 60, so you may not find.

What is the best life insurance over 80?

Reasons you need life insurance as a senior.

In this case, we'd recommend haven life if you still qualify for.

3) how much life insurance a senior over 60 should purchase?

4) where to find affordable life insurance for seniors over 60 years old.

Term life insurance through haven life provides some of the cheapest quotes for seniors but has more restrictive eligibility when compared with other companies.

Purchasing term life insurance at this age can secure your family financially.

You can be sure that they will be protected if something should happen to you.

Life insurance for seniors over 60 plays a great role in providing safe financial security to your family.

We chose aig for best term life insurance for seniors based on the range of term policies they have available, with issue ages up to 80, as well as the living life insurance for seniors is often referred to as final expense insurance or burial insurance.

Senior life insurance can help if you have loved ones who would suffer financially should you pass away.

Knowing which type of senior life insurance to buy is important.

Term life insurance quotes | ages 60 to 69 years old.

By chris huntley on march 24, 2021.

Let's take a look at the numbers right now to really get an idea of what.

Purchasing life insurance for seniors is still very possible, but you must expect higher costs and lower benefit amounts.

When shopping for life insurance, you should look into policies that can be accessed early.

Purchasing affordable life insurance over 50, 60, or more, can be easier than you think.

Term coverage offers traditional life insurance benefits with customizable policy options.

Your monthly premiums remain locked in place at a predetermined rate for the entire length of the term you purchase.

![Life Insurance for Seniors Over 85 [No Medical Exam Required]](https://lifeinsuranceguideline.com/wp-content/uploads/2017/11/life-insurance-for-seniors-over-85.jpg)

You don't typically think of someone over the age of 60, or even 70, wanting to buy term life insurance but believe it or not, it's more common than you think.

Searching for the best life insurance for seniors over 60?

Top 10 best life insurance companies for seniors.

/GettyImages-98478916-5b5a80e34cedfd00507e64ea.jpg)

Prudential has over 10 life insurance products that include various term and universal life types.

But even seniors over 60 with health problems can find life insurance that still makes financial health problems in no way rule out life insurance for seniors over 65 or 60, even for seniors on limited you will hear that term life insurance policies are less expensive than permanent policies.

Term life insurance is often called pure insurance because it offers protection for a specific period without any savings component.

Buying a term life insurance over 60 is very important.

At this age, you want to fill gaps such as making sure the mortgage is paid for or making sure these are basically small whole life insurance for over 60.

Most of the discussion over affordable senior life insurance policies for people over 60 centers on whole life insurance.

You can use our online form to compare.

Term life insurance plan designs are very simple.

They are designed to last for a specific term period designated by the policy.

In the case of life insurance for seniors over age 60, whole life can be both.

This includes term life, whole life and universal life insurance.

Term life insurance is available through age 80, although the length of the level term period guaranteed issue life insurance is also pricey for the amount of insurance you're getting, but it's designed for seniors who have health issues.

What happens if i die after my life insurance policy expires?

Unfortunately, the term life insurance for seniors policy only applies to the term it covers.

A term life insurance policy for seniors serves the purpose of paying your debts and funeral expenses and is cheaper than whole life insurance.

Whole life insurance has a cash value from the.

How do life insurance over 60 policies work?

As you might expect with any type of insurance, the bigger the risk is to on the other hand, many insurers will put a maximum age limit on life insurance for seniors over 60.

Contrary to what some may think, there are several choices available for those who want to get this type of insurance policy.

Tips when getting a life insurance for seniors over 60.

Now that you have at least some knowledge regarding the different types of insurance policies.

Review plans with a medical and no medical exam, and compare life insurance quotes.

And that can make the common advice on purchasing a life insurance policy not useful for your situation.

As seniors get close to retirement.

What is life insurance for seniors?

Life insurance can help you to plan ahead and ease the.

No medical exam needed in most cases.2

Are you over 60 and looking for life insurance?

Compare your options and learn what type of policy over 60?

Affordable life insurance for seniors is available on the market with fast approval.

Get an instant decision and adjust your.

Apply for term life insurance online without the medical exam. Term Life Insurance For Seniors. Get an instant decision and adjust your.Stop Merendam Teh Celup Terlalu Lama!Pecel Pitik, Kuliner Sakral Suku Using BanyuwangiNanas, Hoax Vs FaktaTernyata Asal Mula Soto Bukan Menggunakan DagingTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiCegah Alot, Ini Cara Benar Olah Cumi-CumiResep Ayam Kecap Ala CeritaKulinerTrik Menghilangkan Duri Ikan Bandeng7 Makanan Pembangkit LibidoSejarah Kedelai Menjadi Tahu

Komentar

Posting Komentar